The federal government plans to tax banks 50% of profit realised from foreign exchange revaluation in 2023.

This is contained in the proposed amendments to the 2023 Finance Act sent by the President to the National Assembly for approval.

Revenues from the proposed windfall tax as stated in the letter from the President to the Senate are to be deployed to “Renewed Hope” infrastructure projects, education, healthcare etc.

According to the document obtained by Nairametrics, The tax on foreign exchange gains described as “windfall tax” shall be collected by the Federal Inland Revenue Service (FIRS).

It stated, “There shall be levied and paid to the benefit of the Federal Government of Nigeria a tax of 50% on the realised profits from all foreign exchange transactions of banks within the 2023 financial year.”

“The Federal Inland Revenue Service – (a) shall assess the realised profits, collect, account and enforce payment of tax payable under section 30 in accordance with the powers of the Service under the Federal Inland Revenue Service (Establishment) Act 2007;”

The amendment further that the failure of banks to remit the recommended sum to the appropriate authority will upon conviction pay the tax withheld and 10% of the withheld tax coupled with interest at the Central Bank of Nigeria (CBN) minimum discount rate or risk imprisonment of key principal officials.

Backstory

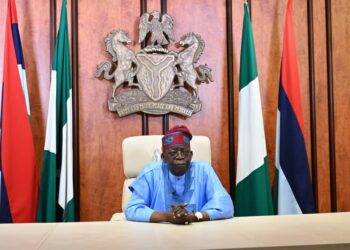

- Nairametrics earlier reported President Bola Tinubu seeking the approval of the senate to amend certain provisions of the 2023 finance act to collect tax on foreign exchange gains recorded by commercial banks in Nigeria in the full year 2023 according to their financial statement.

- In the letter, the President explained that the funds generated from this tax would be used to support capital infrastructure development, education, healthcare access, and public welfare initiatives.

- It is important to note that major commercial banks in Nigeria recorded N3.37 trillion in foreign exchange revaluation gains in FY 2023 and Q1 2024 according to data from Nairalytics.

What you should know

- As part of financial sector reforms, the CBN announced in June the unification of the foreign exchange markets to narrow the gap between the official market rate and the parallel market rate.

- These changes in the forex market led to significant losses for businesses in the industrial and consumer goods sectors, while the banking sector experienced substantial gains. By the end of December 2023, the naira had lost nearly 100% of its value.

- However, the three tiers of government have benefited from the FX revaluation gains, which now constitute around 20% of federal allocations, a significant increase from the previous 1.32% earlier in 2023 while businesses in the private sector especially in manufacturing and industry record significant losses.