The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has stated that International Oil Companies (IOCs) are not refusing to sell crude oil to the Dangote refinery.

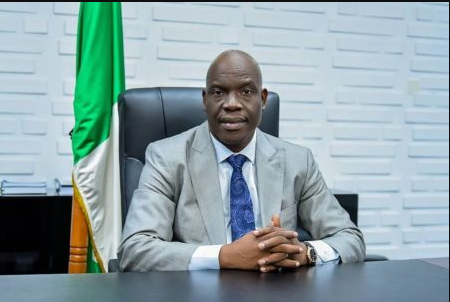

The Chief Executive Officer of the Commission, Engineer Gbenga Komolafe, made this remark during an interview with Arise TV on Monday.

Komolafe said that while the Petroleum Industry Act (PIA) makes it obligatory for IOCs and other producers to sell to local refineries like Dangote, the pricing of the crude is based on a willing-buyer/willing-seller basis.

He said that according to the commission’s knowledge, the IOCs are making crude oil available for interested buyers, and the product is abundant.

“Yes, in recognition of the provisions of the Petroleum Industry Act (PIA) that make the supply of crude to domestic refineries obligatory, the commission has enforced that. The issue is not that the IOCs or other producers are refusing to make crude available.

“To the best of the knowledge of the commission, there is nothing like IOCs being too big or not complying with their statutory obligations to make crude oil available.

“Making the crude available is done at a price and the provisions of the law is that it should be done on a willing-buyer, willing-seller basis.

“No producer is refusing to make crude available to the Dangote refinery,” Komolafe said.

Backstory

The management of the Dangote refinery has repeatedly accused International Oil Companies (IOCs) of refusing to sell and supply crude oil to its massive refinery in Lagos.

The oil company said this refusal has forced them to depend on international suppliers of crude for its refinery.

According to recent reports, about two-thirds of the feedstock of crude in the $19 billion refinery is from the United States.

Recently, the refinery also imported crude from the South American country, Brazil, and it’s planning to further expand its scope to other African oil-producing countries as it ramps up production.

Dangote said the federal government is not doing enough to protect the refinery from manipulative pricing from foreign oil companies.

What you should know

- Recently, the federal government, through the Nigeria Upstream Petroleum Regulatory Commission (NUPRC), reached an agreement with producers to permit the sale of crude oil to domestic refiners at market prices.

- This resolution ends a supply dispute that has strained relations with international oil companies.

- In addition, NUPRC requested monthly cargo price quotes on crude oil supply and delivery from both producers and refiners.

- The NUPRC said it aims to balance upstream development with a sustainable domestic energy supply chain, reinforcing its role in fostering a fair and profitable oil production environment.