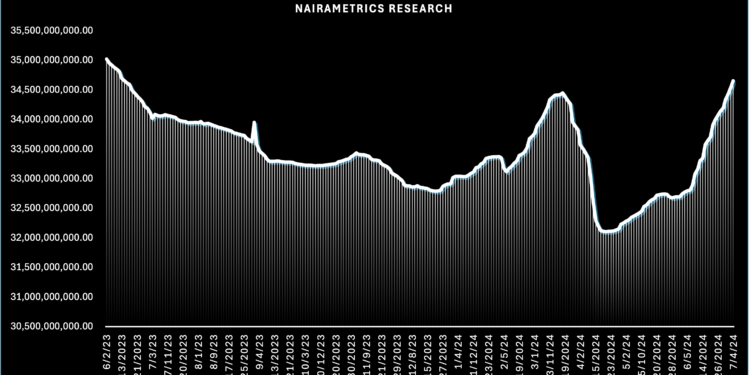

Nigeria’s external reserves have increased yet again, this time by $1.88 billion to $34.66 billion as of July 4, 2024, marking a 13-month high.

This is according to Nairametrics historical records of the central bank’s external reserve data for the last year.

Our records also indicate this is the highest level the external reserve has touched since the introduction of the foreign exchange (FX) unification policy, back in June 2023.

The growth in reserves is also on the back of a string of financial commitments from Afrexim Bank and the World Bank through loans and the CBN introduced a string of FX reforms.

What the data is saying

On June 14, 2023, the Central Bank of Nigeria (CBN) unveiled a strategy to streamline the foreign exchange market by merging all segments into a single unified system.

This pivotal shift, aimed at fostering liquidity and stability within the Nigerian FX Market, ironically seems to have precipitated increased market volatility and a precipitous decline in the naira’s value.

When the CBN announced the FX unification policy, Nigeria’s external reserves were at $34.66 billion. However, from July to December 2023, the reserves fluctuated within the $33 billion range.

According to Nairametrics research, the external reserve hit $34.66 billion as of July 4th 2024 the highest in over a year.

This is only second to the $34.69 billion achieved on the 13th of June 2023, just before the exchange rate was unified by the government.

Nigeria has been experiencing a surge in exchange rate in the last few weeks ending the month of June above $34 billion for the first time since April. The reserves have continued to swell in July hitting multiple highs that have now culminated in the highest reserve in the last one year.

Earlier challenges

The central bank Governor had to address the issue of the decline at the last IMF Spring meeting, where he said that the decreasing reserves were primarily due to debt repayments and other standard financial obligations, rather than efforts to defend the naira.

However, since then, a gradual and consistent upward trajectory has been observed, coinciding with a period of exchange rate stability with the reserves eventually culminating into the $34.66 billion recorded on July 4, 2024.

In the past one month, the reserves have surged by 6% from $32.78 billion recorded on the same day of the previous month.

Policies driving reserve growth

Nairametrics earlier noted that as global forex reserves reached $12.3 trillion at the end of 2023, Nigeria’s forex reserves declined to $32.3 billion, representing just 0.26% of global reserves, down from 0.36% in 2022, mainly due to decreased forex inflows and increased outflows.

The recent rise in FX reserves since May comes after three months of noticeable fluctuations when it plunged to a low of $32.11 billion on April 19, 2024.

This earlier dip may be attributed to increased import demands, payment obligations, or reduced foreign inflows during that period.

The latest data from the National Bureau of Statistics also reveal Nigeria received a total capital importation of $3.9 billion in the first quarter of the year.

Most of the inflows were directed towards government debt securities such as treasury bills, OMO bills and bonds.

What you should know

The Monetary Policy Committee (MPC) recently urged the CBN to focus on boosting the external reserves.

To ensure a steady flow of foreign exchange into the country, the CBN plans to double the diaspora remittance inflow this year.

Also, Afrexim Bank earlier announced the disbursement of $925 million- another tranche of the $3.3 billion crude oil-backed loan agreement it entered into with the NNPC last year. The bank disclosed this in a statement on its website stating that the current disbursement brings the total payment for the facility to $3.175 billion. This loan is expected to help stabilize the forex market in light of the severe volatility.

The World Bank also recently approved $2.25 billion in loans to Nigeria to boost the country’s economic stability and support its vulnerable populations. This financial infusion is intended to provide immediate financial and technical support for Nigeria’s urgent economic stabilization efforts.

Amid the increase in reserves and financial commitments to Nigeria, Fitch noted that the lack of clarity over the precise size and composition of Nigeria’s FX reserves remains a significant constraint on the nation’s sovereign credit profile.