The Minister of Solid Minerals Development, Dele Alake, announced that Nigerian gold bars transaction has boosted the country’s foreign reserve assets by over $5 million.

Alake made this disclosure in a statement in X’s post on Sunday.

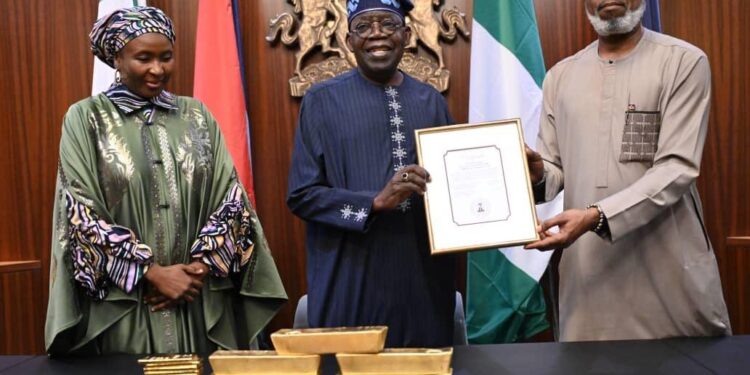

The Minister said he recently presented the first batch of the gold bars under the National Gold Purchase programme to President Bola Tinubu.

According to Alake, the programme aims to increase our country’s reserves and boost the value of the naira against other currencies.

In addition, Alake said the gold bars were sourced from artisanal and small gold miners, adding that the transaction added about N6 billion to the economy.

“I am pleased to report that the National Gold Purchase programme, which aims to increase our country’s reserves and boost the value of the naira, is making significant progress.

“Recently, I had the honour of presenting the latest gold bars to HE President Bola Ahmed Tinubu.

“The bars were sourced from artisanal and small gold miners and refined by an agency of our Ministry, the Solid Minerals Development Fund.

“Furthermore, I am proud to announce that this first commercial transaction has resulted in a substantial increase of over US$5 million in Nigeria’s foreign reserves assets, the refinement of over 70 kilograms of gold to the London Bullion Market Good Delivery Standard, and the successful aggregation of locally mined gold, injecting around N6 billion into the rural economy,” Alake said.

First Gold Purchase under Programme

Speaking further, Alake said the bars of gold were the first commercial transaction under the National Gold Purchase Program (NGPP).

The Minister stated that the initiative is a centralized offtake scheme backed by a decentralized network of artisanal and small-scale miners and cooperatives for aggregation and production.

Furthermore, he mentioned that the bars met the London Bullion Market Association Good Delivery Standard and will be sold to the Central Bank soon.

“They have met the London Bullion Market Association Good Delivery Standard and will soon be sold to the Central Bank of Nigeria to strengthen our foreign reserves.

“This marks the first commercial transaction under the National Gold Purchase Program (NGPP), which is a centralised offtake scheme supported by a decentralised aggregation and production network of artisanal and small-scale miners and cooperatives,” the Minister added.

What you should know

The gold purchase scheme began under the former administration of President Muhammad Buhari in 2018.

The scheme, according to the then Minister of Mines and Steel Development, Dr Kayode Fayemi, included equipping the artisanal miners, provision of extension services and off-take of all gold produced by participants in the scheme.

The scheme was referred to as the Presidential Artisanal Gold Mining Development Initiative (PAGMDI) and some of its purchases were sold to the CBN.

The initiative aims to increase our country’s reserves and boost the value of the naira against other currencies.