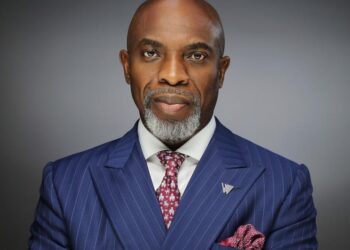

The Managing Director/CEO of Wema Bank Plc, Moruf Oseni has declared that the bank will retain its national banking license when the recapitalization deadline expires in 2026.

He noted while answering questions from shareholders at the bank’s Annual General Meeting that the bank will not go back to its regional banking license.

Oseni highlighted that capital raise is the next major hurdle for the bank, seeking the support of the shareholders.

According to Oseni, “Capital raise is a major one in front of us, but please be rest assured that your bank will do all we can to get the funds in. And in two years’ time, come 2026, Wema Bank will remain a national bank. We have no plans of going back to regional banking.”

Recall that during the 2008-2009 banking crisis, Wema Bank had to take a strategic step of revising its license to a regional banking license, which restricted its operation to a maximum of 12 states.

However, by 2015, the bank raised sufficient funds to elevate its license to one of national authorization.

Wema Bank Capital

Wema Bank presently has a paid-up share capital of about N15.1 billion, thus requiring about N184.1 billion to meet up with the N200 billion minimum capital requirement for a national banking license.

The bank raised about N40 billion in a rights issue in December 2023. When this sum is reflected in its share capital, the bank’s required capital raise is expected to drop to N144.9 billion.

Though the bank is looking to raise N200 billion through rights issue and other means as it looks to issue new 37.14 billion shares.

We will plant branches in the South-East

During the AGM, Moruf Oseni was questioned on the paucity of Wema Bank branches in the South-East. And in addressing the question, he noted that plans are underway to increase the bank’s branches in the region of the country.

Oseni noted that it was an aim of the bank to have branches in every state capital in Nigeria. He highlighted that the appointment of Segun Opeke, former Executive Director overseeing Polaris Bank’s Lagos operations, is anticipated to propel the bank’s expansion into other states across the country.

He said, “We will situate branches where it is necessary, and where there is business. I have no doubt that there’s good business in the South-East. We have a new Executive Director in force right now.”

“Just watch this space, we will situate branches in that axis. There’s no doubt that to be a national bank, the aim at least is to have a branch in every capital of Nigeria.”

Currently, Wema Bank Plc has 149 branches across 19 states and the FCT in Nigeria, with 17 states hosting no Wema Bank branch. The bank has no branches across the five states in the South-East region, and in the North-East it boasts branches only in Bauchi State.

Wema Bank has branches in Lagos, Oyo, Osun, Ekiti, Ondo, Ogun, FCT, Rivers, Delta, Edo, Akwa Ibom, Niger, Kogi, Kaduna, Cross River, Nasarawa, Kano, Bauchi, and Kwara states.

Wema Bank’s dominance in the South-West

Wema Bank has most of its operation domiciled in the South-West, and this can be linked to the bank’s origin in 1945. The bank which began as “Agbonmagbe Bank Limited” operated mostly in areas that are part of present-day Ogun State (Sagamu, Abeokuta, and Ijebu-Igbo).

The bank was acquired by the Western Nigeria Marketing Board in 1969 and subsequently rebranded to Wema Bank. The bank’s operations were mostly exclusive to the Western region of Nigeria, until it listed on the Nigerian Stock Exchange (NSE) in 1990.

In 2001, the bank received a universal banking license from the CBN, however, it had to revert to regional banking license in 2009.