The number of small-scale industrialists in Nigeria has experienced a sharp decline over the past two years as businesses struggle with economic challenges in the country.

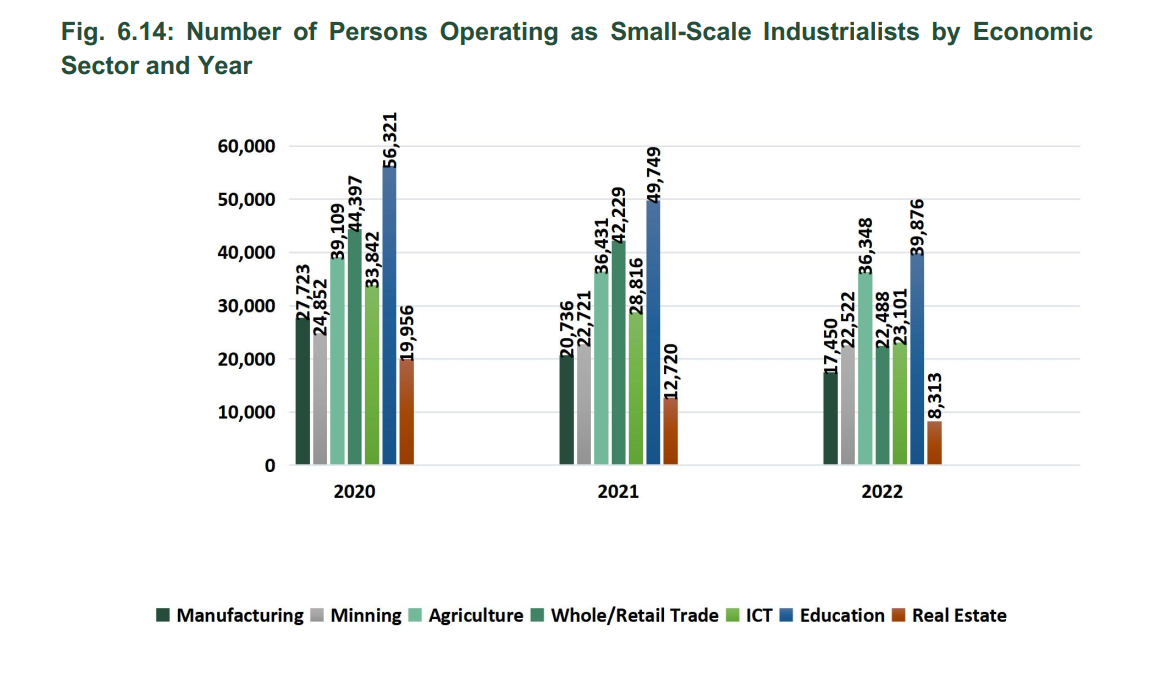

The 2023 Social Statistics Report by the National Bureau of Statistics (NBS) highlights a 45% decrease in the total number of individuals operating as small-scale industrialists across various economic sectors, dropping from 246,200 in 2020 to 170,098 in 2022.

This decline presents a significant challenge for Nigeria’s ambition to achieve a one trillion dollar economy, as small-scale industries are considered the driving force behind economic growth.

More Insights

The aggregate data shows a sharp overall decline in the number of small-scale industrialists across various sectors.

- In 2020, there were a total of 246,200 small-scale industrialists, which decreased to 213,402 in 2021 and further dropped to 170,098 in 2022.

- The NBS data did not provide a reason for the massive decline in the number of SME’s operating in the country.

However, Several factors likely contribute to the decline in the number of small-scale industrialists in Nigeria.

- These include economic instability, policy and regulatory challenges, access to finance, infrastructure deficiencies, and the impact of the COVID-19 pandemic.

- The decline could also be due to the SME’s falling even further into micro business or the more unlikely scenario of them growing into large scale industries.

What this means

The significant decline in the number of small-scale industrialists in Nigeria has far-reaching implications for the country’s economy.

- Small-scale industries are a critical component of Nigeria’s economic structure, providing employment opportunities, contributing to GDP, and fostering innovation and entrepreneurship.

- The 45% reduction in this sector could lead to higher unemployment rates, reduced economic diversification, and diminished economic resilience.

- The decline further affirms the need for targeted interventions to support small businesses, which are crucial for economic growth and employment.

Sectoral Analysis

The education sector: consistently recorded the highest number of small-scale industrialists throughout the years, though the numbers reveal a downward trend.

- In 2020, the sector had 56,321 small-scale industrialists, which decreased to 49,749 in 2021, and further dropped to 39,876 in 2022.

- This represents a 29% decrease over the two years, indicating significant challenges within the sector.

- Factors such as reduced funding, policy shifts, and the impact of the COVID-19 pandemic may have contributed to this decline.

The real estate sector: also saw a substantial reduction in the number of small-scale industrialists.

- In 2020, there were 19,956 small-scale industrialists in the sector, which dropped to 12,720 in 2021, and then to 8,313 in 2022.

- The sector witnessed a 58% drop, reflecting the broader economic challenges and the potential impacts of policy changes or market conditions.

The agriculture sector: experienced a relatively moderate decline. In 2020, there were 39,109 small-scale industrialists in agriculture, which decreased to 36,431 in 2021 and slightly declined to 36,348 in 2022.

- This 7% decline suggests that while the sector faces challenges, it remains somewhat resilient, possibly due to efforts to promote agricultural activities and support from government policies.

The Information and Communication Technology (ICT) sector: experienced a more pronounced decline. The number of small-scale industrialists in ICT was 33,842 in 2020, which decreased to 28,816 in 2021, and further dropped to 23,101 in 2022.

- This sector experienced a 32% reduction, highlighting the potential impact of technological and market shifts.

In the manufacturing sector: there were 27,723 small-scale industrialists in 2020, which decreased to 20,736 in 2021 and further to 17,450 in 2022.

- With a 37% decrease, the manufacturing sector shows significant vulnerability, possibly due to supply chain disruptions, economic policies, and increased production costs.

The mining sector: faced a modest decline compared to other sectors. In 2020, there were 24,852 small-scale industrialists in mining, which decreased to 22,721 in 2021 and slightly declined to 22,522 in 2022.

- The 9% decline indicates some level of stability in the mining sector, which may be attributed to increased extraction activities and investments in mining operations.

- However, challenges such as regulatory changes and fluctuating commodity prices may still impact the sector.

The wholesale and retail trade sector: saw a significant reduction in the number of small-scale industrialists. In 2020, there were 44,397 small-scale industrialists in the sector, which decreased to 42,229 in 2021, and then sharply dropped to 22,488 in 2022.

- This 49% decrease reflects the severe impact of economic conditions on consumer behaviour and business operations.

- Factors such as reduced consumer spending, market competition, and economic uncertainties may have contributed to this decline.