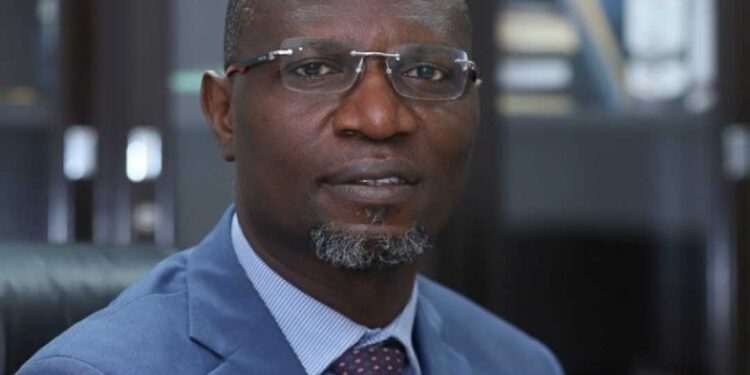

The Acting Director General of the Securities and Exchange Commission (SEC), Dr. Emomotimi Agama, is advocating for a new cryptocurrency measure that aims to remove the naira as a currency pair from cryptocurrency peer-to-peer platforms.

During a virtual meeting with the Blockchain Industry Coordinating Committee of Nigeria (BICCoN), he stressed the need to clean up the virtual assets space from illegal trading activities and safeguard the integrity of the Nigerian capital market.

Agama emphasized the Commission’s readiness to enforce the Investments and Securities Act of 2007 vigorously, ensuring that all market participants adhere to the established legal frameworks, despite the technological advances in digital assets.

These actions represent a bold move by the new Director-General towards strict regulation of the cryptocurrency space.

This move indicates how stringent his approach to cryptocurrency might be. Unlike the previous SEC, which offered an olive branch, this administration may issue guidelines that could make trading crypto more difficult in Nigeria.

P2P crypto trading and naira concerns

Agama noted that the recent surge in peer-to-peer (P2P) crypto trading has reportedly impacted the Naira’s exchange rate, prompting the SEC to consider delisting the Naira from P2P platforms to curb market manipulation.

A statement from the Commission read:

“Agama stated that one of the things that needs to be done is delisting the naira from P2P space in order to avoid the level of manipulation that is currently happening enjoining participants in the crypto space to be patriotic enough to name and shame those that are involved in disrupting the markets negatively.”

Agama highlighted the necessity of a cooperative approach to address these challenges, advocating for a regulatory environment that supports innovation while protecting national economic interests.

Fresh crypto guidelines

The SEC boss also said that the commission is in the process of developing inclusive regulatory guidelines for the digital asset sector.

These guidelines are being crafted with input from various stakeholders and will cover a broad spectrum of crypto-related activities, including wallet services, digital asset custody, fund management, and more.

The aim is to create a well-regulated digital asset marketplace that contributes to Nigeria’s economic progress.

In the statement, Agama was quoted, as saying:

“I want to seek your co-operation in dealing with this as we roll out in the coming days the regulations that would take control of these areas. We want to ensure that this management will ensure that people or institution that require registration with the SEC are quickly licenced. We assure you that we will give guidance when necessary and do well to streamline the processes to make it less difficult.

“We ask that those involved in sharp practices that undermine national interest should cease and desist. It is in our interest as a people to protect what belongs to us. We encourage you to reach out to us by naming and shaming the bad actors. Together, I am confident that we can weed out bad actors and harness the immense potential of this progressive technology for the benefit of all Nigerians in tandem with this government’s renewed hope agenda.”

In his concluding remarks, Agama called for the cryptocurrency community’s support in identifying and addressing any harmful practices within the market.

He stressed the importance of collaboration and openness in achieving a transparent and thriving digital asset environment, reflecting the government’s commitment to fostering a conducive atmosphere for the burgeoning fintech sector.

What You Should Know

- Nairametrics earlier reported that the Blockchain Industry Coordinating Committee of Nigeria (BICCON) planned a roundtable with International and local crypto exchanges and the new director general of the Nigerian Securities and Exchange Commission (SEC) to find a middle ground on the status of crypto in the country.

- This was followed by stakeholders in Blockchain Technology Association of Nigeria (SiBAN), the umbrella body of players in the cryptocurrency industry, blaming the rise of peer-to-peer (P2P) crypto trading in the country on the lack of regulation amid heightened concerns that the government may ban P2P anytime soon.

In February 2024, Binance, a widely used crypto exchange with over 170 million users worldwide, disabled its peer-to-peer feature for Nigerian users.

Recently, Nigeria’s National Security Adviser (NSA) classified cryptocurrency trading as a national security issue. Following this, the Central Bank of Nigeria (CBN) directed four fintech startups operating in the country—Opay, Moniepoint, Paga, and Palmpay—to block the accounts of customers engaging in cryptocurrency transactions and to report those transactions to law enforcement agencies.

Earlier, the Economic and Financial Crimes Commission (EFCC) had obtained a court order to freeze at least 1,146 bank accounts belonging to various individuals and businesses allegedly engaged in illicit foreign exchange dealings.

- All the affected fintechs have since sent messages to their customers warning them against any crypto-related transactions. In a message to its customers on Friday, one of the fintechs, OPay said it would block any account found engaging in such trading and also forward the details of the account owner to the regulator. Other fintechs have since sent a similar warning message to their customers.

- Also, Nigeria’s SEC earlier proposed an amendment to the registration fee of platforms offering Crypto Exchange services, raising it from 30 million naira ($18,620) to 150 million naira ($93,000).