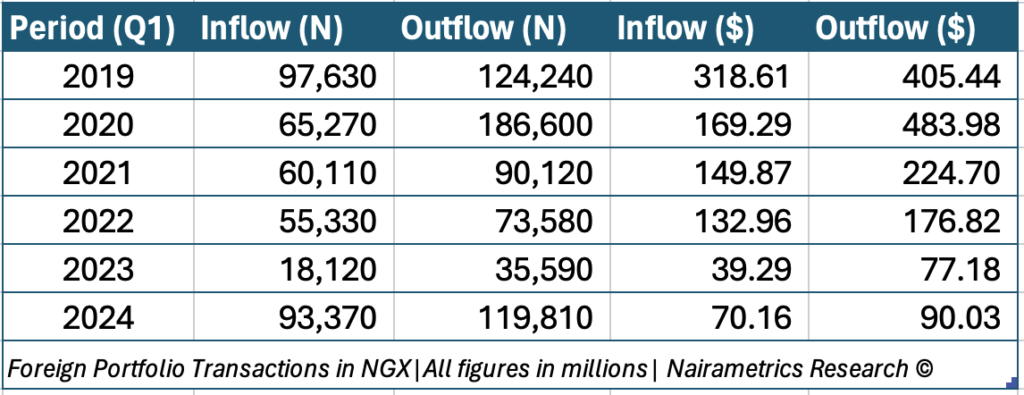

Foreign portfolio inflows into Nigeria’s Stock Market (NGX) reached N93.37 billion in the first quarter of 2024, marking a 415% increase compared to the same period in 2023.

This significant rise is highlighted in the Foreign Portfolio Investment data for the first quarter, as published by the research department of the NGX.

However, in dollar terms, the actual inflow was $70.1 million during the quarter, compared to $39.2 million in the same period of 2023.

The NGX used an exchange rate of N1330/$1 in the first quarter of 2024, a stark contrast to the N461.13/$1 rate used in the first quarter of 2023.

Detailed Breakdown of Data

Foreign portfolio investors contributed $70.1 million in the first quarter of 2024 but also recorded an outflow of $90.03 million.

- This resulted in a net forex outflow of $19.87 million, compared to a net outflow of $37.8 million in the same period last year.

- In terms of monthly foreign portfolio transactions, March recorded the highest with about $70 million, while February and January saw transactions of $49.4 million and $39.9 million, respectively, totaling $160.2 million (N213.8 billion).

- Despite a strong showing in Q1 2024, total FPI transactions for Q1 2023, which topped $116.4 million, lagged far behind the $309 million recorded in 2022. In 2019, before the COVID-19 pandemic and the onset of the latest economic crisis, total FPI transactions reached as high as $724 million.

NGX Insights and Trends

Further analysis of the transactions executed between February and March 2022 revealed that total domestic transactions increased by 3.59% from N138.13 billion to N143.09 billion.

- In contrast, total foreign transactions decreased by 7.17% from N45.43 billion (about $109.30 million) to N42.17 billion (about $101.36 million).

- Meanwhile, institutional investors outperformed retail investors by 16%.

- A comparison of domestic transactions in February and March 2022 showed that retail transactions decreased by 1.27% from N61.39 billion to N60.61 billion.

Long-Term Trends

Over a fifteen-year period, domestic transactions decreased by 58.80% from N3.556 trillion in 2007 to N1.465 trillion in 2021.

- Conversely, foreign transactions also saw a decline, dropping 29.38% from N616 billion to N435 billion over the same timeframe.

- Domestic transactions accounted for about 77% of the total in 2021, while foreign transactions made up approximately 23%. In 2022, domestic transactions totaled around N563.29 billion, and foreign transactions were about N129.01 billion.

- Despite these challenges, foreign investor participation in the Nigerian equities market averaged below 15% since 2022 due to various factors, including Nigeria’s exchange rate situation, rising interest rates in the United States, and global capital flows shifting away from emerging markets.

NGX Performance Amid Foreign Apathy

Despite a general apathy from foreign portfolio investors, the NGX has remained one of the best-performing stock exchanges in the first quarter of 2024.

- According to NGX data, the NGX All Share Index (ASI) returned 38.9% year-to-date, significantly outperforming the 5.82% return recorded in the same period in 2023.

- From 2021 to 2023, the ASI consistently posted strong year-to-date returns: 50.03%, 6.07%, 19.98%, and 45.9% respectively, with most gains accruing to domestic investors who continue to dominate transaction flows.