Mobile money operators (MMOs) in Nigeria, comprising the likes of OPay, Palmpay, and others, witnessed a surge in transactions in the first quarter of 2024, hitting N17.2 trillion.

This is according to data released by the Nigeria Inter-Bank Settlement Systems (NIBSS). The mobile money transactions figure for Q1 2024 represents an 89% year-on-year. growth when compared with the N9.1 trillion transactions recorded in the same period in 2023.

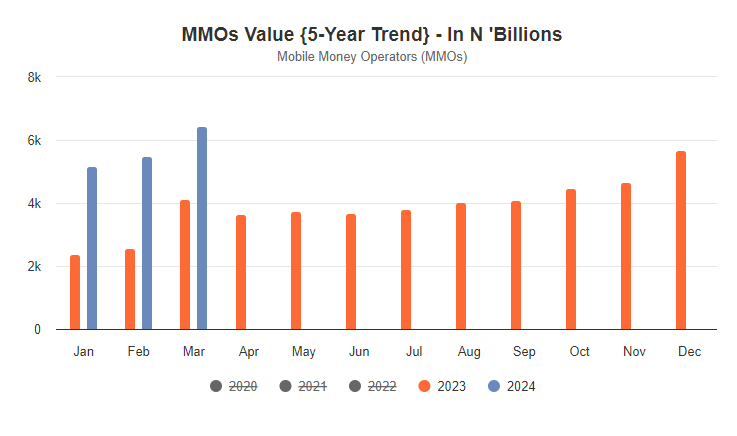

An analysis of the three-month data shows that mobile money transactions maintained steady growth each month. In January, transactions valued at N5.2 trillion were recorded, and by February, mobile money deals shot up to N5.5 trillion, while the figure went up higher to N6.5 trillion in March.

E-payment growth

The surge in mobile money transactions is a reflection of the general upswing in e-payment in Nigeria in the first quarter of this year. According to NIBSS data, transactions across all electronic channels in the country increased by 89% in Q1 2024 to N234 trillion.

Industry analysts believe that the surge in e-payment transactions can be linked to the recent cash crunch experience and the cashless policy of the Central Bank of Nigeria (CBN), which limited the amount of cash that can be withdrawn daily.

According to the revised cashless policy, which came into effect on January 9, 2023, cash withdrawal by an individual is limited to N500,000 a week, while corporate organizations have N5 million withdrawal limit within the same period.

Recommended reading: E-payment transactions in Nigeria hit N600 trillion in 2023

Mobile money operators in Nigeria

Mobile money operations in Nigeria are classified into two groups, according to the guidelines of the Central Bank of Nigeria. They include the bank-led and non-bank-led.

The bank-led operators are commercial banks licensed to provide mobile money services through their subsidiaries. On the other hand, non-bank-led operators are corporate organizations that have been duly licensed by the CBN to deliver mobile money services to customers. These exclude telecommunication companies, who are granted Payment Service Bank (PSB) licences.

Nairametrics recently reported that there are currently 17 companies licensed by the CBN as mobile money operators (non-bank-led). These include; OPay, Palmpay, E-Tranzact, and KongaPay, among others.

The mobile money operators could also be referred to as fintechs. There are over 200 fintechs in Nigeria but only 17 are licensed as mobile money service providers.

Recommended reading: Nigeria records N234 trillion e-payment transactions in Q1 2024