Pension Fund Administrators (PFAs) in Nigeria favoured fixed income investments over other asset classes in 2023 with a preponderance of funds channelled towards investments in the said category.

This is according to the first ever performance report by the Pension Funds Operators Association of Nigeria (PenOp) for the year 2023.

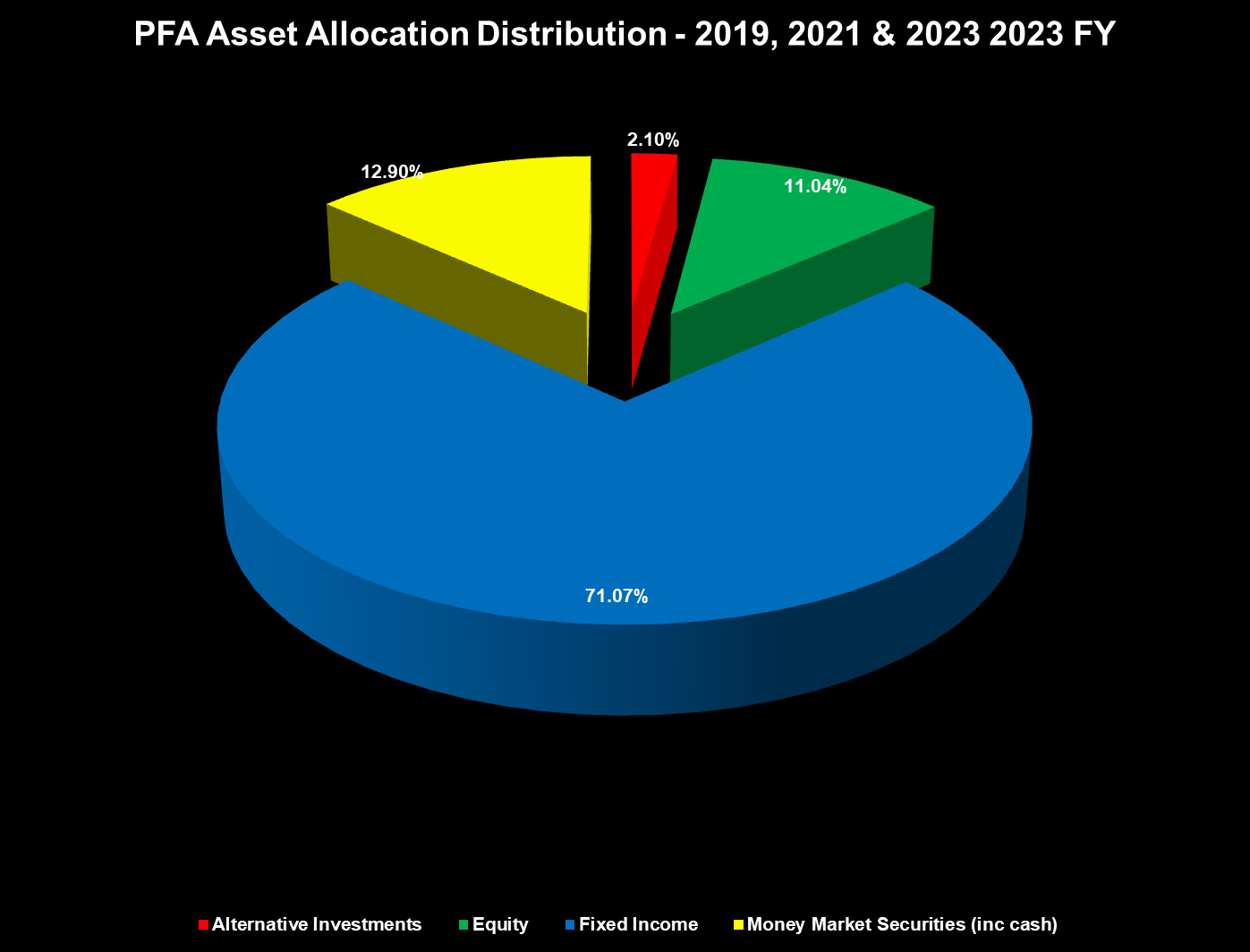

Details of the report reveals that investments by PFAs for the year tilted towards the low-risk fixed income assets with an average of 71.07% of investments by all PFAs featured in the report allocated towards fixed incomes investments. This also aligns with Pencom’s regulation to invest in low-risk assets.

Furthermore, investments in Money Markets Securities trailed well behind low-risk fixed income assets category with only 12.97% of investments in the asset. This was followed closely by investments in equities receiving 11.04% of total investments while only 2.10% of funds were channelled towards alternative investments.

Further It is important to note that alternatives investments are financial assets that fall outside the conventional investments categories such as bonds, stocks etc.

Recommended reading: Best performing Nigerian PFAs in January 2024

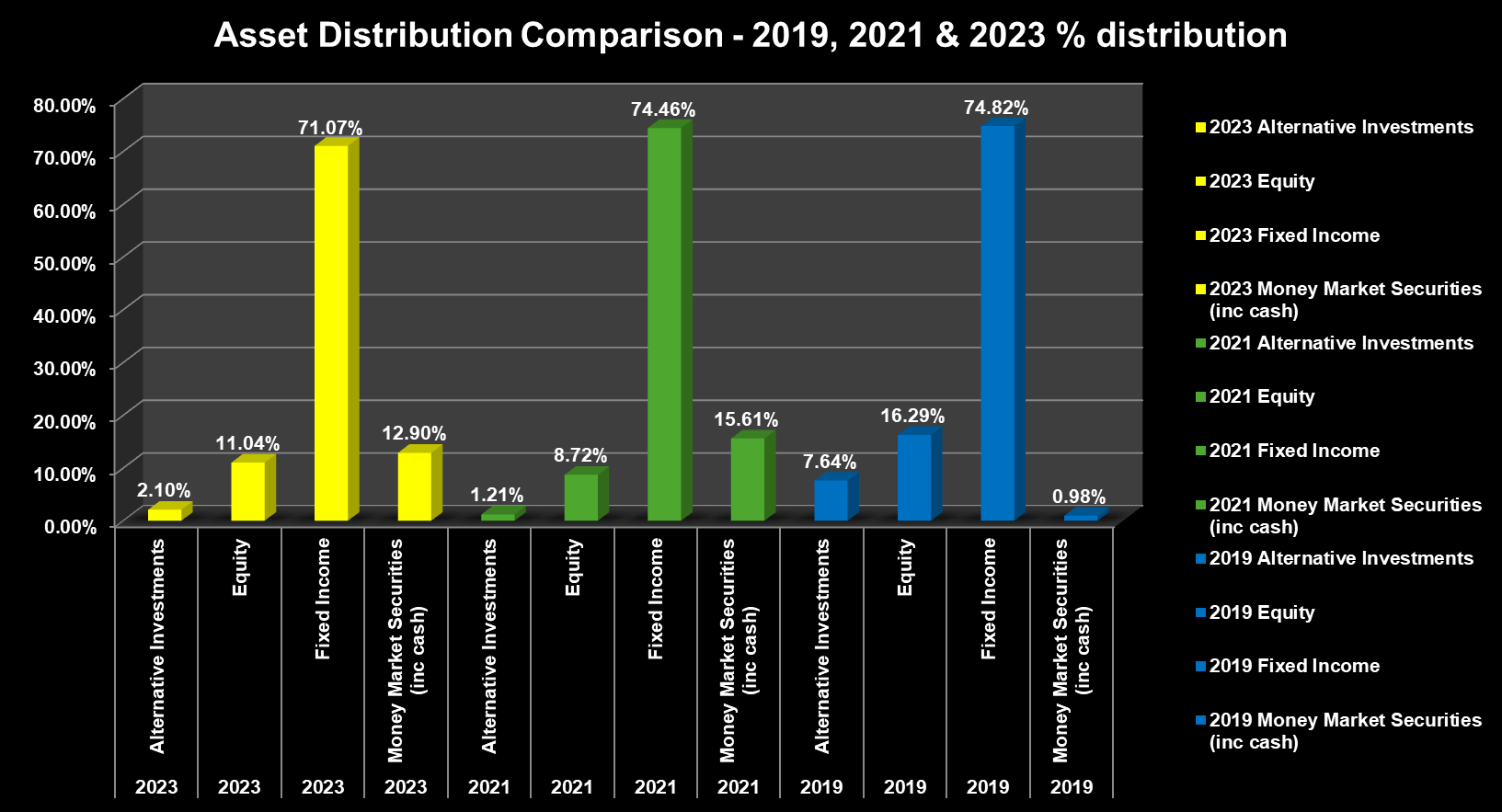

Despite the dominant status of fixed income asset in 2023, a review of asset allocation by PFAs in 2019, 2021 and 2023 reveals a slight shift from fixed income asset towards equities and alternative investments- although marginal.

Despite the dominant status of fixed income asset in 2023, a review of asset allocation by PFAs in 2019, 2021 and 2023 reveals a slight shift from fixed income asset towards equities and alternative investments- although marginal.

For example, investment in equities as share of total investments has risen from 7.64% in 2019 to 11.04% in 2023 while the share of fixed income investments has dropped from 74.82% in 2019 to 71.07%.

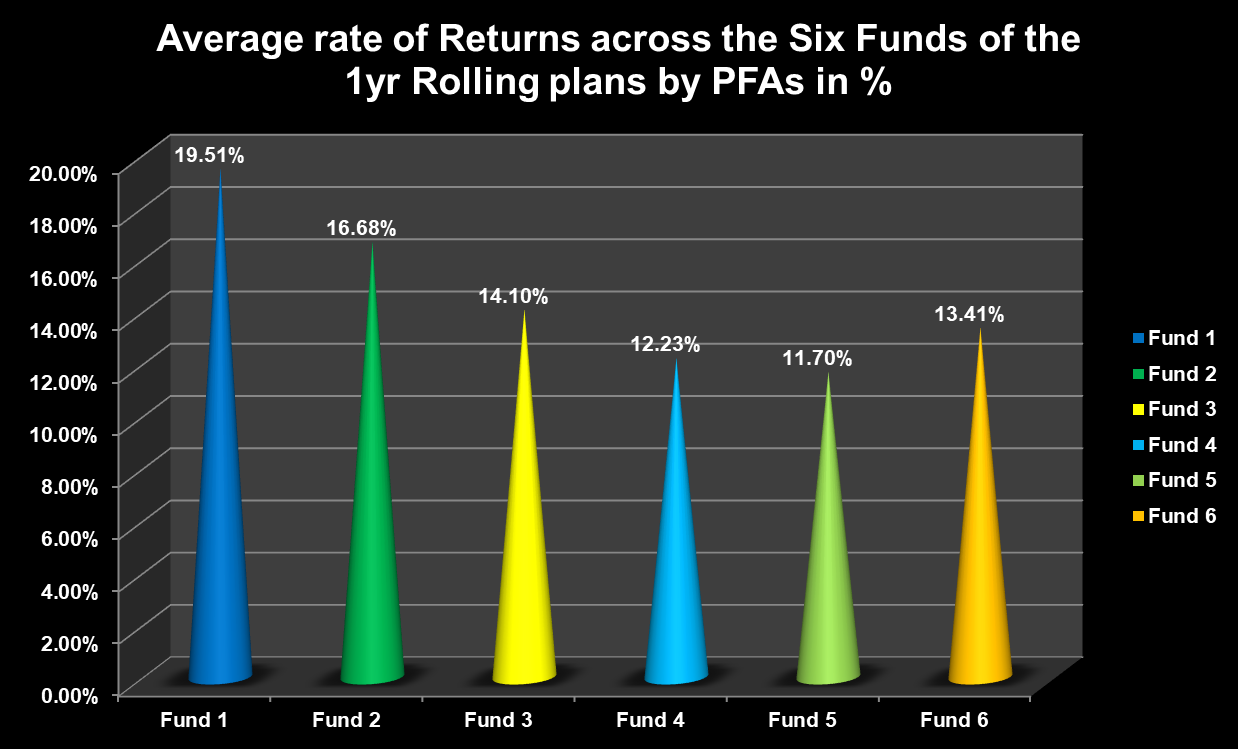

Returns from the 1-year Rolling Investment Plan

- Fund 1

The 1-year Fund 1 RSA rolling investment produced an average return of 19.51%- the highest return across the six Funds for the Multi-Fund structure for the 1-year investment. Of the 19 Pension Fund Administrators in the report, 10 PFAs achieved a return above the average profit of 19.51%.

Pension Fund Administrators with the highest return include; NPF Pension at (31.21%), NUPEMCO and Trustfund Pensions at 30.69% and 23.25% respectively.

- Fund 2

The average percentage return for PFAs on the fund-2 of the 1-year rolling investment plan stood at 16.86%. Also, 10 out of the 19 PFAs featured in the report received returns above the average percentage return.

Tangerine APT Pensions received the highest returns from this plan at 22.19% followed by Crusader Sterling Pensions at 22.08% and PAL Pensions 21.35%.

- Fund 3

On the average, PFAs received 14.10% returns on their investment in this fund and only 5 PFAs’ return superseded this mark.

NPF Pensions emerged as the PFA with the highest return from this category of investment with 21.96% return followed by Crusader Sterling Pensions at 19.17% and Radix Pensions with 15.88%.

- Fund 4

The 1-year rolling investment plan for Fund-4 produced an average return of 12.23% for the 19 PFAs featured in the report. Only 9 PFAs returns were above the above the average return of 12.23% as NPF Pensions received the highest return on investment at 15.56% while NLPC Pensions made the lowest return at 9.58%.

- Fund 5

NLPC Pensions made the highest profits from investment in this Fund at about 15.09%. The average rate of return among the 17 PFAs with records in this report stood at 11.70%. This is the lowest average rate of return among the six RSA funds in the one year rolling investment.

Furthermore, 11 PFAs recorded interests above the average rate of return.

- Fund 6

The average rate of return under this Fund structure is 13.41% with only 8 PFA making above the average. NUPEMCO recorded the highest return on investment at 23.93% while Norrenberger Pensions made the lowest returns at 8.63%.

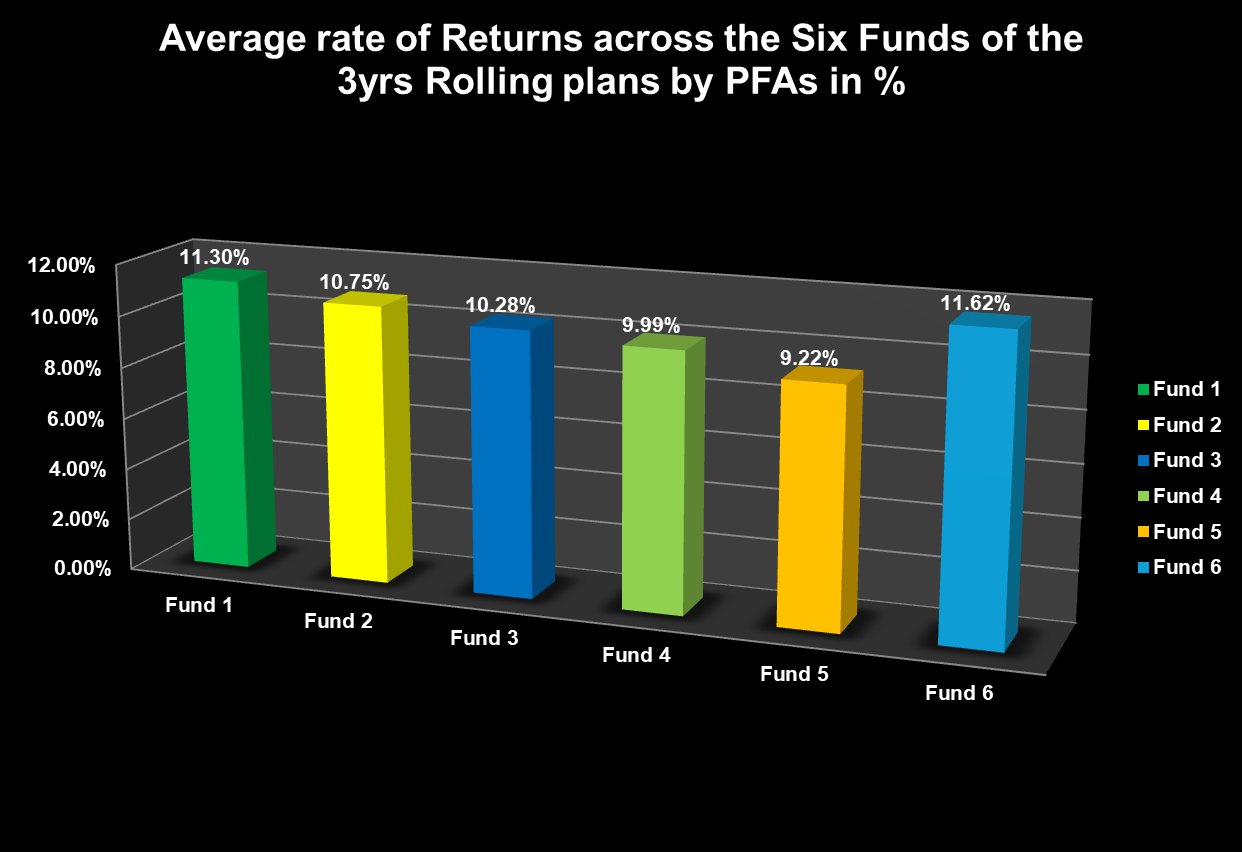

Returns on 3-yrs rolling investment by PFAs

Across the six different funds on the 3-yr rolling investment for PFAs, the average rate of return stood at 10.52%. The Fund 6 reported the highest average return at 11.62% – however, majority of PFAs did not report their returns for the Fund 6.

Furthermore, the Fund 5 reported the lowest average return on investment at 9.22%.

- Fund 1

The average return on investment in the Fund-1 investment for the three-year rolling investment stood at 11.30%. Of the 19 PFAs featured in the report, 10 PFAs’ recorded returns above average mark while 2PFAs did not report their return. NPF Pensions recorded the highest return on investment in this category at 16.46%.

- Fund 2

In this Fund, the 19 PFAs recorded an average return of 10.75%. Tangerine APT Pensions had the highest returns at 14.36%. Also, 11PFAs made returns above the average return of 10.75%.

- Fund 3

The Fund 3 had an average return on investment of 10.28% with 14 of the 19 PFAs recording returns above the average mark. NPF Pensions recorded the highest return on investment.

- Fund 4

The average return on this fund stood at 9.99% with 12 of the 19 PFAs recording returns above the average rate. PAL Pensions emerged as the PFA with the highest return in this category at 12.25%.

- Fund 5

In this fund, the returns from 5 of the 19 PFAs featured in the report was not captured. The average return on investment made by PFAs was 9.22% which was the lowest across the six categories. About 9 PFAs exceeded the average return with Stanbic IBTC pensions recording the highest return at 13.39%.

- Fund 6

While this fund recorded the highest average rate of return at 11.62%, only 7 of the 19 PFAs featured in the overall report were captured. Only one PFA made a return above the average at 16.57% which was NLPC Pensions.

Returns on 5-yrs rolling investment by PFAs

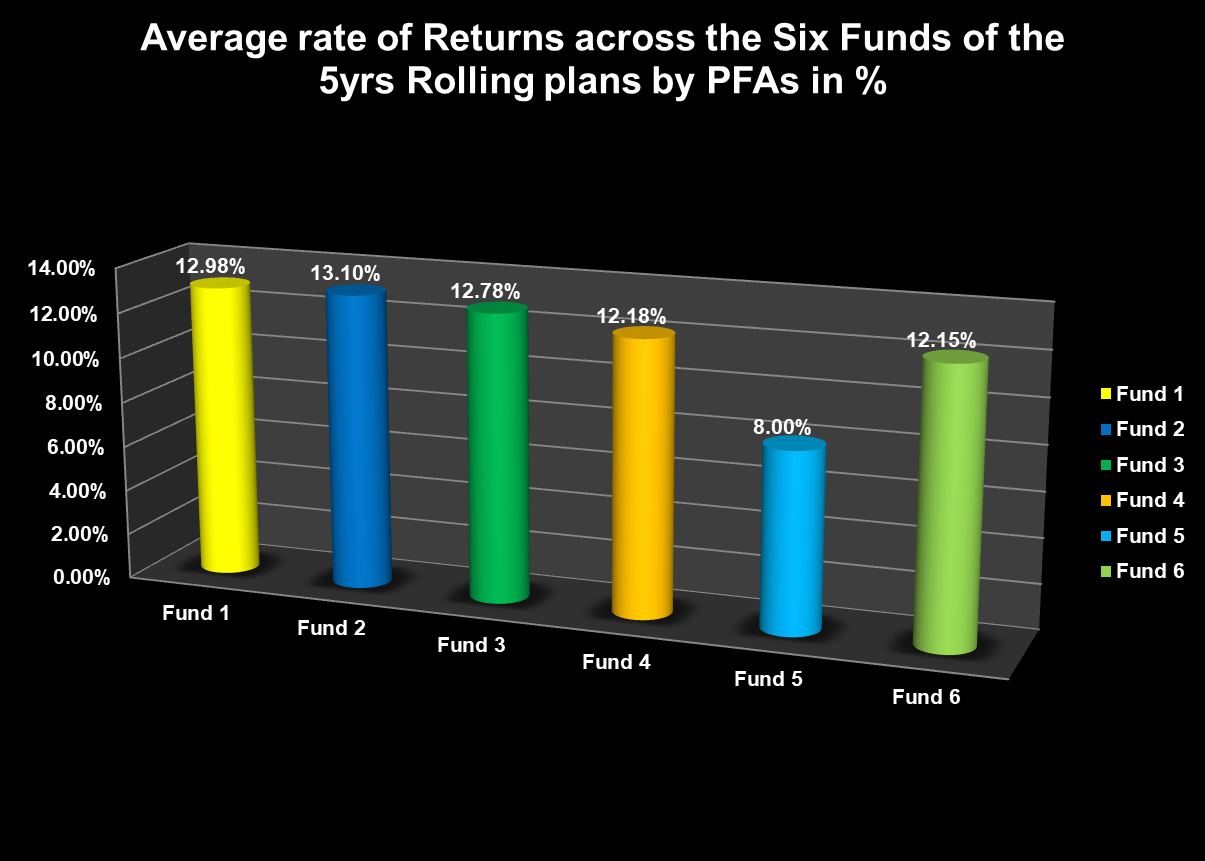

For the 5yr RSA rolling investing plan by PFAs, the average rate of return stood at 11.82% with the highest average return coming from Fund 2 at 13.10%.

- Fund 1

The average return for Fund 1 stood at 12.97% with Stanbic IBTC Pensions recording the highest return at 20.53%. Overall, 9 PFAs had returns above the average rate while there were no records for 2 PFAs.

- Fund 2

On average, PFAs made 13.10% on investments in this Fund with Tangerine APT Pensions have the highest return at 16.84%. Overall, 7 PFAs made returns above the average rate of returns of 13.10%.

- Fund 3

The average rate of return for this investment category stood at 12.78% with only 7 PFAs recording returns above the figure. For this category, Tangerine APT Pensions recorded the highest rate of return at 14.48% slightly above Radix Pensions with 14.47%.

- Fund 4

NLPC Pensions had the highest rate of return among PFAs for this investment category at 14.75%. The average return on investment for this category stood at 12.18% as 10 out of 19 PFAs made returns higher than the average rate.

- Fund 5

This fund had the lowest average rate of return among across all categories from 1-yr to 5-yrs rolling plans at 7.77%. However, only 8 PFAs returns were captured in the report with half (4) of them reporting returns above the average. Stanbic IBTC Pensions had the highest return at 11.44%.

- Fund 6

Only five (5) PFAs returns were captured in the report for this fund with the highest being NLPC Pensions at 16.57%. The average rate of returns for this fund stood at 12.14%.

The report reveals the returns from pension funds investment in 2023 and the diversity of asset classes of their investments.

In 2023, the total asset of Nigerian pension funds industry reached N18.36 trillion- representing a growth of 22.43% year-on-year. According to Nairametrics analysis, this was the fastest growth rate on record.