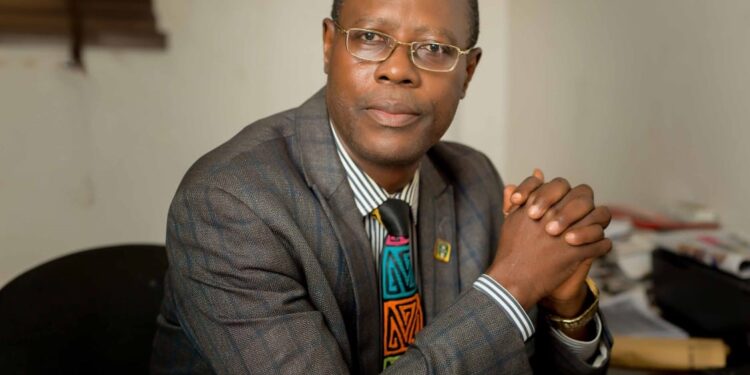

The Registrar/Chief Executive Officer of the National Institute of Credit Administration (NICA), Prof. Chris Onalo, has expressed concerns over the rise of unethical practices among credit management professionals in Nigeria, warning that such behaviours could lead to an increase in bad debts within the country’s financial sector.

In a press statement, Onalo emphasised the critical need for ethics, transparency, and a duty of care in the credit appraisal process, highlighting the role of professional conduct in maintaining financial stability.

NICA is the statutory body responsible for the oversight, control, and regulation of the credit management profession in Nigeria.

Recommended reading: NICA seeks restructuring of credit system in Nigeria

Onalo said:

- “When we talk about being ethical, transparent and carrying out duty of care to make sure that credit appraisal process are transparent, we are looking to keep credit professionals on their toes by being very professional, ethical, and transparent.

- “This is against the backdrop of credit possibly going bad as a result of unethical conducts, some of which may not be economically motivated, but could be factors that can be prevented.

- “When a credit professional is appraising a customer for either credit line, credit review, or credit limit upgrade, the customer must be thoroughly assessed based on the knowledge of the customer and the industry that the credit professional has had.”

The need for comprehensive credit assessment

Onalo pointed out that unethical conduct in credit management could stem from factors beyond economic motivations, which are preventable through stringent ethical practices.

He elaborated on the importance of comprehensive credit assessment, appraisal, or evaluation, considering the business growth or downtrends observed over time. This approach ensures that credit professionals can accurately position and reposition credit customers’ businesses for continuous growth and sustainable economic contribution.

Onalo also highlighted the necessity for credit managers and their teams to gather appropriate credit and business information to construct mitigation strategies against defaults.

In his advice to credit professionals, Onalo stressed the importance of continuous professional development through regular participation in training and retraining programs related to credit management.

Recommended reading: Rising impaired loans in Nigerian Banks: Fallout of Policy Changes

On customers’ obligations

The NICA CEO also emphasised that organisations and individuals utilising credit for business expansion or personal purchases must fulfil their obligations and avoid abusing credit facilities.

The statement noted:

- “To enable credit managers and their teams do their job of appraising, controlling, managing, monitoring and recovering, it is important to state that the organizations and individuals who uses credit to expand, grow, sustain or start up a business, or buy on credit today and pay tomorrow, must endeavour to live up to their obligations.

- “They should not abuse credit, and they should not see credit as a means to defraud the economy.”