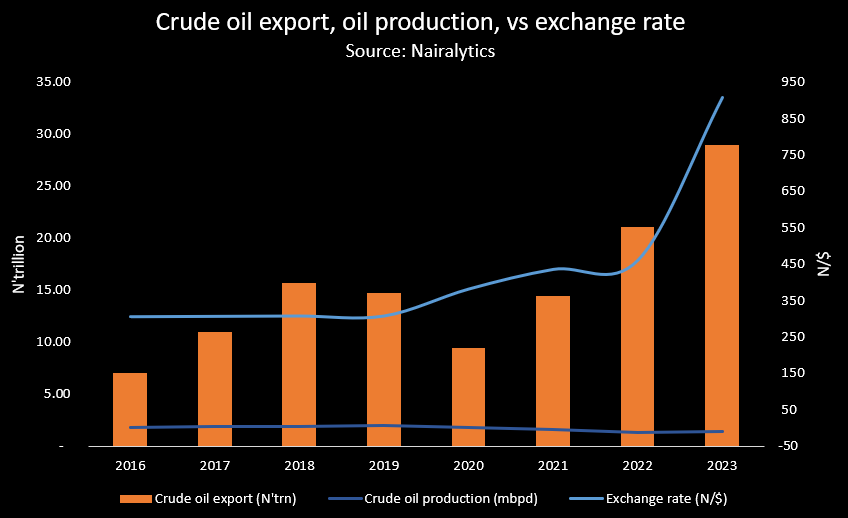

Nigeria recorded a total crude oil export revenue of N29 trillion in 2023, a 37% increase compared to N21.1 trillion recorded in the previous year.

This is contained in the recently released foreign trade report by the National Bureau of Statistics (NBS).

According to data tracked by Nairalytics, the research arm of Nairametrics, this is the highest crude earning on record for Nigeria.

Further breakdown showed that crude exports at N29 trillion accounted for 80.64% of the exports recorded in the period.

The increase in crude oil export is attributed to the combination of FX devaluation and improved oil production. According to the NBS, crude oil production averaged 1.433 million barrels per day (mbpd) in 2023, a 4.9% increase when compared to the 1.37mbpd recorded in 2022.

In the same vein, the exchange rate depreciated by 49.3% in 2023 following the floating of the naira as the CBN began the adoption of the willing seller, willing buyer system in the official FX market.

Despite elated crude oil prices at the global market at $85.03pb, they declined by 18.7% in contrast to an average of $104.62pb recorded in the previous year.

Despite the significant increase in oil revenue, it’s important to note that the oil component of the federation’s revenue in Nigeria still falls below the estimated budget.

According to data from the Budget Office, gross oil and gas revenue amounted to N5.58 trillion between January and September 2023. This figure represents a shortfall of 20.7% compared to the prorated budget of N7.04 trillion for the same period.

This shortfall in oil revenue has implications for the Nigerian economy and government finances. It underscores the volatility and uncertainty associated with reliance on oil revenues, which can be influenced by factors such as fluctuations in global oil prices, production levels, and demand dynamics.

The shortfall in oil revenue, which is a major source of foreign exchange in the country highlights the importance of diversifying the economy away from its heavy dependence on oil exports.

Diversification efforts could include promoting non-oil sectors such as agriculture, manufacturing, services, and technology.

Other highlights of the report

- Total foreign trades increased by 37.2% from N52.39 trillion recorded in 2022 to N71.88 trillion in the review year.

- Imports stood at N35.92 trillion while export was N35.96 trillion, bringing the trade balance to N2.9 billion in 2023.

- Meanwhile, non-crude oil exports increased by 22.2% year over year to N6.96 trillion. Non-oil exports also rose by 22.9% to N3.14 trillion.

The interplay between FX devaluation and Export

The interplay between forex devaluation and the slight increase in crude oil production improved Nigeria’s earnings from crude oil export. It is a common practice for countries and their central banks to devalue their currencies against other currencies in a bid to boost exports and shrink trade deficits.

- Devaluation makes a country’s goods and services cheaper for foreign buyers. This can stimulate demand for exports, leading to increased sales and higher export revenues. As a result, industries reliant on exports can experience growth, generating employment and economic activity.

- Also, by making imports more expensive, devaluation can discourage domestic consumption of foreign goods. This may lead to a decrease in imports and help reduce trade deficits, as the country relies more on domestically produced goods.

- Meanwhile, in cases where a country’s currency is considered overvalued, devaluation can help restore balance by aligning the currency’s value with market fundamentals.

Optics

Indeed, while currency devaluation can offer benefits in terms of international trade, it’s crucial to consider its potential implications, particularly for import-dependent economies like Nigeria. One significant concern is the impact of inflationary pressures and the purchasing power of citizens.

In Nigeria’s case, where a considerable portion of goods consumed domestically are imported, devaluation could lead to higher prices for imported goods.

This can contribute to inflationary pressures, as the cost of living increases for citizens.

For a country with a large population and significant income disparities, this can disproportionately affect the purchasing power of lower-income groups, potentially exacerbating social and economic inequalities.

To mitigate these risks and capitalize on the potential of the international market, the Nigerian government would indeed need to focus on improving industrialization.

By shifting towards value-added production and manufacturing, Nigeria can reduce its reliance on raw material exports and tap into higher-value export markets.

This strategy can help diversify the economy, create employment opportunities, and foster sustainable economic growth.

Furthermore, investing in infrastructure, technology, and skills development is crucial to enhancing the competitiveness of Nigerian industries in the global market.

By improving productivity and efficiency, Nigerian businesses can better compete internationally, leading to increased export earnings and a more balanced trade profile.