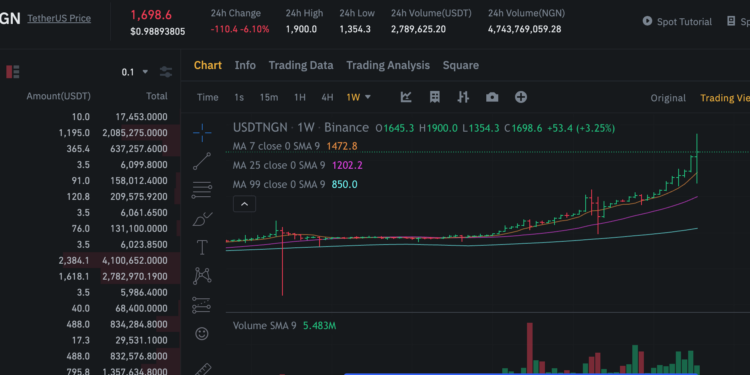

It has been a tumultuous twenty-four hours on the renowned cryptocurrency platform, Binance, after the exchange rate between the naira and the popular stablecoin, Tether (USDT), plummeted to approximately N1900/USDT before subsequently rising to N1354.3.

However, by 7 am on Thursday, February 22, the naira was trading between N1680-N1710/$1 USDT.

This situation arises amid several reports of a crackdown on cryptocurrency trading, which some authorities view as a significant contributing factor to the rapid depreciation of the naira.

Tether (USDT) is a stablecoin used as a medium of exchange for cryptocurrency traders looking to trade their local currency against the dollar. One USDT is equivalent to $1.

This dramatic drop and subsequent recovery underscore the volatile nature of cryptocurrency markets, especially in the context of Nigeria’s current economic climate.

The exact cause of the wild volatility experienced in the last 24 hours remains unclear, even as some attribute it to a broader crackdown on cryptocurrency trading by certain authorities, who argue that such activities have been contributing to the rapid devaluation of the naira.

Recommended reading: Official exchange rate settles at N1551.24/$1 as P2P market crosses N1800/$1

What Binance is saying

Earlier in the day, Binance assured its Nigerian users via a blog post that their funds are safe and secure, stating that its peer-to-peer (P2P) product remains operational but with adjustments.

- “To protect users, and to prevent any abuse, our system automatically pauses in the event of a period of significant currency movement. Late last night, we observed a temporary suppression of prices that briefly reached our system limit. We quickly made the necessary adjustments to allow trading to continue.

- “We have stringent measures in place to protect users in the market, including real-time monitoring, immediate removal of non-compliant advertisements, and permanent removal of bad actors from using our P2P product. Continuous market surveillance ensures the prompt removal of abnormal prices, supported by a fixed security deposit,” it said.

While this is not specific to Nigeria, Binance said it is working with regulators and policymakers to maintain transparency in cryptocurrency trading and its impacts on the financial markets.

It emphasized that Binance does not influence foreign exchange rates.

The volatility experienced in the crypto market brings to the fore the reliability of the platform as a benchmark for the exchange rate.

Nairametrics understands most parallel market operators often cite cryptocurrency-stable coin prices as a reference despite their relatively low volumes of trade.

On average, Binance platforms trade around 3 million USDT compared to the official FMDQ market which has averaged $251 million in daily turnover in February this year.