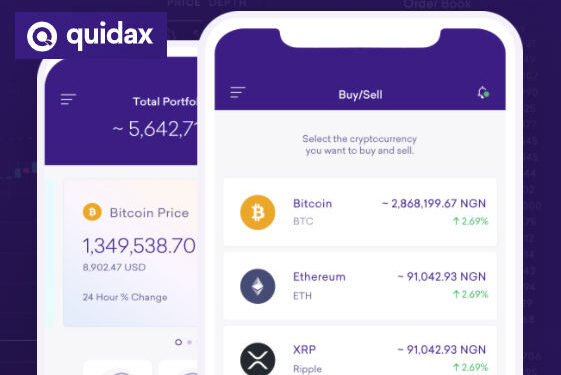

One of the leading crypto exchanges in the African crypto industry, Quidax has announced free bank account deposits and withdrawals to customers in Nigeria.

This came as the Central Bank of Nigeria (CBN) lifted its 2-year ban on crypto transactions in Nigeria. With the ban now relaxed, Quidax is looking to celebrate by providing free bank account deposits and withdrawals to old and new customers for the next 30 days, starting from December 22, 2023.

What this means is that Quidax’s customers will be able to enjoy free transactions using their bank accounts on the exchange platform.

The company described this gesture as its gift to Nigerians this holiday season.

To benefit from this offer, customers can create their accounts on Quidax via the mobile app or web (for new customers) or sign in (for existing customers).

As long as a customer performs the necessary identity verification processes, they will be able to make free deposits and withdrawals using their bank accounts for the next 30 days.

The biggest development of 2023

The lift of the ban on crypto transactions which was announced by the CBN on Friday via a circular to all commercial banks in the country came as the biggest development in the Nigerian crypto industry for 2023.

Recall that in February 2021, Nigeria’s apex financial regulator issued a restriction on banks facilitating transactions with crypto-related entities.

This ban was a setback for the burgeoning Nigerian crypto community which hitherto allowed deposits and withdrawals for crypto/fiat with bank accounts.

Despite the events that have transpired in the past year – especially with the launch of the National Blockchain policy in May 2023 – the ban was still in place until December 22, 2023, when the CBN announced through a circular that it was lifted.

With the release of this circular, crypto investors in Nigeria will be able to process crypto-based transactions via their bank accounts, making it much easier for them to trade and transact with digital assets across exchanges and payment services.

Quidax continued to innovate despite the ban

When the unpopular policy was put in place in February 2021, many Nigerian companies had to go under the radar, either moving their operations out of the country or shutting down entirely.

On the other hand, others such as Quidax, were forced to innovate in a bid to maintain their operations and keep their customers.

- According to an executive at Quidax who spoke to Nairametrics, Quidax understood the enormity of the challenge but was up to the task:

- “It rested on us to conduct business in a manner that still met global best practices despite the regulatory hurdles,” he said.

Speaking on the relaxing of the restriction, the executive said it is a welcome move for the industry and will no doubt bolster crypto adoption in Nigeria.

- “We’re ready to foster an enabling environment for cryptocurrency trading while we remain committed to helping spread its adoption nationwide,” he added.

- The Quidax executive said the company was able to maintain operations even amid the CBN crypto ban. And now that the ban has been relaxed, Quidax is opening doors to even more customers and would like to give them more value.

- The Lagos-based exchange which recently celebrated its fifth anniversary, has been on an expansion spree. And, with the CBN restrictions now being relaxed, the exchange appears poised to capitalize.

Why was it banned in the first place, probably because it was used to receive donations during endsars protest; a typical case of the type of capricious policy somersaults notoriously responsible for many failed businesses in the country.

Done they need VAX license?