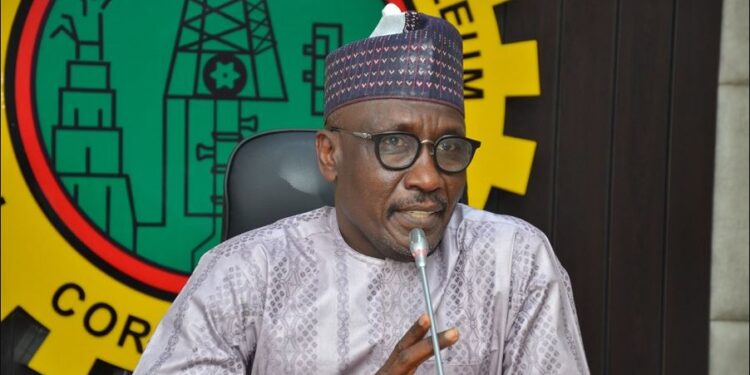

Socio-Economic Rights and Accountability Project (SERAP) has urged Mr Mele Kolo Kyari, the Group Chief Executive Officer, Nigerian National Petroleum Company (NNPC) Limited to “promptly publish details of barrels of oil Nigeria produces and exports every day and the total amounts of revenues generated from oil since the removal of subsidy on petrol in May 2023.

The advocacy group urged Kyari to disclose how much of the revenues generated from oil have been remitted to the public treasury since the removal of subsidy on petrol.

This disclosure is contained in a letter dated December 9, 2023 and signed by SERAP Deputy Director, Kolawole Oluwadare, where the organization noted that there is a legitimate public interest in disclosing the information sought.

Disclose details of N11 trillion subsidy payment

SERAP also urged him “to disclose details of payment of N11 trillion as subsidy, and to clarify allegations that the NNPCL has failed to remit revenues generated from oil to the public treasury since the removal of subsidy on petrol.”

Former Governor of the Central Bank of Nigeria (CBN), Sanusi Lamido Sanusi, had last week alleged that “the NNPCL is failing to remit enough foreign exchange into the treasury despite the removal of fuel subsidy,” asking: “Where is the money?”.

- SERAP said: “Opacity in the amounts of barrels of oil the country produces and exports daily, the revenues generated and remitted to the public treasury would have negative impacts on the fundamental interests of the citizens and the public interest.”

- “Transparency would ensure that the revenues are not diverted into private pockets, and increase public trust that the money would be used to benefit Nigerians.”

Gives 7 days ultimatum

The letter from SERAP partly reads,

- “The public interest in publishing the information sought outweighs any considerations to withhold the information.

- “We would be grateful if the recommended measures are taken within 7 days of the receipt and/or publication of this letter. If we have not heard from you by then, SERAP shall consider appropriate legal actions to compel the NNPCL to comply with our requests in the public interest.

- “SERAP is seriously concerned that years of allegations of corruption and mismanagement in the oil sector and entrenched impunity of perpetrators have undermined public trust and confidence in the NNPCL.

- “Ensuring transparency and accountability in the operations of the NNPCL would improve the enjoyment by Nigerians of their right to natural wealth and resources.

- “SERAP is concerned that despite the country’s enormous oil wealth, ordinary Nigerians have derived very little benefit from oil money primarily because of widespread grand corruption, and the culture of impunity of perpetrators.

- “Combating the corruption epidemic in the oil sector would alleviate poverty, improve access of Nigerians to basic public goods and services, and enhance the ability of the government to meet its human rights and anti-corruption obligations.

- “Nigerians are entitled to the right to receive information without any interference or distortion, and the enjoyment of this right should be based on the principle of maximum disclosure, and a presumption that all information is accessible subject only to a narrow system of exceptions.

- “By Section 1 (1) of the Freedom of Information (FoI) Act 2011, SERAP is entitled as of right to request for or gain access to information, including information on the details of barrels of oil Nigeria produces and exports every day and the total amounts of revenues generated and remitted to the public treasury.

- “The information requested for as indicated above, apart from not being exempted from disclosure under the FoI Act, bothers on an issue of national interest, public concern, interest of human rights, social justice, good governance, transparency and accountability.

- “The Freedom of Information Act, Section 39 of the Nigerian Constitution, and article 9 of the African Charter on Human and Peoples’ Rights guarantee to everyone the right to information, including the details of barrels of oil Nigeria produces and exports every day and the total amounts of revenues generated from oil and remitted to the public treasury.

- “By the combined reading of the provisions of the Nigerian Constitution, the Freedom of Information Act and the African Charter on Human and Peoples’ Rights, there are transparency obligations imposed on the NNPCL to widely publish the details sought.

- “The Nigerian Constitution, Freedom of Information Act, and the country’s anti-corruption and human rights obligations rest on the principle that citizens should have access to information regarding their public institutions’ activities.

- “According to our information, the NNPCL has failed to disclose the amounts of barrels of oil the country produces and exports.

- “The NNPCL has also reportedly failed to publish details of revenues generated from the production and exportation of oil and the amounts of revenues remitted to the public treasury as required by Nigerian laws.

- “According to the former Governor of the Central Bank of Nigeria (CBN), Sanusi Lamido Sanusi, ‘It is only the NNPCL that can give the figures about how much oil we produce daily, how much we sell, and where the money is going. We are no longer paying subsidies so where are the dollars? Where is the money?

- “The NNPCL has a legal responsibility to promote transparency and accountability in barrels of oil the country produces and exports every day, and to ensure that the revenues generated from such production and exportation are dully remitted to the public treasury.

- “The NNPLC also has a legal responsibility to disclose details of payment of N11 trillion subsidy.”