Branch, a leading digital lending platform in Nigeria, is proud to launch its new campaign “Here For You,“ highlighting its commitment to empathy and a customer-centric business model.

With a vision to transform the lending landscape, Branch is dedicated to empowering Nigerians through access to seamless and convenient financial solutions that cater to their unique needs when they need it.

At the core of Branch’s mission is a deep understanding of the challenges individuals face when it comes to accessing affordable credit.

By leveraging technology and data-driven algorithms, Branch has designed a lending platform that creates a bridge between financial institutions and users seeking access to credit, amongst other product benefits, all of which put money back in the pocket of the customer.

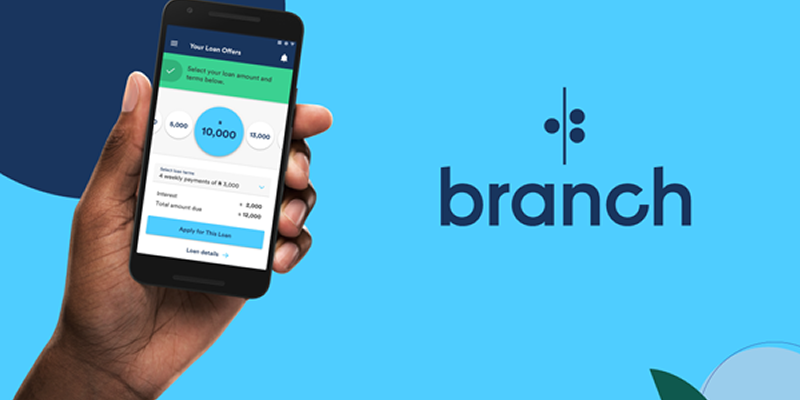

With just a few taps on their mobile devices, users can apply for loans and receive instant approvals, eliminating the traditional hassles associated with loan applications.

Branch recognizes that with the subsisting economic situation, financial emergencies are becoming even more inescapable. From unexpected medical expenses to educational needs, or sometimes, just feeding, there is a growing need for support to stay afloat in very challenging times.

Branch is therefore committed to being that partner that shows up regardless, offering easy access to credit, flexible repayment terms, competitive interest rates and most importantly, non-combative repayment processes that do not impede on the dignity of the user in the event of delayed repayments.

The empathy that Branch showcases through its services goes beyond meeting financial needs.

The platform is fully transparent, ensuring that customers have a thorough understanding of the borrowing process, repayment terms, and associated costs.

Branch also emphasizes financial literacy education, empowering users by providing resources and tools that help them make informed financial decisions.

Branch’s corporate character is rooted in the belief that financial services should be accessible to all, with its brand promise etched in its commitment to creating opportunities that drive positive change in the communities it serves.

By leveraging the power of technology, Branch has been able to reach underserved populations, enabling them to gain control over their financial journeys.

In conclusion, Branch’s “Here For You” campaign serves as a testament to its unwavering commitment to empathy and customer-centricity. Its vision to transform the lending landscape, coupled with its mission to empower individuals with seamless digital lending solutions, sets Branch apart as a trusted partner in times of financial need.

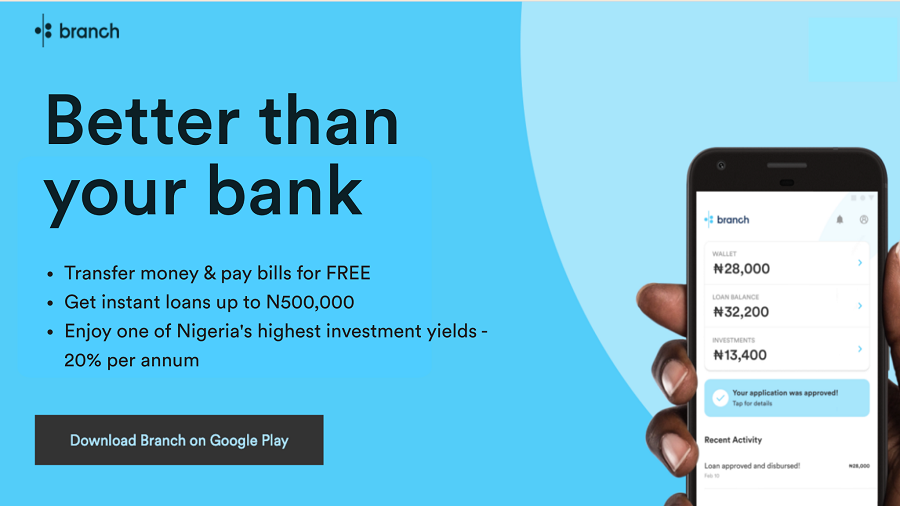

With a corporate character grounded in financial inclusion and a brand promise to drive positive change, Branch stands ready to support individuals and communities, one loan at a time, and with even more offerings like free wallet transfers, cashback rewards on bill payments, debit cards and most importantly, ever listening ears to customer needs.

To find out more about Branch and to access quick loans for your needs, visit www.branch.com.ng