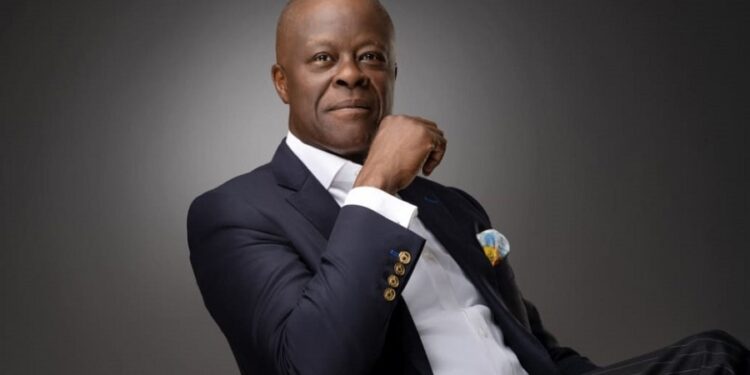

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has said that the government led by President Bola Ahmed Tinubu will prioritize utilizing internal resources, steering away from increasing the national debt burden amid growing concerns about debt sustainability.

Edun, at the close of the G24 Meeting, which was held within the 2023 Annual Meetings of the World Bank and the International Monetary Fund (IMF) taking place in Marrakech, Morocco, further announced the government’s intention to introduce fresh reforms that will prioritize the enhancement of revenue generation through taxation, specifically highlighting tax collection.

Noting that debt sustainability is an issue, he said:

- “Clearly, with interest rates going up around the world, there is the talk and there is the issue that debt servicing is taking a larger share than is feasible, than is practical that is warranted of resources in developing countries around the world.

- “In Nigeria, the answer that we are focusing on as an administration is to increase the flow of non-debt funds. So rather than focusing on borrowing, there will be a focus on encouraging investment, domestic investment and foreign. There will shortly be announcements of measures that rationalize and improve efficiency, which consolidates the issue of tax revenue and domestic resource mobilization.

- “The managing director of the World Bank did say, it’s really simple, the money is in the rich countries. The investments, the opportunity, and the scope for investment as a whole and expansion of business ideas are in poor countries. So, bridging the two is important, and in Nigeria, the focus will be on creating an environment for domestic and foreign investors to thrive.”

Furthermore, he pointed out that there is presently a lack of concessional funding, coupled with a rise in interest rates, even within multilateral organizations.

This situation is causing growing alarm over the potential impact of increasing global interest rates on the mounting debt crisis and the considerable financing gap for the developmental needs of developing nations.

- “Basically, what we have at the moment is not meeting the expectations and the requirements of developing countries, such as Nigeria. There is not enough concessional financing, interest rates are going up even within the multilateral institutions. Interest rates are so high around the world that the issue of debt is, is one that is high on the agenda. And of course, there’s a financing gap, there is not enough funding to fund the developing requirements of the poorer countries,” he stressed.

Need for Domestic Resource Utilization

Speaking further, the Minister also stated that Nigeria, as well as other emerging economies, must emphasize reforms that are centred around domestic resource mobilization, rather than seeking foreign loans to meet budgetary expenditure.

He outlined that President Tinubu’s administration is pushing for inclusive reforms that will stimulate the private sector towards robust development.

The minister also commented on the need to cut back on excessive expenditure as well as expand the tax bracket, adding that the government is implementing certain measures to guarantee efficiency in tax collection.

- “The need for reform, the need for change, the need for improvement. They talked about a bigger, better, and bolder World Bank Group that would also mobilize the private sector funding and of course, for Nigeria, one of the high points was that something that the government of President Bola Ahmed Tinubu has emphasized also came to the fore here, and that is domestic resource mobilization.

- “The fact that we have to depend on our resources, our savings to a larger extent. We must be efficient in collecting taxes and fees and payments that are due, we must be more efficient and cost-effective with our expenditure, and we must create a bigger base of financing from our resources.

- We must rely on ourselves, and we must pull ourselves up much more than relying on others. I think that was an important message that came out,” Edun added.

More on the Story

While speaking at the event, the Minister advocated for a third seat in the governance of international monetary bodies such as the IMF and the World Bank by African nations.

He said that Africans need more representation in these institutions to preserve the collective interest of the continent and put forward policies that are tailor-made for the conditions in Africa.

- “On one hand, as far as the international, multilateral development banks and institutions are concerned, we along with other Africans are calling for a bigger voice, a third seat in the governance of the World Bank and IMF, and for Sub-Saharan Africa, and at the end of the day for Nigeria.

- “So, we are saying we want greater representation at the table in which some of these decisions are taken and of course coming back home, it’s all about what is being done and major steps are being taken to reform the tax environment,” he added.