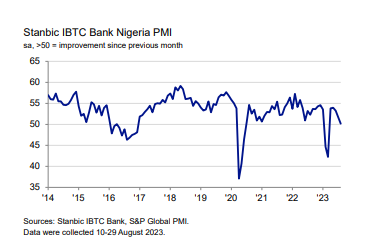

Nigeria’s Purchasing Managers’ Index (PMI) report signals a worrying trend for Nigeria’s private sector, as business activity dipped into contraction for the first time in five months.

The PMI for August registered at 50.2, down from 51.7 in July, revealing only marginal improvement over the previous month and marking the lowest in the current five-month sequence of improving business conditions.

Diminishing Demand and Rising Costs

One of the most startling aspects of the report is the drastic increase in both input costs and output charges, reaching the highest levels since the survey’s inception nearly a decade ago.

- According to the report, “both overall input costs and output charges increased to the largest extent since the survey began almost a decade ago. Inflation again reflected higher transportation costs as a result of the removal of the fuel subsidy, plus currency weakness. Rising transportation costs also caused supplier delivery delays.”

Unsurprisingly, these conditions have acted to diminish demand, as steep price increases make it challenging for firms to secure new orders.

Struggling Employment and New Orders

Rates of expansion in new orders and employment were also sluggish. The rate of new business acquisition has been the softest in the current five-month growth sequence.

- August saw only a marginal increase in new business, with the rate of expansion the softest in the current five-month sequence of growth. Similarly, employment also rose only marginally.

The employment sector also experienced only a marginal rise. These indicators point to a private sector struggling to cope with the escalating costs and subdued demand.

Sector-Specific Analysis

Midway through the third quarter, business activity indicated that not all sectors are created equal in this downturn.

- “Meanwhile, business activity decreased slightly midway through the third quarter, ending four months of expansion.”

- “Sector data pointed to a drop in activity in wholesale & retail and no change in services. Meanwhile, agriculture and manufacturing continued to see output increase.”

Meanwhile, the service sector saw no significant change, revealing a mixed impact across sectors.

Supply Chain and Delivery Delays

Companies are not merely grappling with higher costs; they’re also facing delays from suppliers.

- Although firms have continued to expand their purchasing activity, high transportation costs have affected the speed of input receipt.

- Delivery times from suppliers have only shortened marginally, stalling the marked improvement in delivery times in recent months.

Wary Business Sentiment

Despite these challenges, business sentiment has improved from its record low but remains historically weak.

- Businesses forecasting a rise in output over the next year often linked their optimism to expansion plans and increased advertising activities.

- Yet, the sentiment is far from buoyant, underscoring the general caution pervading the private sector.

The Larger Picture

The report comes amid the government’s struggle to contain inflation and stimulate economic growth.

- The significant pressures affecting the private sector, especially rising costs and sluggish demand, could potentially ripple across the broader economy, affecting consumer spending and employment.

Having had the opportunity to read the article on Nigeria’s Purchasing Managers’ Index (PMI) report, which highlights some concerning trends in the private sector. I must say, the findings are indeed worrisome, and they shed light on the challenges our economy is currently facing.

The dip in business activity into contraction for the first time in five months, as indicated by the August PMI of 50.2, is a clear signal of the hurdles we are encountering. The marginal improvement over the previous month, coupled with the highest levels of input costs and output charges in nearly a decade, present a challenging scenario.

The report’s insight into the causes of these challenges, such as the increase in transportation costs due to the removal of the fuel subsidy and currency weakness, is quite revealing. These factors, along with supplier delivery delays, are understandably affecting demand and making it difficult for businesses to secure new orders.

The sluggish rates of expansion in new orders and employment further emphasize the hurdles our private sector is currently navigating. It’s evident that the escalating costs and subdued demand are creating a tough environment for businesses.

The sector-specific analysis provided in the report also sheds light on how different sectors are experiencing varying impacts during this downturn. While agriculture and manufacturing continue to see output increase, other sectors like wholesale & retail are facing drops in activity.

The challenges extend to supply chains, with companies grappling not only with higher costs but also facing delays from suppliers. These supply chain disruptions are impacting the speed of input receipt, which is critical for businesses’ operations.

Despite these challenges, it’s somewhat encouraging to note that business sentiment has improved, albeit from a record low. Businesses are cautiously optimistic, often linking their outlook to expansion plans and increased advertising activities. However, the overall sentiment remains cautious, reflecting the uncertainties that prevail in the private sector.

In the larger picture, these challenges in the private sector could potentially have broader implications for the economy, including consumer spending and employment. It’s crucial that we closely monitor and address these issues to ensure sustainable economic growth.

Thank you for sharing this insightful article. It’s important for us to stay informed and engaged in discussions surrounding our country’s economic challenges.