Fintech company, Moniepoint Inc. said it now processes average monthly transactions valued at $12 billion as more businesses in Nigeria embrace digital payments.

The Acting Managing Director of Moniepoint Microfinance Bank, Babatunde Olofin, who disclosed this on Thursday during a chat with journalists in Lagos, attested to the fact that the cash scarcity incidence that occurred early this year pushed more businesses and individuals to go cashless.

Olofin further disclosed that the fintech which recently announced its entry into personal banking having been on the business side of digital financial services for years, is now recording an average of 400 million transactions monthly.

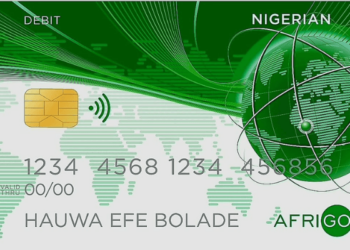

- “Moniepoint currently serves over 1.6 million businesses, and going into personal banking, the fintech is targeting at least 4.8 million retail customers in the first three months.Moniepoint Inc that has birthed a robust and reliable digital payment infrastructure that has carried out an average monthly transaction value of $12 billion for about 1.6 million businesses.”

He said this is based on the projection that each of the 1.6 million businesses it has onboarded has, at least, 3 workers, who are potential customers of Moniepoint personal banking services

Deepening financial inclusion

Olofin said the fintech’s move into personal banking was to help in achieving the financial inclusion target of the Central Bank of Nigeria as it will be targeting many unbanked Nigerians through agent banking.

- “In every corner of the nation, we have our representatives known as agents. Even in areas where we don’t have a physical bank presence, we are there. We call our agents ‘man bank’ because you can actually do everything you can do in a banking hall with our agents. So, we are everywhere because we want to drive financial inclusion in Nigeria.

- “I remember talking to someone one day and she said because she stayed at Ijede, before she could withdraw N5,000, she had to spend N500 on transport to Ikorodu just to use an ATM.

- “So, you can now imagine when such a person discovered that we have agents right within Ijede and she does not have to spend N500 to go to Ikorodu for cash withdrawal anymore.

- “The agents are not like ATMs that will say unable to dispense because they are always able to dispense and hardly will you have dispense error because of our solid infrastructure. So, this is how we are driving financial inclusion and that was how we won the market in the first place even in areas where there are banks. We are making sure that financial service is not a privilege but a right for everybody,” he said.

Coping with rising transactions

With the increase in digital transactions, especially since March this year when many Nigerians were forced to embrace cashless payments due to cash crunch, Olofin said the fintech has deployed elastic infrastructure to accommodate the growing volume of digital transactions on its platform.

- “We have built our infrastructure in such a way that it is very elastic infrastructure. As transactions grow, we expand our infrastructure and this is because we have several monitoring tools that help us to monitor how transactions are growing.

- “We have a system that triggers and says oh, the transactional threshold has gotten to this level. And immediately we know what to do to expand our infrastructure. And that’s why even during those times when people find it difficult to transact with other banks, we were always up and we are still and we will continue to be up to satisfy our customers,” he said.

In 2022, Moniepoint processed 1.7 billion transactions worth over $100 billion, according to its 2022 performance review report. It also disbursed $1.4 billion in loans and booked less than 1% in NPL (Non-Performing Loan).

Moniepoint is good, and it’s been good for me since have been using it.i make profit on it not loose.

I will always be using moniepoint .

This fintechs and their perversion of data for investment…how much Naira is in circulation today digital and physical that you yurnover 12bn dollars? …what is the basis for this figure. Nairametrics just publish without questioning?? Poor.

I concur with your assertion and line of thought. That turnover volume looks unfeasible!

It’s always good to provide a source we can reference. Extremely, ridiculous volume even if failed transactions were included.

I ll say their investment in Advertisement especially with the headlines Sponsorship of BBN All stars gave them a huge visibility platform to garner such number of subscribers. I trust they have a plan to gainfully engage

banking system in Nigeria

Moniepoint is the best among the banking system in Nigeria