The latest data from the National Bureau of Statistics (NBS) has revealed that the metal ore sub-sector under the mining sector recorded the highest growth rate among all the sectors of the Nigerian economy in the first two quarters of 2023.

In an era when most eyes are on technology and finance, Nigeria’s traditional sectors Metal Ores and Quarrying led the pack, claiming the top spots in terms of economic growth for Q2 2023, according to recent data.

This sector, which includes iron ore, gold, copper, and other minerals, is drawing significant investor attention to Nigeria’s rich geological assets.

What the data revealed

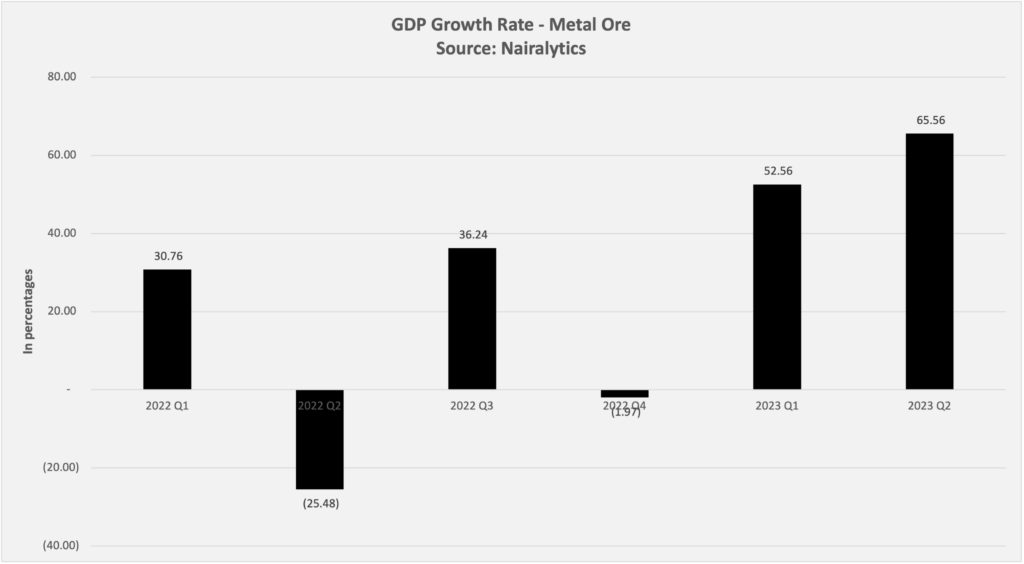

The metal ores sector also rebounded strongly from a slight contraction of 1.97% in the fourth quarter of 2022 to register a GDP growth rate of 65.56% in the second quarter of 2023.

- The sector also registered a real GDP growth rate of 52.56% in the first quarter of 2023.

- Another sector that has shown remarkable growth is the quarrying and other minerals sector, which grew by 39.18% in the second quarter of 2023, compared to the same period in 2022.

- This sector includes stone, sand, clay, and other materials used for construction and manufacturing.

- Combined the mining sector (without crude oil and coal mining) makes up just 0.21% of GDP. In nominal terms, the metal ore and quarrying sectors have a GDP value of N38.5 billion N464.9 billion, and N1.9 trillion respectively.

The mining sector garnered significant attention under the Buhari administration as the government listed it as one of the key sectors in its economic diversification drive. Under the government’s National Development Plan, the mining sector is targeted to contribute up to 3% of GDP by 2023.

To achieve this, the government adopted 5 key strategies which include, establishing an independent and well-resourced regulatory authority responsible for the orderly development of the mining industry.

- They also want to revitalize Ajaokuta Steel Company Limited (ASCL) and the Nigerian Iron Ore and Mining Company (NIOMCO) and develop an Artisanal and Small-Scale Mining (ASM) policy into a broad rural development strategy.

- They also plan to invest in increased infrastructure for activities in this sector and further leverage the Natural Resources Development Fund to develop the sector.

- The report also indicates the government plans to create mining economic clusters with extensive backward and forward linkages both orientated around the minerals sector and the broader economy.

- They will also Invest in R&D and skills development to enhance local knowledge generation and improve sector competitiveness.

Despite these lofty plans, the sector has been besieged by illegal mining which the EFCC recently announced it plans to clamp down.

Miners also recently accused state governments were overregulating the sector, warning that that some new governors have started issuing executive orders, either banning mining activities or attempting to regulate the sector.

Other fast-growing sectors

The financial institutions sector also recorded a robust growth of 29.23% in the second quarter of 2023, compared to the same period in 2022.

- The financial institutions sector also maintained a consistent growth rate of above 10% in each of the previous three quarters, reflecting the stability and resilience of the financial system.

Water and Waste Management’s Unexpected Surge: The waste management and remediation sector also registered a notable growth of 20.56% in the second quarter of 2023, compared to the same period in 2022.

- The water supply, sewerage, waste management, and remediation sector also recovered from a relatively low growth rate of 3.89% in the third quarter of 2022, which was due to operational and maintenance challenges.

Telecom: A Slight Disconnect – The telecommunications sector also achieved a respectable growth of 9.74% in the second quarter of 2023, compared to the same period in 2022.

- This sector, which includes mobile and fixed telephony, internet services, broadcasting services, and other information and communication technologies (ICT), has been fueled by the increased demand and consumption of these services by individuals and businesses.