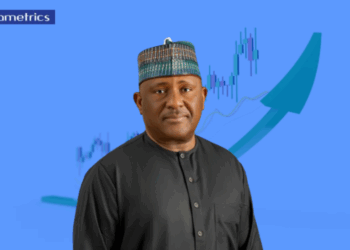

Abdulsamad Rabiu, the Chairman of BUA Cement and one of Nigeria’s richest men has experienced a significant decline in his net worth, losing a staggering $3 billion in just 60 days.

As of the time of this report, his current net worth stands at $5.6 billion, a sharp contrast to the $8.6 billion reported by Nairametrics on April 29, 2023, according to Forbes Billionaire index data.

As a result, his current net worth now stands at $5.6 billion, a sharp contrast to the $8.6 billion reported by Nairametrics on April 29, 2023, according to Forbes Billionaire index data.

How did Abdulsamad Rabiu’s net worth drop to $5.7B?

The 62-year-old business mogul experienced a 1.59% drop in net worth within a 24-hour period, equating to an estimated loss of $159 million.

Additionally, the devaluation of the Naira and the recent unification of the exchange rate system in June further weakened his wealth valuation, similar to the impact felt by other prominent billionaires in Nigeria, such as Aliko Dangote and Mike Adenuga.

Rabiu reportedly lost a significant portion of his wealth, approximately $2.73 billion, in June alone due to the effects of the naira unification.

Most of Rabiu’s wealth is derived from BUA Cement, where he holds a majority stake of 93% in BUA Foods and 98% in BUA Cement.

Consequently, any fluctuations in the share price of these companies can exacerbate the decline in net worth.

Abdul Samad Rabiu’s background

Rabiu’s previous surge in net worth led to his inclusion in Bloomberg’s list of the top 500 billionaires. However, due to the downward trajectory of his net worth, he has since been removed from the list.

Just two weeks ago, Nairametrics reported that Rabiu experienced a significant gain in the Nigerian exchange market, contributing to his net worth.

The appreciation of his shares in BUA Cement Plc, which increased by 23% in the first half of the year, played a significant role in this growth, adding $1.3 billion to his net worth.

The billionaire businessman, Rabiu studied economics at Capital University in Ohio. He returned to Nigeria at 24 to run the family business.

Rabiu founded the BUA Group in 1988, importing food and steel. After a series of mergers, including the 2009 acquisition of Cement Company of Northern Nigeria (CCNN), the company has become a producer of cement and sugar.

BUA Cement, is the country’s second-largest cement producer, with sales of N361 billion (US$847 million) in 2022 alone.

usman

Allah bless him again