Background.

CrusaderSterling Pensions Limited, was incorporated on the 12th of October 2004 and is licenced as Pension Fund Administrator (PFA) under the provisions of the Pension Reform Act 2014.

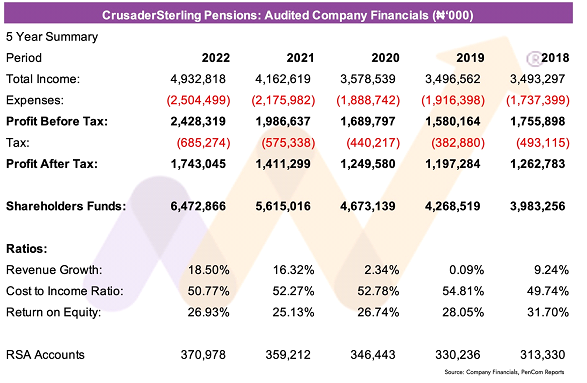

The company is owned by Custodian Investment Plc, Sterling Asset Management and Trust Ltd, WSTC Financial Services Limited, and Ideal Insurance Brokers Ltd. As of December 31, 2022, the company had shareholders’ funds of N6.47 billion.

Analysis:

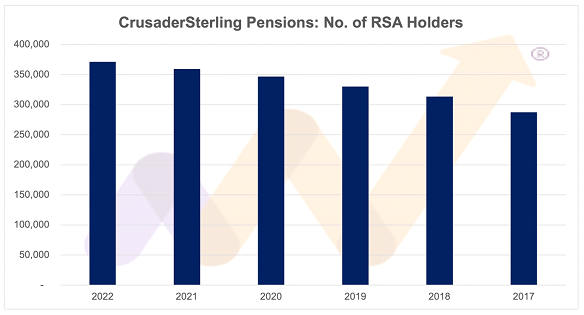

CrusaderSterling Pensions ended the 2022 financial year with 370,978 RSA holders in the 6 publicly available RSA funds, an increase of 11,766 RSA holders from 359,212 in 2021.

Additionally, assets under management for the 6 audited Retirement Savings Accounts (RSAs) published reached N389.26 billion, up 15.77% from N336.22 billion in 2021.

Performance Analysis: Company

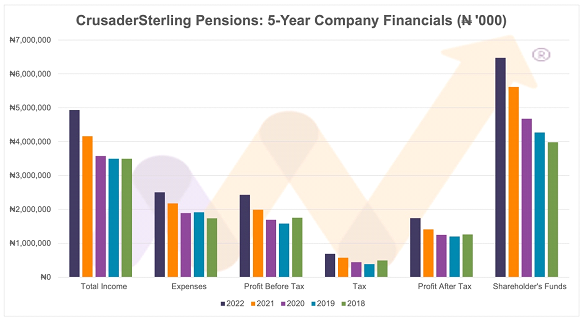

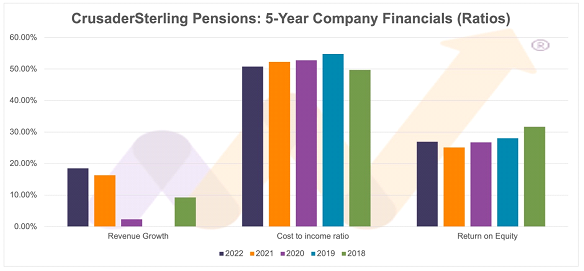

Company revenue for the year ended December 31, 2022, grew by 18.50% to N4.93 billion, compared to N4.16 billion in 2021.

- Total expenses for managing the business rose by 15.10% to N2.50 billion, N2.12 billion (2021), leading to a cost-to-income ratio of 50.77%, slightly down from 52.27% in 2021.

- The company has a five-year average cost-to-income ratio of 52.07%.

- Profit After Tax (PAT) for 2022 increased by 23.51% to N1.74 billion, compared to N1.41 billion in 2021. Shareholders’ funds grew to N6.47 billion in 2022 from N5.62 billion in 2021.

Performance Highlights: RSA Funds (audited)

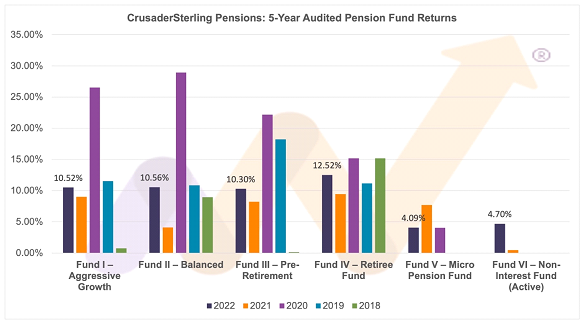

For the year ended 31 December 2022, the CrusaderSterling Pensions Fund I appreciated by 10.52%, Fund II appreciated by 10.56%, Fund III by 10.30%, Fund IV by 12.52%, Fund V by 4.09% and Fund VI – Non-Interest (Active) by 4.70%.

- Information on the company’s website indicates that the company offers 6 of the 7 PenCom approved funds to the public.

- Returns benchmarks are yet to be established for pension funds but for indirect comparisons for the year 2022, the NGX All-Share Index (a measure of performance of the stock market) appreciated by 19.98%, the NGX Pension Index appreciated by 16.96%, inflation was 21.47% and MPR closed the year at 16.50%, having risen steadily through the year.

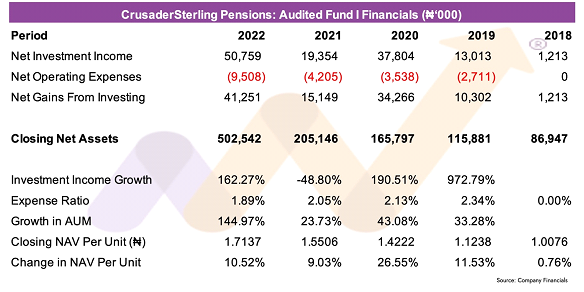

CrusaderSterling Pensions Fund I highlights:

- Fund performance: up 10.52% in 2022, higher than the 9.03% in 2021 but lower than the 26.55% in 2020. The fund’s 4-year average is 14.41%. The fund was launched sometime in 2018.

- Fund income was N76 million in 2022, up 162.27% from N19.35 million in 2021.

- Net gains from investing activities rose 172.30% to N25 million in 2022, up from N15.15 million in 2021.

- Fund size: the size of the fund, measured by net assets, grew 144.97% to N54 million from N205.15 million.

- The fund expense ratio (cost of managing the fund) was 1.89% in 2022, down from 2.05% in 2021.

- Asset Allocation as of 31-12-2022 was as follows: Fixed Income Instruments 66.84% (2021: 55.07%), Equities 8.00% (2021: 17.35%), Money Market instruments 12.01% (2021: 21.14%), Cash 10.83% (2021: 1.29%), Others 2.32% (2021: 5.15%).

- Performance ranking: The fund performance for 2021 was ranked 3 out of 19 in our 2022 report.

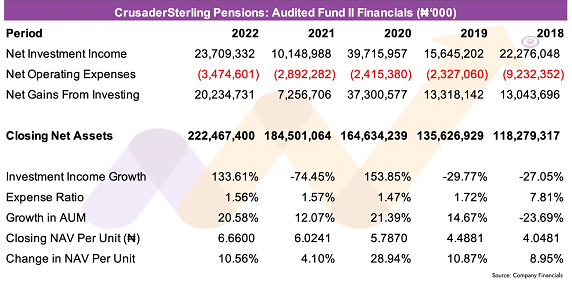

CrusaderSterling Pensions Fund II highlights:

- Fund performance: up 10.56% in 2022, compared to 4.10% in 2021 and 28.94% in 2020.

- Fund income was up 133.61% to N71 billion in 2022. Though this was up from N10.15 billion in 2021, it was still substantially below N39.72 billion in 2020.

- From the summary accounts, there seem to be no substantial withdrawals from nor transfers to other funds.

- Net gains from investing activities as N23 billion in 2022, up 178.84% in 2021 which was N7.26 billion. 2020 was N37.30 billion.

- Fund size: Inconsistent growth in Fund II continued with the fund growing 20.58% to N47 billion from N184.50 billion in 2021. The fund had grown 12.07% in 2021, 21.39% in 2020, 14.67% in 2019, fell 23.69% in 2018 having grown 29.02% in 2017.

- Fund expense ratio: The cost of managing the fund was 1.56% in 2022, a slight drop in the 2021 figure of 1.57%. The fund has a 5-year average of 2.82%, though 2018 was unusually high at 7.81%.

- Asset Allocation as of 31-12-2022 was as follows: Fixed Income Instruments 69.20% (2021: 76.03%), Equities 12.60% (2021: 15.30%), Money Market instruments 16.76% (2021: 7.22%), Cash 0.13% (2021: 0.02%), Others 1.31% (2021: 1.43%).

- Performance ranking: The fund performance for 2021 was ranked 14 out of 19 in our 2022 report.

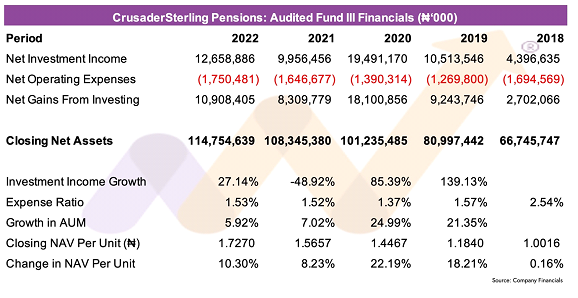

CrusaderSterling Pensions Fund III highlights:

- Fund performance: was 10.30% in 2022, compared to 8.23% in 2021 and 28.94% in 2020.

- Fund income was up 27.14% to N66 billion in 2022. Though this was up on the N9.96 billion of 2021, it was over 35% lower than the N19.49 billion of 2020. From the summary accounts, the fund paid out N3.44 billion in benefits and had N1.01 billion of negative employer/employee contribution in 2022.

- Net gains from investing activities in 2022 was N91 billion, up 32.27% from N8.31 billion in 2021. 2020 was N18.1 billion.

- Fund size: Fund III grew 5.92% to N75 billion from N108.35 billion in 2021. The fund had grown 7.02% in 2021, 24.99% in 2020 and 21.35% in 2019.

- Fund expense ratio: 1.53% in 2022, barely changed on 2021 which was equally 1.52%. The fund has a 4 year average of 1.50%.

- Asset Allocation as of 31-12-2022 was as follows: Fixed Income Instruments 86.65% (2021: 89.87%), Equities 7.32% (2021: 8.26%), Money Market instruments 5.81% (2021: 1.71%), Cash 0.13% (2021: 0.07%), Others 0.09% (2021: 0.09%).

- Performance ranking: The fund performance for 2021 was ranked 6 out of 19 in our 2022 report.

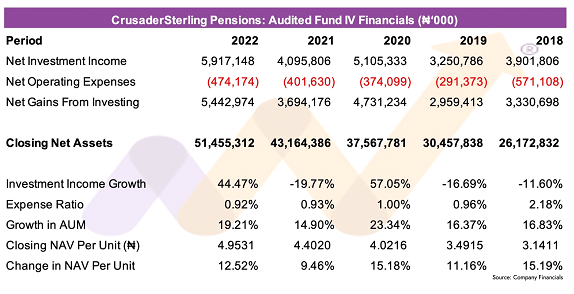

CrusaderSterling Pensions Fund IV highlights:

- Fund performance: up 12.52% in 2022, compared to 9.46% in 2021 and 15.18% in 2020. This fund had the highest performance of all CrusaderSterling Pensions funds for 2022.

- Fund income: N92 billion in 2022, up 44.47% from N4.10 billion in 2021.

- Net gains from investing activities: N44 billion in 2022, up 47.34% from N3.69 billion in 2021.

- Fund size: Fund IV grew 19.21% to N46 billion, from N43.16 in 2021.

- Fund expense ratio: 0.92% in 2022, relatively unchanged on 2021, which was 0.93%.

- Asset Allocation as of 31-12-2022 was as follows: Fixed Income Instruments 77.44% (2021: 85.147%), Equities 2.55% (2021: 3.59%), Money Market instruments 19.36% (2021: 1.71%), Cash 0.65% (2021: 0.01%), Others 0.00% (2021: 0.00%).

- Performance ranking: The fund performance for 2021 was ranked 6 out of 19 in our 2022 report.

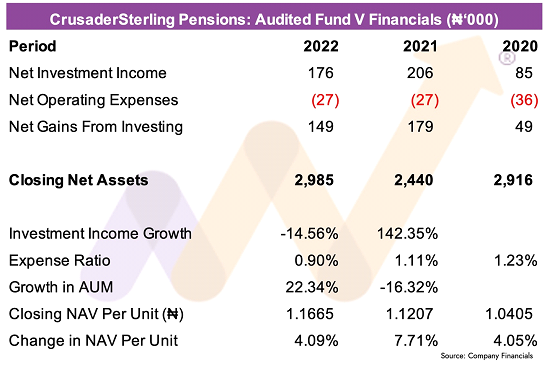

CrusaderSterling Pensions Fund V highlights:

- Registered Fund V RSA holders: 1,464 in 2022, up from 1,445 in 2021. Total industry Micro Pension RSA holders in 2022 were 89,327, giving CrusaderSterling Pensions a 1.64% market share.

- Total assets in the fund: N99 million in 2022, up 22.34% from N2.44 million in 2021.

- Fund income: Net fund income for the fund was N176,000 in 2022, down 14.46% from N206,000 in 2021.

- Net gains from investing activities: N149,000 in 2022, down from N179,000 in 2021.

- Fund performance was 4.09% in 2022 compared to 7.71% in 2021.

- Performance ranking: The fund performance for 2021 was ranked 7 out of 14 in our 2022 report.

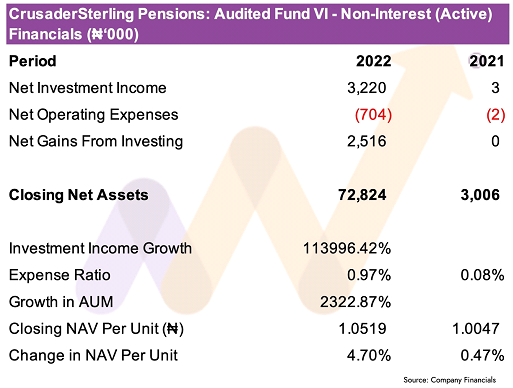

CrusaderSterling Pensions Fund VI – Non-Interest (Active):

- Income: N22 million in 2022.

- Net gains from investing activities: N5 million in 2022.

- Fund size: Fund VI (A) grew to N82 million from N3.0 million in 2021.

- Fund performance was 4.07 in 2022. 2021 was a partial year.

- Performance ranking: The fund performance for 2021 was ranked 9 out of 11 in our 2022 report.

Watch out for our 2023 report detailing all fund rankings for 2022 in the 2023 Money Counsellors Annual Report on Pensions (MCARP 2023). Download the 2022 report here.

This article was written by Michael Oyebola.

For more information and analysis, visit moneycounsellors.com

Coming out soon, our 2023 Annual Report on ALL Pensions. See our 2022 report: the Money Counsellors Annual Report on Pensions (MCARP 2022) for a full analysis of all Pension Fund Administrators (PFA) in one single document.