- Stanbic IBTC Pension Managers’ assets under management for Retirement Savings Accounts (RSAs) increased to N4.38 trillion in 2022, with positive performance across various funds.

- Stanbic IBTC Pension Managers experienced growth in total income and profit after tax in 2022, despite a rise in the cost of managing the business.

- The company is the largest Pension Fund Administrator (PFA) in Nigeria, with significant shareholders’ funds and a large number of RSA holders.

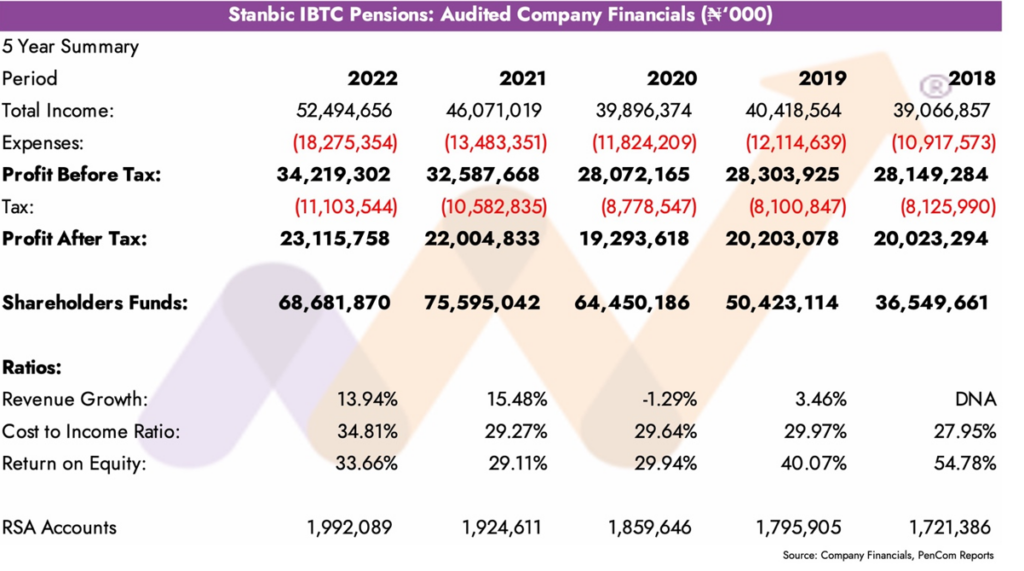

Data collated from PenCom’s periodic reports in 2022 shows that Stanbic IBTC Pension Managers ended the 2022 financial year with 1,992,089 RSA holders in the 7 publicly available RSA funds, an increase of 67,478 RSA holders from 1,924,611 in 2021.

Additionally, assets under management for the 7 audited Retirement Savings Accounts (RSAs) reached N4.38 trillion, up 11.52% from N3.93 trillion in 2021.

Performance Analysis: Company

For the year ended December 31, 2022, total income grew by 13.94% to N52.49 billion, compared to N46.07 billion in 2021.

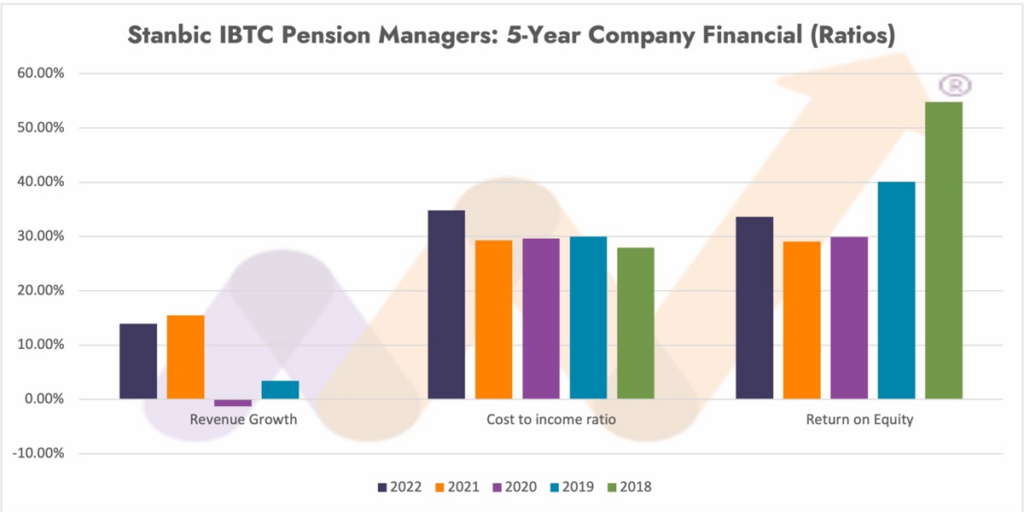

The cost of managing the business rose by 35.54%, leading to a cost-to-income ratio of 34.81%, up from 29.27% in 2021. This ratio was 29.64% in 2020, and the five-year average stands at 30.33%, the lowest in the industry so far.

Profit After Tax (PAT) for 2022 increased by 5.05% to N23.12 billion, compared to N22.00 billion in 2021. Stanbic IBTC Pension Managers did not require recapitalization during the last regulator-induced recapitalization exercise.

Shareholders’ funds were a very healthy N68.68 billion, though it did drop 9.15% from N75.60 billion in 2021.

Performance Highlights: RSA Funds (audited)

Performance Highlights: RSA Funds (audited)

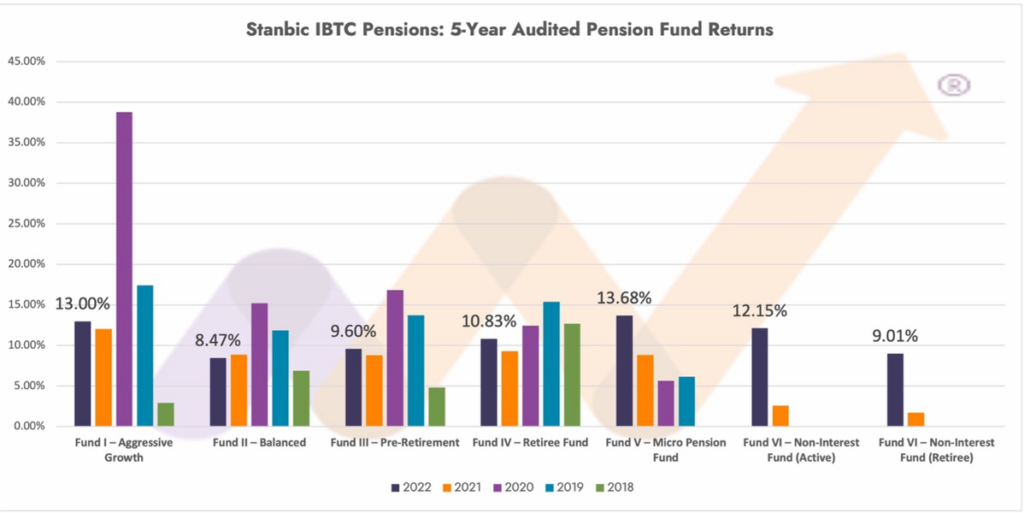

For the year ended 31 December 2022 the Stanbic IBTC Pension Managers Fund I appreciated by 13.00%, Fund II appreciated by 8.47%, Fund III by 9.60%, Fund IV by 10.83%, Fund V by 13.68%, Fund VI – Non-Interest (Active) by 12.15% and Fund VI Non – Interest (Retiree) by 9.01%. The Stanbic IBTC Pension Managers Fund VI – Non-Interest (Active) was launched on 6 August 2021 whilst Fund VI Non–Interest (Retiree) was launched on 20 August 2021. Stanbic IBTC Pension Managers offers all 7 PenCom-approved funds to the public.

Returns benchmarks are yet to be established for pension funds but for indirect comparisons it is worth noting that for the year 2022 the stock market appreciated by 19.98%.

The NGX Pension index appreciated by 16.96%, inflation was 21.47% and MPR closed the year at 16.50%, having risen steadily through the year.

Stanbic IBTC Pension Managers Fund I highlights:

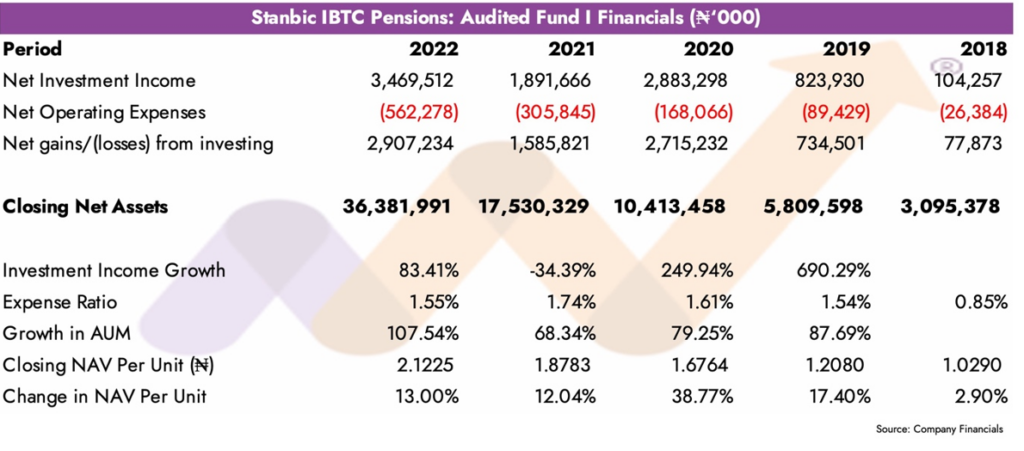

- Fund performance: up 13.00% in 2022, higher than the 12.04% in 2021 but lower than the 38.77% in 2020. The fund’s four-year average is 20.30%. The fund was launched in 2018 and had a partial year.

- Income: N47 billion in 2022, up 83.41% from N1.89 billion in 2021.

- Net gains from investing activities: N91 billion in 2022, an 83.33% increase over 2021.

- Fund size: the size of the fund, measured by net assets, grew 107.54% from N53 billion to N36.38 billion.

- Expense ratio: 1.55% in 2022, down from 1.74%.

- Asset Allocation (31-12-2022): Fixed Income Instruments 0.00%, Equities 5.20%, Money Market instruments 28.09%, Cash 0.00%, Others 66.71% (2021 comparison data unavailable).

- Performance Ranking: 1 out of 19 in 2021. The ranking for 2022 will be revealed later.

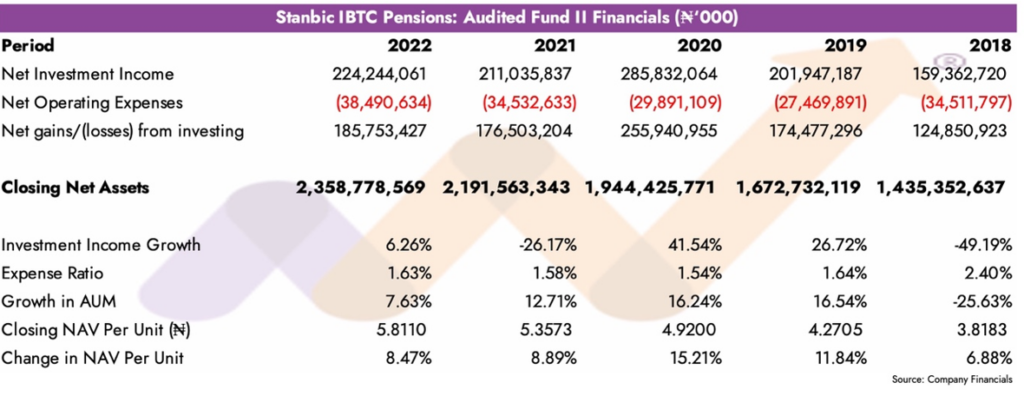

Stanbic IBTC Pension Managers Fund II highlights:

- Fund performance: up 8.47% in 2022, compared to 8.89% in 2021.

- Income: N24 billion in 2022, up from N211.04 billion in 2021.

- Net gains from investing activities: N75 billion in 2022, up from N176.50 billion.

- Fund size: Fund II grew 7.63% to N36 trillion. Growth slowing faster than the last 3-year double digits.

- Expense ratio: 1.63% in 2022, an increase on the 2021 figure of 1.58%.

- Asset Allocation (31-12-2022): Fixed Income Instruments 0.04%, Equities 10.08%, Money Market instruments 13.54%, Cash 0.00%, Others 76.34% (2021 comparison data unavailable).

- Performance Ranking: 5th out of 19 in 2021. The ranking for 2022 will be revealed later.

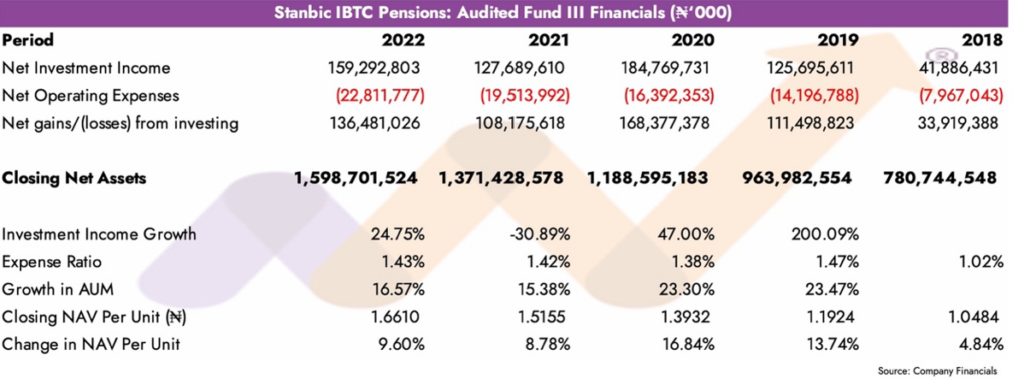

Stanbic IBTC Pension Managers Fund III highlights:

- Fund performance: up 9.60% in 2022, compared to 8.78% in 2021.

- Income: N29 billion in 2022, up from N127.69 billion in 2021.

- Net gains from investing activities: N48 billion in 2022, up from N108.18 billion.

- Fund size: Fund III grew 16.57% to almost N60 trillion.

- Expense ratio: 1.43% in 2022, slightly higher than 1.42% in 2021.

- Asset Allocation (31-12-2022): Fixed Income Instruments 0.02%, Equities 2.56%, Money Market instruments 14.49%, Cash 0.00%, Others 82.93% (2021 comparison data unavailable).

- Performance Ranking: 4th out of 19 in 2021. The ranking for 2022 will be revealed later.

Stanbic IBTC Pension Managers Fund IV highlights:

Stanbic IBTC Pension Managers Fund IV highlights:

- Fund performance: up 10.83% in 2022, compared to 9.30% in 2021.

- Income: N52 billion in 2022, up from N 31.63 billion in 2021.

- Net gains from investing activities: N11 billion in 2022, up from N28.94 billion.

- Fund size: Fund IV grew 10.22% to N1 billion, though growth is still double digits, this is the slowest growth rate of the last 7 years.

- Expense ratio: 0.90% in 2022, up from 0.77% in 2021.

- Asset Allocation (31-12-2022): Fixed Income Instruments 0.00%, Equities 0.46%, Money Market instruments 18.39%, Cash 0.00%, Others 81.15% (2021 comparison data unavailable).

- Performance Ranking: 3rd out of 19 in 2021. The ranking for 2022 will be revealed later.

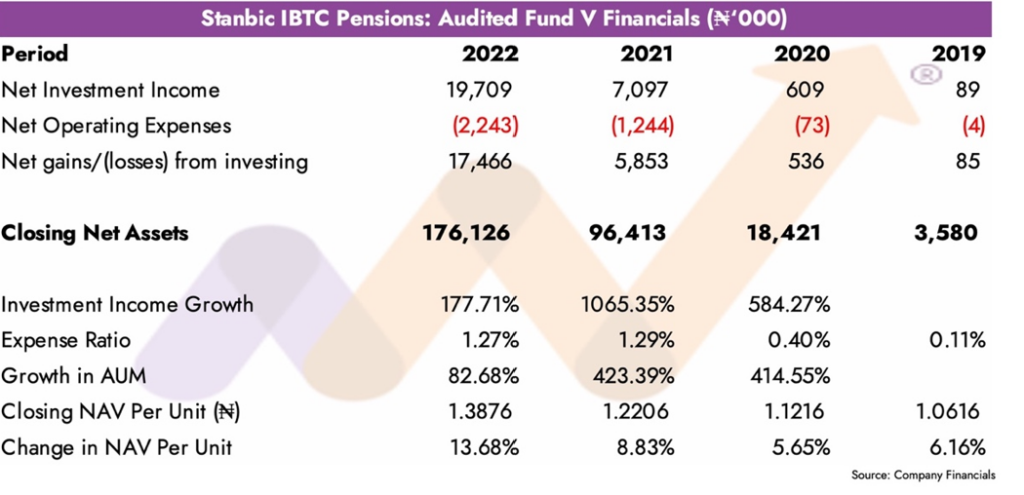

Stanbic IBTC Pension Managers Fund V highlights:

Stanbic IBTC Pension Managers Fund V highlights:

- Registered RSA holders: 14,962 in 2022, up from 11,405 in 2021.

- Total Micro Pension RSA holders: 89,237 in 2022, with a 16.75% market share.

- Total assets in the fund: N13 million in 2022, up 82.68% from N96.41 million in 2021.

- Income: N71 million in 2022, up from N7.09 million in 2021.

- Net gains from investing activities: N47 million in 2022, up from N5.83 million in 2021.

- Fund performance: up 13.68% in 2022, compared to 8.83% in 2021.

- Performance Ranking: 2nd out of 14 in 2021. The ranking for 2022 will be revealed later.

Stanbic IBTC Pension Managers Fund VI – Non-Interest (Active) highlights:

Stanbic IBTC Pension Managers Fund VI – Non-Interest (Active) highlights:

- Income: N91 million in 2022, up from N71.56 million in 2021.

- Net gains from investing activities: N38 million in 2022, up from N57.07 million in 2021.

- Fund size: Fund VI (A) grew 125.13% to N35 billion. The fund, launched on 6 August 2021 closed 2021 with N2.82 billion of assets under management.

- Fund performance: up 12.15% in 2022. The fund was launched on 6 August 2021, hence was not a full year for comparative purposes.

- Performance Ranking: Not ranked in 2021. The ranking for 2022 will be revealed later.

Stanbic IBTC Pension Managers Fund VI – Non-Interest (Retiree) highlights:

- Income: N75 million in 2022, up from N4.27 million in 2021.

- Net gains from investing activities: N81 million in 2022, up from N3.06 million in 2021.

- Fund size: Fund VI (R) grew 88.07% to N50 million. The fund, launched on 20 August 2021 closed 2021 with N164.56 million of assets under management.

- Fund performance: up 9.01% in 2022. The fund was launched on 20 August 2021, hence was not a full year for comparative purposes.

- Performance Ranking: Not ranked in 2021. The ranking for 2022 will be revealed later.

Please note that all fund rankings for 2022 will be included in the 2023 Money Counsellors Annual Report on Pensions. Download the 2022 report here.

What you should know

Stanbic IBTC Pension Managers Limited, incorporated on 19 May 2004, 2004, is a Pension Fund Administrator (PFA) licensed under the provisions of the Pension Reform Act 2014.

The company is a subsidiary of Stanbic IBTC Holdings PLC (a member of the Standard Bank Group) and is a joint venture between Stanbic IBTC Holdings PLC (88.24%) and Linkage Assurance PLC (11.76%). As of December 31, 2022, the company had shareholders’ funds of N68.68 billion.

By Michael Oyebola

For more information and analysis, visit moneycounsellors.com