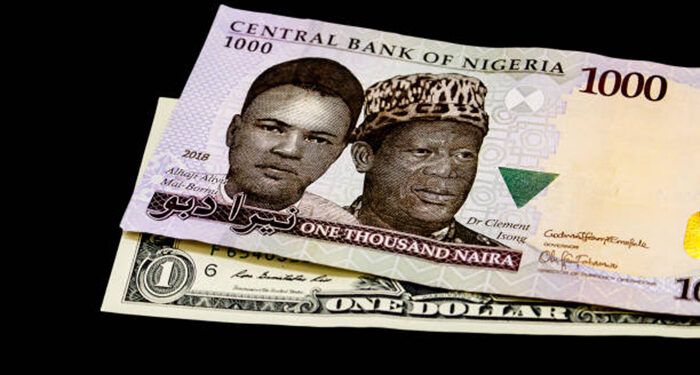

- The Central Bank of Nigeria (CBN) has announced the unification of all segments of the forex market collapsing all windows into one.

- Under the new system, market forces such as supply and demand will play a significant role in determining the exchange rate.

- This means even those applying for BTA and PTA will also pay the official exchange rate at the I&E window.

The Central Bank of Nigeria (CBN) in an official statement has announced the unification of all segments of the forex market collapsing all windows into one.

Previously, there were different windows and a fixed exchange rate system in place. However, with the recent changes, the exchange rate will be determined through the Investors and Exporters (I&E) window, where transactions will be conducted.

With this new development, market forces such as supply and demand will now play a significant role in determining the exchange rate.

Nairametrics tracked the various reactions to this announcement on social media as netizens expressed their views and how it affects them.

Reactions on Social Media

Oloye said that the naira float could lead to an increase in fuel prices. He said:

- “An effect of the Naira float is an upward review of fuel price. The former prices were based on the old exchange rate. If NNPC has to source $ at 750. It’s impossible to keep the price at N500-570/L. The prices will add another 100 Nair Asan at least. Prepare to buy fuel at 650-700/L.”

An effect of the Naira float is upward review of fuel price.

The former prices were based on the old exchange rate. If NNPC has to source $ at 750.

It's impossible to keep price at N500-570/L.

The prices will add another 100 naira at least.

Prepare to buy fuel at 650-700/L.

— Olóyè. (@Ol0ye) June 14, 2023

Meanwhile, Akin Oyebode said the naira unification could cause short term-nairas discomfort but be beneficial in the long term. He said:

- “Subsidy and the exchange rate peg gone in two weeks. PBAT’s economic agenda is well and truly on. It’ll be a bumpy ride for a few months for sure, but two necessary actions for long-term long-term macro and fiscal recovery done.”

Subsidy and the exchange rate peg gone in two weeks. PBAT’s economic agenda is well and truly on. It’ll be a bumpy ride for a few months for sure, but two necessary actions for long term macro and fiscal recovery done.

— Akin Oyebode (@AO1379) June 14, 2023

A user called Foundational Yoruba Boy indicated that the unification of exchange rates would put an end to those who were profiting from the multiple exchange rates. He said:

- “This exchange rate is very much like the subsidy regime. Few rich people put govt money in their pockets at the expense of everybody else. Now, we all buy fuel for the same amount and we all trade dollars for the same amount, no one is making obscene profit thru round-trippingputpocketsthe .”

This exchange rate is very much like the subsidy regime.

Few rich people putting govt money in their pocket at the expense of everybody else.

Now, we all buy fuel for same amount and we all trade dollars for same amount, no one is making obscene profit thru round tripping— Foundational Yorùbá Boy (@Chrisbamidele) June 14, 2023

Mu’awiyyah Yusuf Muye is happy that there won’t be manipulation of the dollar anymore. He said:

- “Nobody will cut corners to sell dollars again. That’s just great. Atleast there is no reason to manipulate the dollars the dollar against Naira again, but knowing Nigerians, May God help us.”

Nobody will cut corners to sell dollars again. That’s just great. Atleast there is no reason to manipulate dollar against Naira again, but knowing Nigerians, May God help us.

— Mu’awiyyah Yusuf Muye (@MP_Muye) June 14, 2023

Oyemaja wants the restriction of naira cards to be lifted so dollar transactions can be made. He said:

- “Can they at least remove the restrictions on naira cards to carry out dollar transactions for God’s sake.”

Can they at least remove the restrictions on naira cards to carry out dollar transactions for God's sake.

— Oyemaja (@OlamideOyemaja) June 14, 2023

Finally, Hamma is concerned that floating the naira would lead to an increase. in the price of petrol. He said:

- “If truly the Dollar is now on free float PMS can be 800 a litre the if dollar remains 750 Like I said before I am 100% in supportPMSthe PMS pms subsidy removal but totally against idea of floating the naira and living at the mercy of FX cartels Every responsible govt defend its currency.”

If truly the Dollar is now on free float PMS can be 800 a litre if dollar remains 750

Like I said before I am 100% in support of pms subsidy removal but totally against idea of floating the naira and living at the mercy of FX cartels

Every responsible govt defend its currency

— Hamma (@HAHayatu) June 14, 2023

What You Should Know

According to the press release, part of the changes made by The Central Bank of Nigeria indicated that all foreign exchange transactions will now be conducted through the Investors and Exporters (I&E) window.

This means even those applying for BTA and PTA will also pay the official exchange rate at the I&E window. The exchange rate in this window will be determined by market forces

So applications for medicals, school fees, BTA/PTA, and SMEs would continue to be processed through deposit money banks.

Fingers are not equal… Some people in the villages . All those people churning out this rule are on inflated wages. .. garri in market wil increase but producer or farmer wil be at loss .. transporter wil only go to villages if dey find middle men wishing to go to the village.. where they can buy at cheaper rate ….and hoarding is there .. to increase price .

The more you look the more u see.