- Implementation of a Student Loan scheme in Nigeria will be made much easier now through the use of the National Digital Identity system.

- President Tinubu says Act we shall ensure that every deserving student has access to affordable and quality education, irrespective of their financial background.

- Applicant’s individual or family income must not exceed N500,000 per annum.

Nigeria’s Presidency maintains that the implementation of the Student Loan Act would offer Nigerian students access to affordable and quality education.

They added that this would be implemented through the use of the Nigerian Identity Number (NIN).

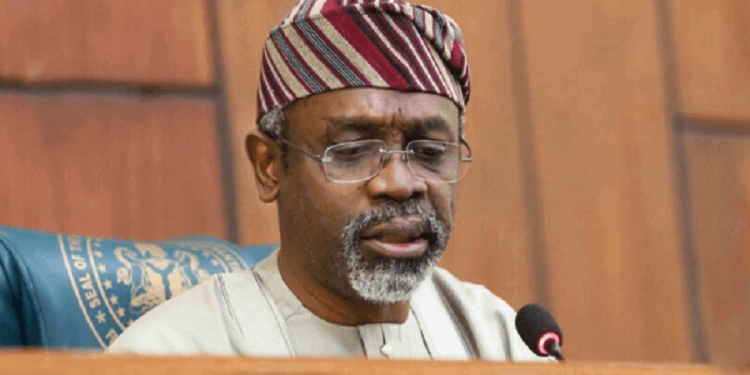

This was disclosed by President Bola Tinubu, and his Chief of Staff, Femi Gbajabiamila in statements after the Act was signed on Monday.

Quality education

President Bola Tinubu urged that he was pleased to sign the law that would offer financial assistance to those who wish to further their education, he added:

- “I was pleased, today, to have signed into law, the Access to Higher Education Act which provides interest-free loans to deserving students across the country who wish to further their education in tertiary institutions.

- “With this Act, we shall ensure that every deserving student has access to affordable and quality education, irrespective of their financial background.

NIN

Media aide to former President Buhari, Tolu Ogunlesi, stated that the scheme would be implemented with the use of the National identity card, he said:

- “Implementation of a Student Loan scheme in Nigeria will be made much easier now by the existence of a Digital Identity system (NIN). That’s how one policy helps pave the way for another. Nigeria’s NIN database has recently crossed the 100-million mark, up from 7 million in 2015.”

Femi Gbajabiamila noted that he is excited that President Bola Tinubu signed the “Student Loan (Access to Higher Education) Bill” into law.

- “I sponsored this Bill in the House of Representatives, confident it will assist indigent students and families in grasping the opportunities that higher education can provide,” he said

How to apply for the Students Loan

Prospective students seeking access to the loan are required to follow specific steps to initiate their applications.

These steps include submission through their respective banks, accompanied by a comprehensive set of required documents.

Eligibility

To apply for a loan under the Students Loan Bill, prospective students must satisfy the conditions outlined in Section 17 of the Act.

These conditions are as follows:

(a) Admission into Accredited Institutions: Applicants must have secured admission into Nigerian universities, polytechnics, colleges of education, or vocational schools established by the Federal Government or any state government.

(b) Income Limit: The applicant’s individual or family income must not exceed N500,000 per annum.

(c) Guarantors: Each applicant must provide a minimum of two guarantors. The guarantors must fall into one of the following categories: (i) Civil servants of at least level 12 in the service, (ii) Lawyers with a minimum of 10 years of post-call experience, (iii) Judicial officers, or (iv) Justices of the peace.

Ineligibility for Loan Access

Under the Students Loan Bill, certain circumstances disqualify students from accessing the loan. These disqualifying factors include:

To continue reading the application process.

This bill requires significant improvements in order to be effective. While it has good intentions, many of its provisions and overall execution appears problematic. For example, Imprisonment for loan default is not a viable solution; instead, we need a comprehensive bankruptcy law or a clear set of rules outlining the consequences of default. Loan default should be treated as a civil matter, not a criminal one, and this will likely be challenged in court on constitutional grounds

The inclusion of guarantors is unnecessary and should be reconsidered. Allowing the chairman of a student loan approval committee and the requirement of unnecessary documentation from university officials to approve loans opens the door to corruption. The process should be objective and preferably online, utilizing an automated approval or rejection system based on specific questions or submitted documents.

The significance of parents’ credit history in the context of student loans is unclear. As the loan is taken by the student and the student is responsible for repayment, it seems unnecessary to consider the credit history of parents.

Moreover, the proposed parental income threshold of N500K per year appears unreasonably low. Rather than imposing a cap on the number of student loan applicants based on family income, a more effective approach would be to implement a merit-based cap on the number of students. Drawing inspiration from countries like Australia, where they introduced a limit on the number of government-funded university seats, we can create a scenario of heightened competition for admissions and restrict loan access to students with stronger academic qualifications. Consequently, those who secure a place based on merit will tend to experience improved graduation rates and demonstrate a greater likelihood of pursuing full-time employment and loan repayment, thereby making this policy self sustaining for the future while ensuring that Nigeria’s best and brightest are able to receive quality education.

While this student loan bill seems well-intentioned, the specified requirements may undermine its intended purpose. It is crucial to review and amend the requirements and penalties as soon as possible.

We really should avoid a situation similar to the flawed power reforms implemented by Jonathan, which were announced with great enthusiasm but ultimately had a poorly structured market framework due to rushed and inelegant implementation. Nigeria should study the student loan market reforms implemented by countries rather than attempting to blindly impose a model that may yield few positive results.

I have already register for but have not got it from the agent.