Article Summary

- Nigerian companies demonstrated resilience and achieved impressive financial results in 2022 despite economic challenges.

- Top companies in Nigeria, including banks, telcos, consumer goods, and cement producers, increased their profits.

- MTN Nigeria emerges as the most profitable company with significant revenue growth and increased dividends to shareholders.

Nigerian companies continue to post impressive financial results on the back of increased demand despite economic headwinds ravaging the economy. Businesses in Africa’s largest economy have remained resilient in the face of high inflationary pressure and weak economic growth.

The Nigerian economy expanded by 3.1% in real terms in 2022, representing slow growth when compared to the previous year’s 3.4% expansion. Headline inflation also rose to a 21-year high of 18.77% in 2022 due to the pass-through effect of the Russia-Ukraine war.

Nonetheless, businesses in the country have been able to increase their income, whilst giving value in the form of dividends to their shareholders. In 2022, fifty (50) top companies listed on the Nigerian Exchange (NGX) posted profit before tax of N3.54 trillion, surpassing the previous year by 8.1% (N3.27 trillion).

Post-tax profit also increased by 9.8% to N2.69 trillion as the firms paid a sum of N1.39 trillion as total dividends to their shareholders in the period. It is worth noting that while inflation and FX challenges impacted the expenses of the companies, they were able to post impressive numbers, hence, competing for the most profitable companies.

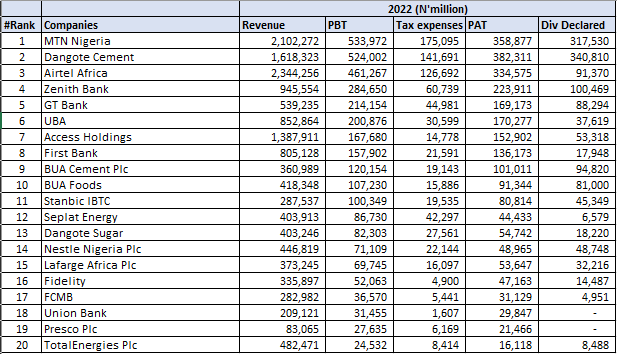

Nairametrics Research has compiled a list of the top 10 most profitable companies in Nigeria in 2022 based on their profit before tax (PBT). PBT is an important metric in determining how well a company is performing especially from a shareholder’s perspective as dividends payment will come from the net income, which is the remnant when taxes are deducted from the PBT.

A cursory review of the ranking showed that 20% of the companies were telcos, 20% were cement-producing firms,10% were consumer goods, and the remaining 50% were made of banks.

The listed banks posted N1.03 trillion as PBT, the telcos recorded N995.2 billion, the consumer goods company posted N107.2 billion, while the two cement companies recorded N644.2 billion as PBT.

Below is the list of the 10 most profitable companies in Nigeria in 2022.

#5 GTCO – N214.2 billion (-3.3%)

Guaranty Trust Holdings ranked fifth on the list of most profitable companies in the country with a PBT of N214.2 billion, which is slightly lower than the N221.5 billion recorded in the previous year.

The company’s PBT was impacted by rising operating costs as well as an N35.6 billion Expected Credit Loss to its exposure to securities issued by the Ghanaian government. Meanwhile, GTB posted revenue growth of 20.4% to N539.4 billion.

Profit after tax also declined slightly by 3.2% to N169.2 billion from N174.8 billion recorded in the previous year.

GT Holdings, which was awarded as Independent Best Commercial Bank in Digital Technology and Support for SMEs in 2022 declared a total dividend of N88.29 billion to its shareholders in the review year.

#4 Zenith Bank Plc – N284.7 billion (+1.5%)

Zenith Bank Plc recorded a pretax profit of N284.7 billion in 2022, a slight increase of 1.5% compared to N280.4 billion recorded in the previous year. The company rode on the increased interest rate environment and high demand for credit to post significant revenue gains. The bank, which was awarded the top bank in the country by Tier-1 capital posted a 23.5%YoY increase in gross earnings.

Meanwhile, due to the 69.6% increase in tax expenses, Zenith Bank’s net income dipped by 8.4% to N223.9 billion in the review year. It is also worth noting that the bank’s financials were also impacted by the N59 billion impairment on Ghana’s government debt instruments.

The multiple award-winning banks in 2022 declared a total dividend payment of N100.5 billion, up from the N97.3 billion paid in the previous year. The firm also incurred N60.7 billion as income tax expense.

#3 Airtel Africa Plc – N334.6 billion (-10.2%)

Airtel Africa Plc, which earns about 40% of its revenue from Nigeria, recorded a profit before tax of N461.3 billion in 2022 compared to N513.5 billion in the previous year. It is worth noting that the company reports its financials in USD, which has been converted using the prevailing N/USD exchange rate.

Revenue surged by 18.5% to N2.34 trillion, while operating profit also increased by 21.7% to N783.8 billion. However, net profit increased by 5.6% to N334.6 billion in the review year compared to 2021.

Meanwhile, the company attributed the decline in profitability to the impact of currency devaluations across its markets. The firm declared $0.05 as total dividends in the review year, translating to a dividend payment of N91.4 billion.

#2 Dangote Cement Plc – N524 billion (-2.7%)

Dangote Cement, the largest cement producer in Africa posted a PBT of N524 billion in 2022, down marginally by 2.7% from N538.4 billion in 2021. The firm, which made most of its revenue from the sales of cement and clinker saw its revenue increase by 17% to N1.62 trillion from N1.38 trillion a year ago, despite a decline in sales volume.

Operating profit improved slightly by 0.6% to N585.9 billion as net income increased by 4.9% to N382.3 billion, due to a decline in income tax expenses, which fell by 18.5% to N141.7 billion.

Dangote Cement declared a total dividend of N20 per share, amounting to a payment of N340.8 billion in 2022.

#1 MTN Nigeria – N553.97 billion (+22.3%)

MTN Nigeria, the leading telecommunications company in the country with over 75.6 million mobile subscribers and 39.5 million data subscribers, recorded a PBT of N533.97 billion in 2022, representing a 22% increase from N436.7 billion in 2021. The company attributed its growth to increased revenue from data, fintech, and digital services, as well as cost optimization and operational efficiency.

Revenue surged by 22% to N2.01 trillion, representing the first Nigerian company to post revenue above N2 trillion. Its operating profit despite rising costs increased by 25% to N733.29 billion while PAT was stated at N175.1 billion. MTN incurred N175.1 billion as income taxes for the year.

MTN Nigeria rewarded its shareholders with a total dividend of N15.6 per share for the year, up from N13.12 per share in 2021. The company’s total dividend summed up to N317.53 billion from N267.1 billion in the previous year.

Bubbling under

- UBA – N200.9 billion

- Access Holdings – N167.7 billion

- FBN Holdings Plc – N157.9 billion

- BUA Cement – N120.2 billion

- BUA Foods – N107.2 billion

Its good to see that the real sector is well represented.

Most profitable Listed companies in Nigeria 2022. This title will be acceptable. We have some unlisted private companies doing exceptionally well. NNPCL GMD confirmed booking trillions of profit. Did you consider the international oil companies, private upstream companies even CBN itself. Let us be clear in our analysis.