Article Summary

- Nigeria’s pension industry is shifting its investment strategies away from traditional fixed-income instruments due to rising inflation and interest rates.

- Alternative assets in the industry have experienced significant growth, with a particular focus on infrastructure funds and open/close ended mutual funds.

- Pension funds are recognizing the need to diversify their portfolios and explore alternative assets to generate higher returns and manage risk effectively.

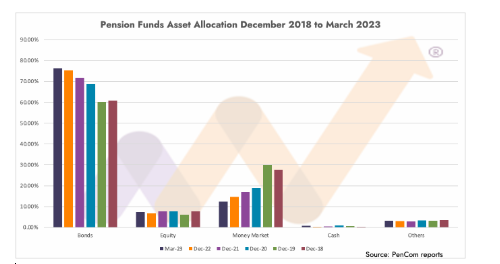

The National Pension Commission (PenCom) recently released data on total asset allocation for the pension industry as of 31 March 2023.

This prompted a thorough analysis of the industry’s investment landscape, specifically examining the shift away from overreliance on traditional fixed-income instruments, which are certainly not inflation-friendly, as inflation continues to rise.

Notably, Nigeria’s inflation rate stood at a staggering 22.22% in April 2022, while the Central Bank of Nigeria yet again raised interest rates, this time to 18.50%.

Meanwhile, the average year-to-date returns for the pension products available to RSA holders ranged from 3.57% to 4.45%, whilst for the year to December 2022 average returns have ranged from 8.77% to 10.24% (unaudited).

The results reveal that total assets under management (AUM) have experienced significant growth of 80.4% between December 2018 and March 2023 from N8.64 trillion to N15.58 trillion. However, the focus lies on the remarkable growth of 64.15% in alternative assets.

Despite this positive trend, investments in alternative assets currently account for only 3.20% of total AUM, indicating the untapped potential in this space with a trend only beginning to form in the last 2+ years (see chart below).

Detailed analysis further unravels compelling stories. For instance, infrastructure fund allocations have skyrocketed by over 560% since 2018, reaching N123.4 billion by March 2023 from N18.51 billion.

Similarly, Open/Close Ended Mutual Funds have experienced remarkable growth of over 900%. The reality about this growth in Open/Close Ended Mutual Funds is that within this class are still some infrastructure funds, as those in the former are structured differently.

Delving into pension fund allocations to alternative assets reveals intriguing shifts in investment strategies within the industry. The data showcases the percentage distribution of total alternative assets under management (AUM) across various categories over six periods.

Open/Close Ended Mutual Funds

The data uncovers a fluctuating trend in pension fund investments in open/close ended mutual funds with allocations ranging from 2.79% to 18.15% over the observed periods.

REITs

Real Estate Investment Trusts (REITs) have recently garnered attention from pension funds. Over the past four years, allocations have surged from under 1% to 5.22%, underscoring pension funds’ responsiveness to market conditions and the opportunities presented by the real estate sector.

Real Estate Properties

The absolute Naira value of legacy pensions (called existing schemes) as well as CPFA legacy investments in real estate properties have remained constant but as aum has grown over the years the percentage value of these investments has shrunk.

As such whilst total value has remained above N200 billion since 2018, percentages have shrunk from 75.67% to 43.81% as of March 2023. An investment in real estate as a tangible and income-generating asset class.

Private Equity Funds

Private equity funds also attracted a noteworthy portion of pension fund investments, with allocations ranging from 7.90% to 11.63%.

Though falling YTD to March 2023 to 8.85%, this asset class has consistently grown over the past four years, recognizing its potential for higher returns and diversification.

Infrastructure Funds

The data underscores pension funds’ increasing interest in infrastructure funds over the last five years.

Allocations within this category have steadily grown from 6.10% in 2018 to 24.75% by March 2023, highlighting the allure of infrastructure investments for their long-term stability and income generation potential.

These findings vividly illustrate the dynamic nature of pension fund allocations to alternative assets.

The observed shifts in allocations demonstrate the adaptability of pension funds in response to market conditions and their pursuit of diversification strategies to generate optimal returns for RSA holders.

As the investment landscape continues to evolve, pension funds are likely to explore alternative assets further to continue driving returns and effectively manage risk.

This shift towards alternative assets signifies a broader recognition within the pension industry of the need to diversify investment portfolios beyond traditional fixed income instruments.

The volatile inflation and rising interest rates in Nigeria have highlighted the importance of seeking alternative avenues that can potentially provide higher returns and hedge against inflationary pressures.

Moreover, the growth in infrastructure funds reflects a positive sentiment towards long-term investments in critical sectors such as transportation and logistics, energy and oil & gas, information and communications, etc. These investments not only offer stability but also contribute to the country’s economic development and job creation.

While investing directly in real estate properties have historically been a significant component of legacy pension fund portfolios, REITs are now the form in which pension funds get exposure to the sector and that shift has begun to gather momentum.

As the investment landscape continues to evolve, pension funds will likely continue exploring alternative assets to optimize their returns and manage risk effectively.