Article Summary

- FCMB Pensions, a licensed Pension Fund Administrator, experienced growth in 2022.

- The company acquired AIICO Pensions, expanding its operations and paving the way for future growth.

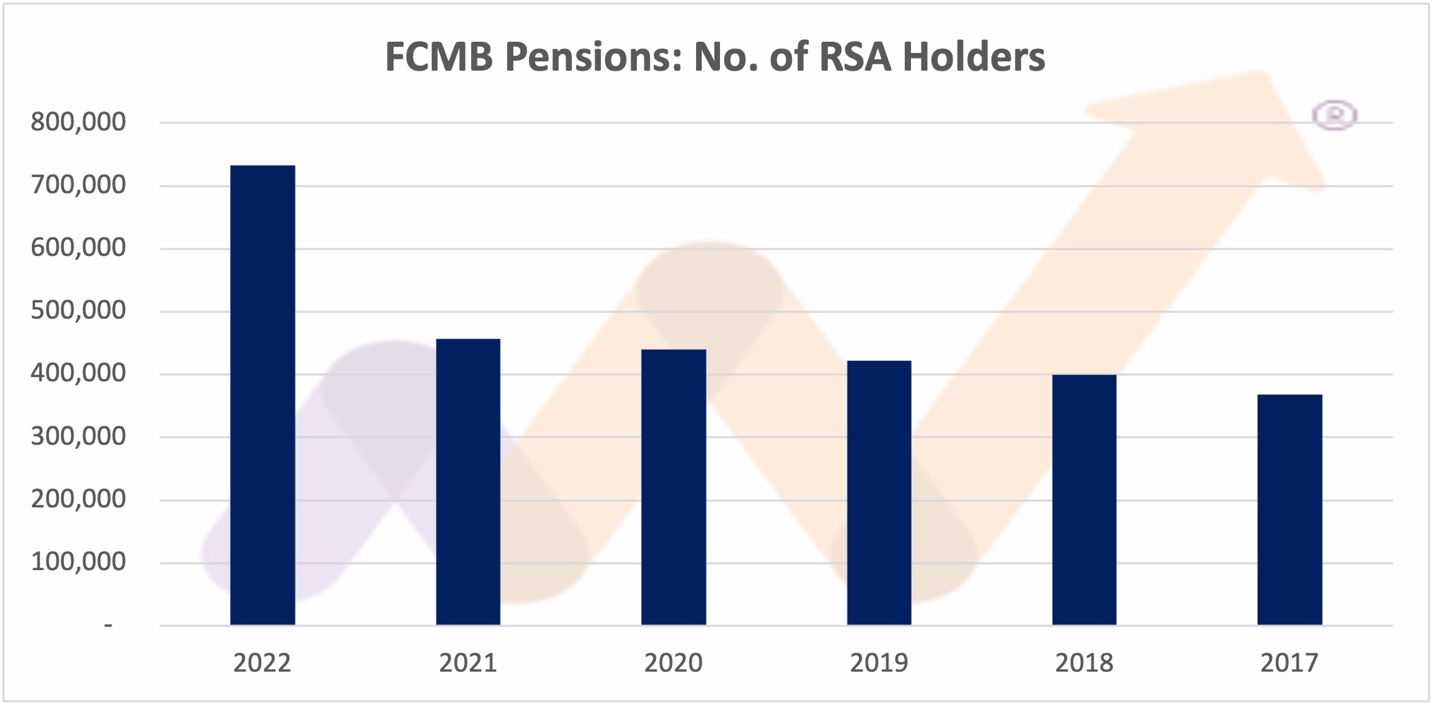

- FCMB Pensions saw an increase in RSA holders and significant growth in assets under management.

FCMB Pensions closed the 2022 financial year with 773,028 RSA holders, up from 456,959 RSA holders in 2021. Additionally, assets under management for Retirement Savings Accounts (RSAs) reached N518.62 billion, up from N305.35 billion in the previous year.

The company also demonstrated impressive and improved metrics. Total income for the year ending 31st December 2022 soared 63.22%, surpassing the previous year’s figure to reach N6.26 billion (N 3.84 billion).

Cost to income ratio declined to 56.97% from 59.42% in 2021 and 62.18% in 2020. Over the last five years, this ratio has consistently averaged 58.96%.

The company’s Profit After Tax (PAT) exhibited remarkable growth, surging by 70.10% to N1.86 billion, compared to N1.09 billion in 2021.

While the return on equity (ROE) experienced a slight dip, falling to 18.11% from the previous year’s 24.72%, the shareholders’ funds experienced a surge of 132.1% to reach N10.27 billion, surpassing the N4.43 billion recorded in 2021.

Audited Returns on RSA funds

For the year 2022 Fund I rewarded its RSA holders with a return of 8.63%, Fund II returned 9.97%, Fund III 10.47%, Fund IV 10.54%, Fund V 11.00%, Fund VI – Non-Interest (Active) 8.61% and Fund VI Non – Interest (Retiree) 8.76%. FCMB Pensions offers all 7 PenCom approved funds to the public.

In a landscape where benchmarks are yet to be established for pension funds, it is worth noting that for the year 2022 the stock market returned 19.98%, inflation was 21.47% and MPR closed the year at 16.50%, having risen steadily through the year.

FCMB Pensions Fund I

FCMB Pensions Fund I RSA holders experienced an increase in returns in 2022. The fund managers of FCMB Pensions generated a return of 8.63%, surpassing the 6.97% achieved in 2021. Notably, the fund’s income rose by 127.7%, reaching N44.33mn compared to N19.47mn in 2021.

Net gains from investing activities also saw substantial growth, increasing from N14.45mn to N33.76mn. Additionally, the fund’s expense ratio, which measures the annual cost of managing the fund, decreased to 2.03% from 2.22%.

Over the past five years, the average expense ratio stood at 1.94%. In terms of performance, the fund ranked 7th out of 19 in 2021. The ranking for 2022 will be out soon.

FCMB Pensions Fund II

Income earned in the FCMB Pensions Fund II was 85.69% higher than 2021, rising to N30.39bn from N16.37bn in 2021, with net gains from investing activities rising to N25.33bn from N13.60bn. The funds expense ratio also increased to 1.69% from 1.60%.

Over the last 5 years the ratio has averaged 1.89%, hence some improvements taking place. The fund managers generated a return of 9.97% in 2022 compared to 8.90% in 2021. In 2021 the fund ranked 4 out of 19 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

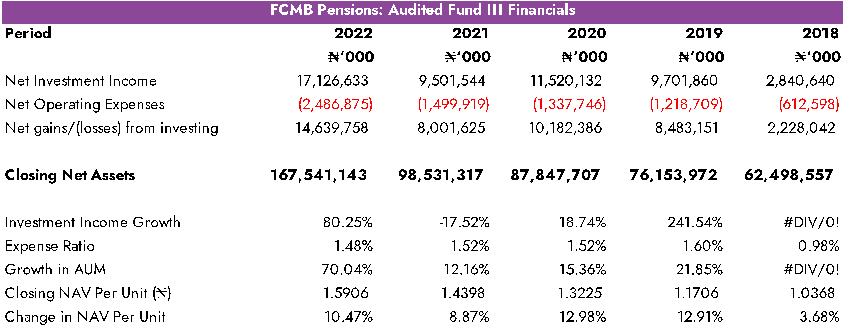

FCMB Pensions Fund III

Income earned in the FCMB Pensions Fund III grew 80.25% to N17.13bn from N9.50bn in 2021, with net gains from investing activities rising to N14.64bn from N8.00bn.

The funds expense ratio was slightly lower at 1.48% compared to 1.52% the year before. 5-year average has been 1.42%. The fund managers generated a return of 10.47% in 2022 compared to 8.87% in 2021.

In 2021 the fund ranked 3 out of 19 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

FCMB Pensions Fund IV

Fund IV returned a performance of 10.54% compared to 8.45% in 2021. Income earned by the fund grew 69.70% to N4.87bn from N2.87bn in 2021, with net gains from investing activities rising to N4.45bn from N2.61bn.

Expense ratio was 0.87%, slightly up from 0.79 in 2021. The 5-year average has been 0.88%. In 2021 the fund ranked 8 out of 19 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

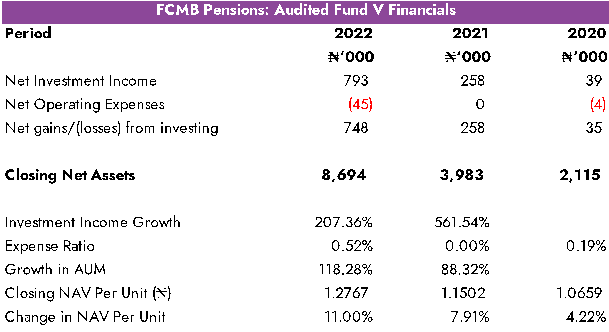

FCMB Pensions Fund V

Income earned in the FCMB Pensions Fund V grew 207.36% to N793mn from N258mn in 2021, with net gains from investing activities rising to N748mn from N258mn.

The funds expense ratio was 0.52%. The fund had no investment expenses in 2021. Performance of the fund was 11.00% in 2022 compared to 7.91% in 2021. In 2021 the fund ranked 6 out of 14 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

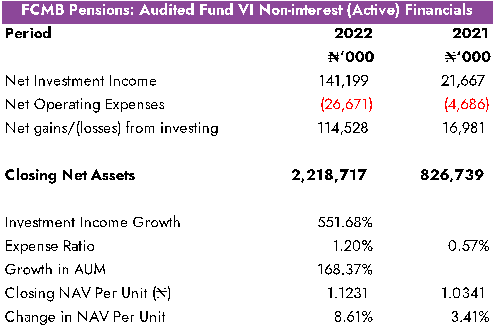

FCMB Pensions Fund VI – Non-Interest (Active)

Income earned in the FCMB Pensions Fund VI (Active) grew to N144.12mn from N21.67mn in 2021, with net gains from investing activities rising to N114.53mn from N16.98mn.

The funds expense ratio was 1.20% compared to 0.57% in 2021%. The funds’ performance was 8.61% in 2022 compared to 3.41% in 2021 (2021 was a partial year). In 2021 the fund ranked 2 out of 11 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

FCMB Pensions Fund VI – Non-Interest (Retiree)

Income earned by the FCMB Pensions Fund VI – Non-interest (Retiree) was N20.82mn (N1.70mn) whilst net gains from investing activities was N18.53mn (N1.37mn). The funds expense ratio was 0.70% (0.49%).

Performance was 8.76% in 2022 compared to 2.13% in 2021, which was a partial year. This fund ranked 3 out of 5 in terms of performance for 2021. The ranking for 2022 will be revealed in our 2023 report later in the year.

What you should know

FCMB Pension Managers Limited was incorporated on 7 April 2005 and is duly licensed by the National Pension Commission (PenCom), to carry on business as a Pension Fund Administrator (PFA) as defined under the Pension Reform Act, 2014.

The company expanded its horizons through the successful acquisition and integration of AIICO Pensions in 2022, which was concluded in 2022. This strategic move is meant to open new avenues for growth with some of that becoming visible in 2022. results.

For more information and analysis, visit moneycounsellors.com