Article Summary

- Nigeria’s foreign exchange inflow declined by 23.3% to $72.4 billion compared to the previous year, with foreign direct investment dropping by 33% and foreign portfolio investment decreasing by 27.9%.

- The country’s external reserves also declined by $3.44 billion, and the naira depreciated by 5.7% against the US dollar.

- The CBN continues to implement policies to increase FX inflows, including the Naira4Dollar scheme and the RT 200 FX program.

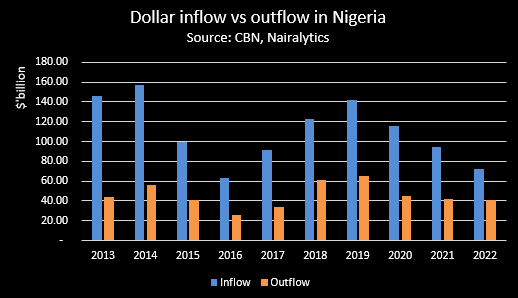

Nigeria recorded a total foreign exchange inflow of $72.4 billion in 2022, according to data contained in the CBN’s quarterly statistical bulletin for Q4 2022.

The figure marked a 23.3% decline compared to the $94.3 billion recorded in 2021 and also a 37.4% decline compared to $115.6 billion received in 2020.

A breakdown of the data showed that $29.89 billion came into the country through the CBN, while $42.49 billion came in through autonomous sources.

Conversely, a total of $40.99 billion was recorded as outflow in the same period, slightly lower than the $41.62 billion recorded in the previous year. This indicates a net surplus of $31.39 billion in the review year.

Nigeria has since been witnessing recurrent decline in dollar inflow into the economy, on the back of decline in foreign direct and portfolio investments. According to data from the National Bureau of Statistics (NBS), capital importation declined by 20.5% to $5.33 billion in 2022.

A further breakdown showed that foreign direct investment (FDI) in Nigeria dropped by 33% to $468.1 million compared to $698.87 million recorded in the previous year. Similarly, foreign portfolio investment declined by 27.9% to $2.44 billion in the review year.

Reducing FX impacting dollar supply

CBN’s dollar supply in the FX market has been impacted by the drying inflows of dollar into the Nigerian economy. Data from the CBN revealed that a total of $15.27 billion was supplied by the CBN into the economy, all of which were supplied to I&E window, SME, and Invisibles.

Compared to the previous year, FOREX supply declined by 15.3% from $18.03 billion recorded in 2021 and 31.1% drop from $22.16 billion supplied in 2020.

It is worth noting that, the decline in the amount of FX supplied by the CBN is partially attributed to the halt of FX sales to Bureau De Change (BDC) operators in previous year. In the review year, the apex bank made no sale of dollar to BDCs, compared to $2.77 billion and $5.33 billion recorded in 2021 and 2020 respectively.

The decline in FX inflows has also affected the nation’s external reserves as the apex bank continues to defend the naira and fund import bills at the expense of the reserve level. Nigeria’s external reserves declined by $3.44 billion in 2022 to close at $37.1 billion. Furthermore, the reserves level has dropped to $35.22 billion as of 10th May 2023.

Nigeria continues to experience decline in FX inflows following the impact of the COVID-19 pandemic on the world economy. This has had a ripple effect on the performance of the naira at the official and black market.

Despite the interventions by the CBN in the official Investors and Exporters window, the naira depreciated by 5.7% against the US dollar in 2022, while the exchange rate trend in the same direction at the black market by 23.1%.

Industrial sector top sectoral utilization

The industrial sector received a sum of $8.68 billion in 2022 from the CBN to fund their imports, accounting for 47.6% of the total FX supplied for import use. The manufacturing sector, followed with $3.89 billion, representing 21.3% of the total.

- Others include, food products ($2.77 billion), oil sector ($1.41 billion), minerals ($664.7 million), transportation ($521.11 million), and agriculture ($286.75 million).

- In terms of invisibles, most of the funds were allocated to financial services, as they received a whopping $8.32 billion in 2022, accounting for 70.7% of the total amount, followed by educational services and business services with $1.01 billion (8.6%) and $937.8 million (8%) respectively.

Bottom line

The CBN also continues to adopt its policies towards increasing foreign exchange inflows into the country, especially through non-oil export. Although the impact of Naira4Dollar scheme, which offers recipients of diaspora remittances through CBN’s IMTOs to be paid N5 for every $1 received as remittance inflow.

In the same vein, the RT 200 FX programme, which is aimed getting US$200 billion in Foreign Exchange earnings over the next 3-5 years from non-oil proceeds is also ongoing and is expected to improve FX inflows in the Nigerian economy, in the short to medium term.

According to the CBN governor, foreign exchange repatriation attributed to the RT 200 FX programme increased by 40% to US$ 5.6 billion 2022.from US$3.0 billion in 2021.

He also noted that the year 2023 has started strongly and showing impressive prospects. In the first quarter of 2023, a total of US$1.7 billion was repatriated to the economy while about US$970 million was sold at the I&E window year-to-date.