Article summary

- Fuel prices in Kenya have increased due to the removal of government subsidies and the addition of an 8% VAT.

- The increase in fuel prices will lead to reduced demand for suburban real estate, increased housing prices, and low uptake in luxury real estate.

- These effects are expected to be temporary, and the real estate market is expected to rebound once the period of economic uncertainty subsides.

On 14th September 2022, the Energy and Petroleum Regulatory Authority announced new fuel prices effectively resulting in price increments for petrol, diesel and kerosene.

This hike in prices did not come as a surprise as the new President had earlier announced in his inaugural speech the removal of the government subsidy on petroleum products. The president noted that the previous subsidies had caused a strain in Kenya’s economy and the prices will now include an 8% Value Added Tax (VAT).

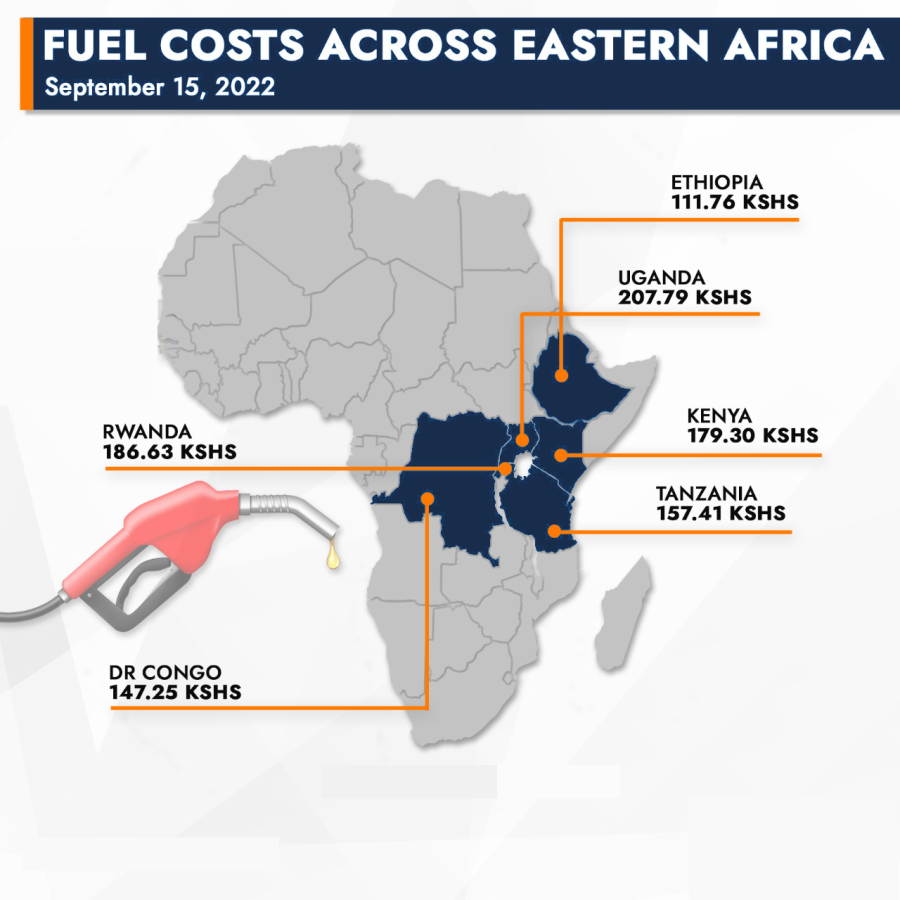

Notably, the hike in fuel prices has not been unique to Kenya with the Russia-Ukraine war impacting on prices all over the world. In Africa, Seychelles is recorded as the country with the highest price in fuel of $7.213 per gallon of petrol followed closely by Cape Verde at $6.892 per gallon.

While it may not be as obvious, fuel prices have a significant impact on real estate both in the short and long-term.

Reduced demand for suburban areas

As a result of the fuel price shock, houses located farther away from the Central Business District of a city are likely to experience a decline in their prices. The price decline would be caused by a decrease in demand due to high transportation costs. This means more people would prefer to live closer to the CBD in order to forego high transportation costs.

Fortunately, the impact of the fuel price hike will be limited as 42% of African employees work remotely at least once a week.

Increased Housing Price

The fuel price hike will cause a further increase in the price of commodities that were already affected by the global pandemic. Consequently, the price of construction materials – from taps to plywood – will inevitably increase as well. In addition, service providers will have to spend more on transportation and increase their rates to match operating costs. To keep up with the rising costs, landlords are likely to increase the rates on their rental property too.

Low uptake in Luxury Real Estate

In times of economic uncertainty, consumers are more likely to limit their spending to basic commodities due to reduced purchasing power. As a result, high-end items – such as luxury real estate – suffer from reduced interest and subsequent low uptake.

The Long-Term View

Luckily, these effects are temporary and will ease up when the fuel prices eventually stabilise. Although the real estate market will experience some strain, we expect it to rebound once this period of economic uncertainty subsides.

Subscribe to Estate Intel for access to comprehensive data and exclusive insights on the current real estate market in Kenya.

We love your feedback! Let us know your thoughts on How Soaring Fuel prices are affecting Kenyan Real Estate by sending an email to insight@estateintel.com.