Key Highlights

- Constitutional amendments in Nigeria aim to decentralize the country’s power sector, providing an opportunity to transform the struggling sector and make it more efficient and sustainable.

- The decentralization of the power sector allows sub-national State governments to create and implement electricity supply markets within their regions, legislate local laws to facilitate investments, prosecute energy theft, and legislate on mini and microgrid projects, energy fuel sources, and emissions reduction.

- Implementation of mini and microgrid projects by state governments can improve access to electricity in rural and underserved areas, create jobs, reduce rural-urban migration, and contribute towards Nigeria’s 2050 net zero emission targets. Collaboration with existing agencies and operators in the sector is crucial for maximizing the advantages of the constitutional amendments.

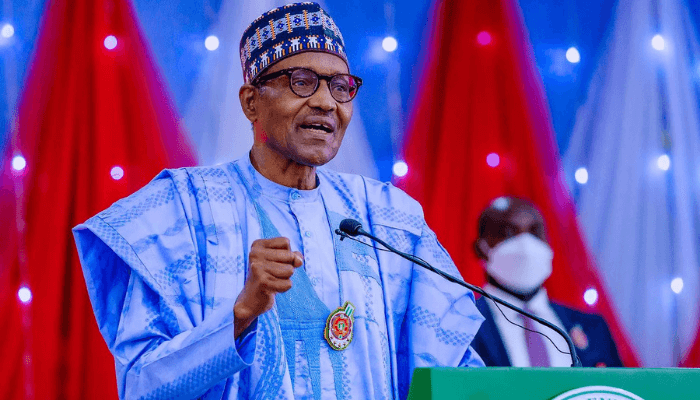

When President Muhammadu Buhari announced constitutional amendments that aim to decentralize the country’s power sector, it sent shock waves throughout the country as it brought up a rare opportunity to transform this long-suffering sector and make it fit for Africa’s largest and most populous country.

Nigeria’s power sector has been struggling for decades with electricity policy enforcement, uncertainty in gas supply, and constraints in its transmission system. All these challenges resulted in frequent and long Power cuts that put a strain on the economy and growth. According to a World Bank report, 85 million Nigerians don’t have access to grid electricity. This represents 43% percent of the country’s population, making Nigeria the country with the largest energy access deficit in the world.

The recent constitutional amendments pave the way for better access to stable, efficient, and sustainable energy throughout Nigeria, by cutting bureaucracy and opening the door to private sector investment as well as providing fiscal and regulatory independence to state governments.

But, this decentralization of the power sector will need to be implemented carefully, to avoid fragmentation of laws, regulations, and standards, as well as avoid inequality between wealthier and poorer states, and most importantly, avoid corruption. There will also be a need for a long-term plan to develop a national grid that will support Nigeria to reach its power-producing potential and achieve economic and industrial growth.

A rough start

Nigeria’s power sector is complex, and this has traditionally slowed down progress. The reason for this complexity is that the sector is controlled by different stakeholders, who each have their own objectives and their own models of working. The upstream gas supply and power generation segment is controlled by both public and private sector players. Some generation plants are owned by the government, others are concessioned to private operators, or owned by a mix of government and private investors, and there are a few IPPs.

The transmission grid is 100% controlled by the federal government, while electricity distribution companies (Discos) are controlled by private operators (with a 40% stake retained by the government). There is no uniformity of purpose or objective among these players. Each stakeholder in the power sector does what they consider best and does it in silos, making it very difficult to reform this sector.

Funding is also a challenge. Private operators cannot raise debt by leveraging power assets without government approvals and public financing is limited for new investments, so the power sector has been locked at a standstill.

Prior to these amendments to the constitution of the Federal Republic of Nigeria, the federal government had begun a series of activities aimed at liberalizing the power sector and creating a viable electricity market in 2013. Some bold steps have been taken, including the transformation of the old National Electric Power Authority (NEPA) into the Power Holding Company of Nigeria (PHCN) and the subsequent unbundling into different segments and firms, leading to the eventual privatization of the 11 distribution companies and some generation assets. Between 2013 and now, the market has seen increasing roles by the different players in shaping the industry and creating a robust energy supply market. The Federal Government, supported by International Development Partners and the organized private sector, created a series of funding schemes and structures to attract investments into the sector, in addition to federal government budgets.

Still, the availability of a stable and reliable electricity supply has remained a big challenge for Nigeria. The Presidential Power Initiative (PPI) of President Buhari’s administration, which was launched in July 2019 to resolve the power sector’s challenges and create a sustainable path for ramping up capacity, has not been implemented as initially envisaged. The project has largely been slowed down by the Covid-19 pandemic and the ongoing supply chain crisis which affects the equipment global manufacturing sector. However, through the PPI, certain critical equipment – power transformers and mobile high voltage Substations (first of its kind in Nigeria) have been delivered. When installed and commissioned, these would provide immediate relief to the transmission grid network and enhance power evacuation capacities.

With the removal of the power sector from the Exclusive legislative list of the Constitution to the Concurrent legislative list, sub-national State governments can now adjudicate over specific areas of this sector. This change could result in the transformation that will enable Nigeria’s power sector to finally reach its full potential.

What does the new constitution amendment imply?

Following the changes to the constitutions, sub-national State governments can now design, create, and implement electricity supply markets within their sub-regions. The new law empowers states to create laws that cover the generation, transmission, and distribution of electricity to areas not covered by a national grid system within the state and establish any authority for the promotion and management of electric power stations. However, the laws have not changed the statutes of existing federal agencies and private operators like the National Electricity Regulatory Commission, the Transmission Company of Nigeria, and electricity distribution companies (Discos).

There are clear advantages the new laws provide. State governments are now able to legislate local laws that will facilitate investments in electricity supply projects in their domains; create laws against energy theft and prosecute offenders, an issue that has overwhelmed Disco operators for many years; and legislate on mini and microgrid projects, energy fuel sources, including the use of small gasoline-generators to minimize carbon emissions. By this, State governments should execute sustainable energy projects that will help Nigeria achieve 2050 net zero emission targets. Implementation of mini and microgrid projects will improve Access to electricity in rural and un-served areas. This will improve the quality of lives of inhabitants, enable the creation of direct and indirect jobs, and reduce rural-urban migration.

To maximize these advantages, state governments should strive to collaborate with existing agencies and operators in the sector. The costs of building new or separate power evacuation and distribution network assets could make such projects less commercially viable. It is important to streamline regulations in the sector to avoid new bottlenecks that will slow down project implementation. A situation where all 36 states set up their own regulators, in addition to NERC, would likely create additional bottlenecks for investors. The uneven distribution of energy fuel sources such as gas is another area that will affect states’ abilities to execute large power projects.

For Nigeria to achieve desirable industrial growth and economic development, a strong, stable, and efficient national grid is still essential. Nigeria’s installed generation capacity is currently at ~14GW and its grid network capacity of about half of that is not sufficient to support Nigeria’s ambition of being an industrialized nation. Nigeria’s landscape is a mix of the coastal and tropical rainforest in the South, where most fossil fuel potentials are deposited. It also has a northern region with high solar irradiation, wind, and hydro potential. The situation makes a strong case for the continued existence of a national grid that will maximize the availabilities of fuel sources in the different regions, to create a leveled cost of electricity that is affordable for the citizens and industries. It is therefore important that, while the states would be focusing on small captive decentralized power supply systems, there must be a longer-term plan to ensure the operating efficiency and effectiveness of the national grid.

The Presidential Power Initiative (PPI) is conceptualized to champion and coordinate all intervention projects in the sector to ensure alignment and targeted results accomplishments in the national grid. Both Federal and State governments should ensure the successful implementation of the PPI. Phase 1 of the project seeks to resolve the grid network issues, while phases 2 and 3 aim at further increasing the grid network and generation capacities.

Siemens Energy’s portfolio of products, systems, and solutions are suitable to support both the Federal and sub-national authorities to fulfill their electricity supply targets. In addition to the fit-for-purpose technologies for renewable energy, embedded and captive power solutions, and small and large-sized grid-scale projects, Siemens Energy has over over 50 years of experience in Nigeria delivering quality and time-tested projects and a local organization populated by top-quality Nigerian experts.

Oladayo Orolu, FCA

Head Business Development, Siemens Energy Nigeria

April 2023