Key highlight

- The share price gained a maximum of 10% or N5.69 billion at the close of the trading session on Thursday as the benchmark Index closed marginally by 0.02% lower to settle at 51,944.58 points.

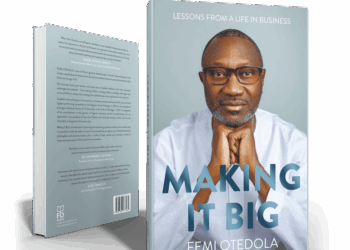

- Femi Otedola had acquired about 2.245 billion shares of Transnational Corporation Plc, becoming the second largest shareholder of the company.

- The Group’s total revenue and operating profit also recorded significant growth, rising by 21% from N111.2 billion in December 2021, to N134.7 billion in 2022.

Transnational Corporation Plc (Transcorp) is witnessing investors’ positive sentiment after the announcement that Nigerian business mogul and billionaire, Femi Otedola, has acquired of 5.52% stake in the company.

The acquisition which spurred investors ‘interest in the company’s stocks resulted in the share price gaining a maximum of 10% or N5.69 billion at the close of the trading session on Thursday as the benchmark Index closed marginally by 0.02% lower to settle at 51,944.58 points.

Gain

Checks by Nairametrics showed that the company’s stock price rose to N1.54 per share at the close of trading on Thursday from N1.40 it traded the previous day, representing a growth of 10% or N5.69 billion.

Further analysis showed that Transcorp Plc closed the trading day with N62.597 billion in market capitalization as against N56.907 billion the previous day.

What you should know

Femi Otedola had acquired about 2.245 billion shares of Transnational Corporation Plc, becoming the second largest shareholder of the company.

The transaction, which represented about 5.52% of Transcorp shares, was consummated between an entity owned by Otedola and the Asset Management Corporation of Nigeria.

Transcorp is currently controlled by another billionaire, Tony Elumelu who took over control of the company in 2012.

Elumelu, who chairs Transcorp, holds 273.1 million shares directly in the company, 274 million indirectly through Heirs Holdings Limited, and 294 million shares indirectly through HH Capital Limited.

According to reports, while about 1,695 investors own about 89% of the company’s shares, only UBA Nominees own about 9.25% of the company as of December 2022. No other shareholder holds above 5%, it was gathered.

The company also has about 39.65 billion out of its 40.65 billion outstanding shares on a free float.

Transcorp has released its financial results for the full year ended December 31, 2022, demonstrating significant improvements in its major income lines.

The Group’s total revenue and operating profit also recorded significant growth, rising by 21% from N111.2 billion in December 2021, to N134.7 billion in the period under review, and from N38.5 billion in December 2021 to N46.7 billion in December 2022, respectively.

The conglomerate with investments in the hospitality, power, and oil & gas sectors, recorded growth in its profit before tax, which rose by 8% to N30.3 billion compared to N27.9 billion in December 2021, according to a statement.

The statement disclosed that the conglomerate saw a 7% increase in its power investments, despite the challenges faced in the year from the issues with the gas supply, off the diminished oil & Gas production in the country in 2022.