Key highlights

- Femi Adesina said Nigerians should credit Buhari for diversifying the country’s economy from oil.

- In 2015, Buhari promised to diversify Nigeria’s economy from oil.

- Nigeria is no longer a mono-product economy.

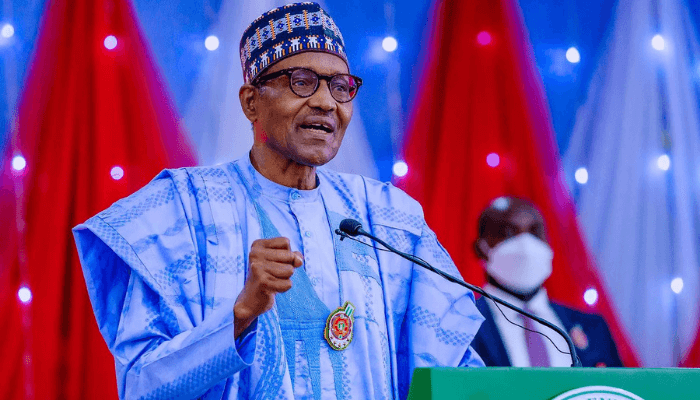

The Special Adviser on Media and Publicity to President Muhammadu Buhari, Femi Adesina, has said that Nigerians need to credit Buhari for successfully diversifying Nigeria’s economy away from oil, for the first time in 60 years. He said this during an interview via Channels TV on Monday night.

According to Mr Adesina, other industries are currently contributing more to the economy than oil, so, President Buhari deserves some credit for that. He said:

- “This government met a mono-product economy, an economy that depended solely on oil so that when oil prices crashed in the international market, Nigeria crashes with it. But it is no longer so, oil contributes less than 10% of our gross domestic product (GDP) today, and oil used to contribute about 90%.

- “For the first time in our history, Nigeria has a diversified economy. Diversification has long been a promise, today, it is no longer a promise, but it is a reality. I think people must credit the Buhari administration for that, because you now have Agriculture, ICT and Manufacturing to an extent, contributing to Nigeria’s GDP.”

Is the Nigerian economy truly diversified?

During a January 2023 public presentation and breakdown of the 2023 Appropriation Act, Nigeria’s Minister for Finance, Dr Zainab Ahmed, said that the oil and gas sector contribution to the GDP as of the third quarter (Q3) of 2022 was 5.66%, which shows that it is the non-oil sector that is running the country’s economy.

She further highlighted the fact that sectors like ICT and Agriculture were doing better than mining as well as oil and gas sectors, so Nigeria’s economy is truly diversified and can no longer be referred to as a mono-economy.

Meanwhile, in its latest Global Economic Outlook, KPMG stated that while Nigeria’s non-oil sector grew by 4.84% in 2022, the oil sector contracted by 19.22%. KPMG attributed the contraction to worsening oil theft, pipeline vandalization, underinvestment, and other operational challenges inhibiting oil production.

The backstory

In 2015, Buhari promised to diversify Nigeria’s economy from oil. At the time, he noted that Nigeria had depended on oil as its major source of revenue at the expense of agriculture and the non-oil sector industries that could contribute significantly to the country’s economy.

What you should know

In its April 2023 Africa’s Pulse Report, the World Bank noted that Nigeria’s economy will be driven by the non-oil sector as oil production is projected to remain subdued in 2023 due to several factors.

well, the contribution of the oil sector to the GDP could have been far way more than that percentage, if only Nigerian government are maximizing the benefits accruing to the oil and gas sector and also curbing irregularities.The sector is bastardized that we won’t even see an outright and true view

With all due respect, Mr. Adesina sounds like an economic illiterate.

Petroleum has NEVER contributed up to 90% of Nigeria’s GDP. In fact, as of 2015, when Mr. Buhari came to power, petroleum contributed merely about 8% to Nigeria’s real GDP.

Instead, petroleum revenues has traditionally contributed about 90% or more to foreign currency earnings. Presently, that contribution is only marginally different, with contributions of up to 80% to foreign receipts in 2021.