The Nigerian Central Bank on Friday, February 24, 2023, issued revised regulatory requirements for the tenure limit of Executive and Non-Executive Directors of Deposit Money Banks and Financial Holding Companies.

The CBN stated that the policy was part of measures aimed at strengthening governance practices in the banking industry and is coming 13 years after the Apex Bank limited the tenure of Chief Executive Officers of banks to 10 years.

The announcement has once again brought to the fore, the spate of adoption of financial holding companies, which in most cases have seen long-standing powerful bank MD/CEOs remain at the helm of affairs. But is the quest for power really the major reason for adopting a HoldCo structure?

In this article, we will analyze the number of Nigerian banks that have transitioned to the HoldCo structure, the number of subsidiaries within the structure, and more importantly, why the transition.

CBN & HoldCo Structure

The Central Bank of Nigeria (CBN) introduced the Holding Company in December 2011 via a circular to all banks.

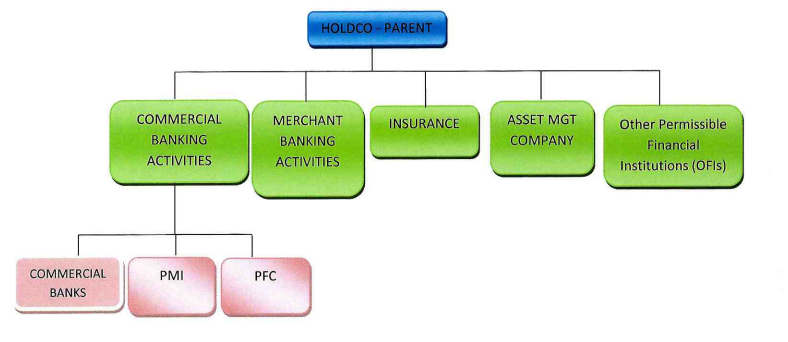

The model allows banks to retain non-core banking businesses by evolving into a non-operating Holding Company (HoldCo) structure.

The CBN’s guideline defines a HoldCo as a company whose principal object includes the business of a holding company set up for the purpose of making and managing equity investments in two or more companies being its subsidiaries, engaged in the provision of financial services, one of which must be a bank.

According to the CBN, this arrangement seeks to ring-fence depositors’ funds from risks inherent in non-core banking businesses.

Since its introduction in 2011, banks in Nigeria have increasingly adopted the HoldCo structure due to the numerous advantages it offers.

Power grab?

It has been suggested by some analysts that adopting the HoldCo structure allows long-standing bank MDs/CEOs to remain in power even after exceeding their tenure limits.

By retaining control of the core banking entity at the group level, executives may seek to circumvent regulatory requirements and corporate governance practices.

However, it is important to note that the HoldCo structure is not designed to facilitate this kind of abuse of power. Section 6.1 of the CBN’s guidelines for licensing and regulating Financial Holding Companies in Nigeria require that the HoldCo is a separate legal entity from its subsidiaries and that the boards of directors of the subsidiaries are independent and autonomous.

Furthermore, the CEO and other key management positions in the subsidiaries must be separate from those of the HoldCo.

Therefore, it is crucial to ensure that there is adequate oversight and governance in place to prevent abuse of power and ensure that the HoldCo structure is used for its intended purpose of promoting financial stability, diversification, and compliance with regulatory requirements.

Advantages of HoldCo structure

One of the major advantages is that it allows banks to separate their core banking operations from their non-core businesses such as insurance, asset management, and other financial services.

This helps to mitigate risks associated with these non-core businesses, as losses in one subsidiary will not affect the core banking operations of HoldCo.

Additionally, the HoldCo structure allows banks to raise capital by selling shares in their subsidiaries or spinning off subsidiaries into standalone entities, which can then raise capital independently. This enables the bank to expand its operations without straining its balance sheet.

Another advantage of the HoldCo structure is that it allows for more efficient management of the bank’s assets and liabilities. Since HoldCo is responsible for managing the equity investments in its subsidiaries, it can easily monitor their performance and make decisions that will enhance the profitability of the entire group.

Furthermore, the HoldCo structure allows banks to comply with regulatory requirements and international best practices, which are aimed at promoting financial stability, transparency, and accountability.

Disadvantages of HoldCo structure

Although the HoldCo structure offers several advantages, there are also potential disadvantages that banks should consider before adopting it.

One of the major disadvantages is the complexity and cost associated with establishing separate legal entities for each subsidiary and ensuring compliance with regulatory requirements for each entity. This can be a challenge for banks that are already facing operational and regulatory challenges.

In addition, the HoldCo structure can reduce flexibility in decision-making and operations, which can make it difficult to implement changes or strategies across the entire group. There is also a risk concentration concern as losses in one subsidiary can affect the entire group, which is especially problematic if the subsidiaries engage in risky activities such as securities trading or derivatives.

Moreover, the HoldCo structure can be subject to increased regulatory oversight and scrutiny, as each subsidiary must comply with its own regulatory requirements, and the HoldCo must ensure that each subsidiary is operating in compliance with applicable regulations.

Recent financial statements of some HoldCos indicate that the adoption of the HoldCo structure does not always lead to increased shareholder value. Although the group may have a larger balance sheet, profit margins, and dividend payments are not always improved.

Most of the Holdco surveyed by Nairametrics suggest they have been struggling to improve their profit margins and dividend payments since the transition. Despite having subsidiaries in insurance, asset management, and other financial services, HoldCos has not been able to translate these into significant improvements in its core banking operations.

This has led to criticism from some analysts who argue that the adoption of the HoldCo structure has not been beneficial to shareholders.

Source: CBN

Banks operating HoldCo structure in Nigeria

Following the introduction, FBN Holdings, Stanbic IBTC Holdings, and FCMB Group became the first three banks to transition to the HoldCo structure, until in 2021 and 2022, when Guaranty Trust Bank and Access Bank Plc, joined the HoldCo structure foray respectively.

FBN Holdings Plc: First Bank Nigeria Plc transited into a HoldCo structure in 2012. Currently, the HoldCo has 100% direct holdings in

- First Bank of Nigeria Limited.

- FBNQuest Capital Limited.

- FBN Insurance Brokers Limited.

- FBNQuest Merchant Bank Limited.

- FBNQuest Trustees Limited.

- FBNQuest Funds Limited and

- 55% holdings in New Villa Limited (Rainbow Town Development Limited).

Current MD/CEO: Nnamdi Okonkwo

Stanbic IBTC Holding Plc: Stanbic IBTC Bank Plc, the erstwhile holding company of the bank changed to a non-financial banking holding company on November 23, 2012, following the delisting of the Group’s erstwhile holding company, Stanbic IBTC Bank Plc (‘the Bank”), pursuant to its compliance with the CBN Regulation on Barking and Ancillary Matters No. 3 of 2010.

Currently, HoldCo has the following 11 subsidiaries.

- Stanbic IBTC Bank PLC

- Stanbic IBTC Ventures Limited

- Stanbic IBTC Capital Limited

- Stanbic IBTC Asset Management Limited

- Stanbic IBTC Pension Managers Limited

- Stanbic IBTC Stockbrokers Limited

- Stanbic IBTC Trustees Limited

- Stanbic IBTC Insurance Brokers Limited

- Stanbic IBTC Insurance Limited

- Stanbic IBTC Financial Services Limited

- Stanbic IBTC Nominees Limited – Indirect subsidiary

Current MD/CEO: Demola Sogunle

FCMB Group Plc: Following the acquisition of FinBank in October 2012, FCMB Group Plc became a non-operating financial holding company in June 2013, joining FBNH Plc as a HoldCo. The Group restructuring which followed resulted in FCMB Group Plc becoming the holding company fo

- FCMB Limited.

- FCMB Capital Market Limited

- CSL Stockbrokers Limited.

- FCMB Trustees Limited.

- FCMB Pension Limited.

- FCMB Microfinance Bank Limited

- Credit Direct Limited.

Current MD/CEO: Ladi Balogun

GTCO Plc: On July 2021, Guaranty Trust Holding Company became the parent company of Guaranty Trust Bank Nigeria, all Guaranty Trust banking and non-banking businesses across Africa and the United Kingdom.

- Guaranty Trust Bank Plc

- HabariPay

- GT Fund Managers

- GT Pension Managers

- GTB Asset Management Limited

- GTB Registrars Limited

- GTB Securities Limited

- GTB Trustees Limited

Current MD/CEO: Segun Agbaje

Access Holding Plc: Access Bank Plc transited to a HoldCo structure on February 22, 2022. The HoldCo subsidiaries consist of:

- Access Bank Plc (includes about 8 banks outside Nigeria)

- Access Payment Services Limited

- Grow Microfinance Bank Limited

- Access Insurance Brokers Limited

Current MD/CEO: Hebert Wigwe

Was this the reason have been unable to access my money on access bank for the past 4days now?

While With Holdco it allows to retain power indirectly, it also means less time availability for CEO/ M.D. of s Holdco per company.

Naturally it adds fatigue and burdon to him as a person.

Therefore, I don’t consider it as a good practice.

I would do the same if I own a bank