The Nigerian government is on the verge of sanitizing the micro-lending space with its ongoing registration of digital lending companies in the country.

This registration, undertaken by the Federal Competition and Consumer Protection Commission (FCCPC), is expected to distinguish between legitimate loan apps and unlicensed/illegitimate ones, otherwise known as loan sharks.

As of January 2023, the FCCPC said a total of 78 companies had secured full approval to operate as digital lenders in the country. A total of 40 others are said to have gotten conditional approval from the Commission, bringing the total number of digital lenders under the watch of the FCCC to 118.

Suffice it to say that Nigerians have not stopped the patronage of the so-called loan sharks despite their sharp practices and their unethical means of loan recovery, which often involve blackmailing or publicly harassing their borrowers.

While many are unable to distinguish between the approved and the unapproved loan apps, the key considerations for credit-seeking Nigerians are promptness in loan disbursement, the flexibility of repayment, and interest rates.

Nairametrics took a look at 10 of the most-downloaded loan apps in Nigeria and the interest rates they offer. We’ve detailed what we found below.

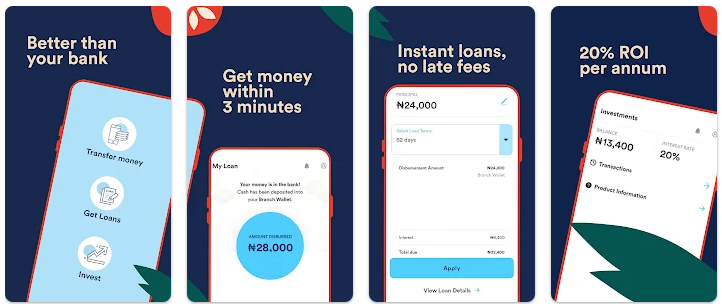

1. Branch

Branch is a platform that offers quick online loans in Nigeria. Today, the app is one of the most downloaded apps in the lending category on Google Play Store with over 10 million downloads.

The app determines loan eligibility and personalized loan offers using the users’ smartphone data. The app’s monthly interest rates range from 3% – 23% depending on the risk profile of the customer. You can get access to personal loans from N2,000 to N500,000 within 24hrs, depending on your repayment history, with a tenure of 62 days to 1 year.

An analysis of the app’s interest rate shows that if, for instance, you borrowed N60,000 at an Annual Percentage Rate (APR) of 181% with a tenure of 62 days, the total amount to repay will be N78,400 (N60,000 plus N18,400 interest).

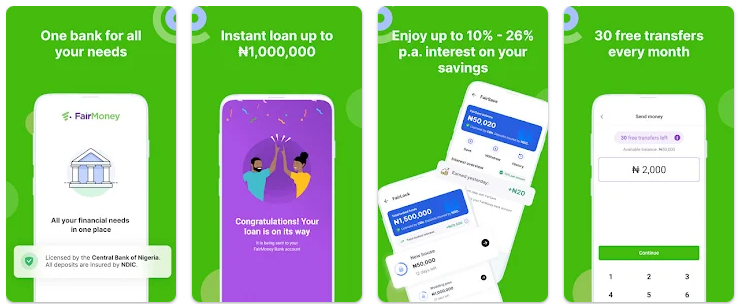

2. FairMoney

FairMoney, which has been downloaded over 10 million times on the Google Play Store, offers fast loans within 5 minutes with no documentation or collateral required. The loan amounts vary based on your smartphone data and repayment history.

Loan amounts range between N1,500 to N1 million with repayment periods from 61 days to 18 months at monthly interest rates that range from 2.5% to 30%.

For instance, if you borrow N100,000 over 3 months, you will be expected to repay N43,333 each month, which brings the total repayment to N130,000 at the end of the 3 months.

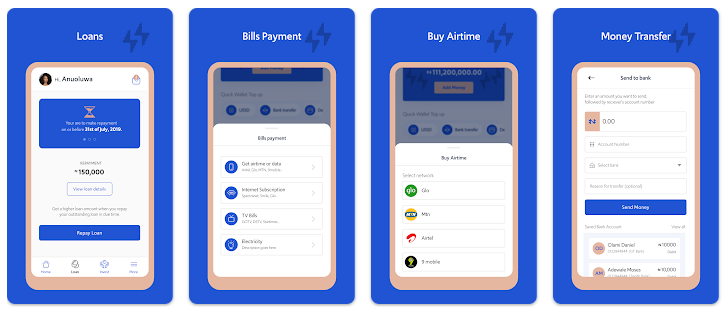

3. Palmcredit

On the Google Play Store, the Palmcredit app has been downloaded over 5 million times thus qualifying as one of the top loan apps in the country. The lending platform says it can provide a quick loan of up to N300,000 in less than 3 minutes without any form of collateral.

You can borrow between N10,000 to N300,000 quick loan and if your documentations are complete and accurate, you can get your disbursement within a business day, the platform claims.

The Annual Percentage Rate (APR) on the platform range from 24% to 56%.

For example, if you choose a 6-month loan and borrow N100,000, Plamcredit charges an interest rate of 4% per month. The interest rates for the 6 months will be N24,000, hence, the total repayment will be N124,000.

4. Carbon

Carbon is a digital financial service platform that provides a range of financial services, including personal loans, business loans, payments, funds transfers, credit scoring, savings, and investments. The Carbon loan application process typically takes less than 5 minutes to complete.

Their interest rates range from 2% to 30%, and this depends on the loan repayment period and the amount of money you wish to borrow. The app has been downloaded over 1 million times.

5. Okash

Okash is a convenient quick online loan platform for Nigeria mobile users managed by Blue Ridge Microfinance Bank Limited. OKash fulfills customers’ financial needs completely online 24/7. The application process takes just a few steps with minimal documentation and the approved loan amount is transferred to the applicant’s bank account. The app offers loans ranging from N3,000 to N500,000 and repayment plan ranges from 91 days to 365 days.

The company’s range from 0.1% to 1%. However, Okash interest rate is calculated on a daily basis, which amounts to an Annual Percentage Rate (APR) of between 36.5% to 360%. The OKash app has been downloaded over 5 million times.

6. Aella Credit

Aella Credit provides Quick and easy access to loans in 5mins. With no paper documentation, you can grow your credit score and increase your credit limit by prompt repayments. All you need is your basic information, BVN, and a smartphone (iOS or Android).

The app which has recorded over 1 million downloads offers loans ranging from N2,000 to N1.5 million with a tenor of 61 days to 365 days. Its monthly interest rate ranges from 2% – 20% and APR from 22% – 264 %/annum.

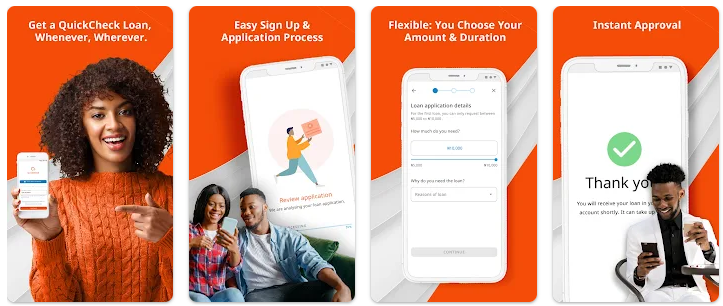

7. QuickCheck

QuickCheck is a quick loan app that uses machine learning to predict borrower’s behaviour and instantly evaluate loan applications. This app is among the top loan apps in Nigeria that have crossed 1 million downloads.

QuickCheck loan has interest rates starting from as low as 5% monthly on the first loan. Loans range from N1,500 to N500,000 with terms from 91 days – 1 year. Interest ranges from 2% – 30%, with an equivalent monthly interest rate of 1 – 21%.

8. Umba

Umba, like other top loan apps in Nigeria, has crossed 1 million downloads. The lender prides itself as the leading digital bank in Africa. The app allows users to apply, draw down and repay loans directly from their smartphone or desktop computer.

Umba loans have a maximum and minimum duration of 62 days, with credit amount ranging from N2,000 to N30,000. The company’s maximum annual interest rate is 10%.

9. Newcredit

Newcredit is another instant loan app in Nigeria that has crossed 1 million downloads. The personal loan app gives Nigerian collateral-free loans of up to N300,000. The app uses Artificial Intelligence (AI) to analyze prospective customers financial records, including the bank transaction SMS on their phones and their credit worthiness from other lenders.

The app’s loan amount range from N10,000 to N300,000 with repayment from 91 days to 365 days. The company charges a monthly interest rate of 4%.

10. Ease Cash

Ease Cash prides itself as a secure, reliable, and online loan app in Nigeria. With over 1 million downloads, the app gives out instant loans ranging from N1,000 to N100,000 with a tenure of 91 to 180 days.

Aside from the 14% Annual Percentage rate on its loans, Ease Cash said it charges a one-time processing fee(per transaction) at a minimum of 5% and a maximum of 20%.

Note: Many operators of loan apps have been known to recover their monies through harassment, including calling a defaulter’s telephone contacts to request the contact’s intervention. Such contacts may be friends, family members, co-workers or even a borrower’s employers.

Once you register for loan on any of these apps, you are surrendering your contacts list privacy to them and this is used if you default in repaying. The watchwords in dealing with the loan apps are: Do not owe them.

Thanks 👍🙏 to you all for all this good work.

I need a business loan

the loan help me

how can I bee paying back the loan

I trust this company because he is the best to apply loan and you will get insanity with any delay and also the interest is not over too much.and later when you about to finish the loan if you need top up they will credit you with the immediate effect.

Okash helped me too…fist they i borrow 5k next is 20k. .hopefully wen i pay the 20k they will make it 50k or 100k..let see i will always give you people update. .thanks okash

Koko

ANY WAY I AM INTO PALMCREDIT AND NEWCREDIT THEY OK

I need a loan

Most times, these loan companies starts calling you 2 days to the due date. They go further by

threatening the borrower, that they will publish his name as fraudster and to all his contacts. This

is not quite good.