The Chinese Yuan component of Nigeria’s external reserve fell to $3.2 billion (equivalent) it lowest level in two years. This is according to third quarter external reserve data from the central bank of Nigeria.

Nigeria’s external reserves is made up of several basket of foreign currency holdings including the US dollars, Chinese Yuan, British Pounds, Japanese Yen, Euro and the Swiss Francs.

According to the data seen by Nairametrics, Nigeria recorded an all time high Yuan balance of the equivalent of $4.298 billion in the second quarter of 2021 when the total gross external reserve was just $35.1 billion. It remained above the $4 billion levels all through the first quarter of 2022 before the drop started.

Nigeria’s external reserve have fallen from the high of $41.5 billion in the third quarter of 2021 but fell to $37.3 billion at the end of the third quarter of the same year. The current external reserve balance is $36.7 billion as of February16 2023.

Nigeria is experiencing foreign currency challenges due to a dwindling oil and gas exports, dearth in foreign investments and forex policies that have stifled repatriation of forex. Apart from the Remnibi or Yuan all foreign currency components also fell.

For example, the US dollar components also fell $30.3 billion to $27.5 billion on year to the third quarter of 2022.

Chinese currency, Renminbi became a part of Nigeria’s foreign exchange reserves in 2011. However, central bank first reported the data in third quarter of 2014 at $2.2 billion.

Why did it fall? The central bank did not provide details however, there are a few factors that could have contributed to the decline in the Chinese Yuan component of Nigeria’s external reserves.

- One major factor is the economic slowdown in China, which could have reduced demand for the Yuan. Additionally, the Covid-19 pandemic has caused disruptions in global trade and weakened demand for commodities like oil, which is a key export for Nigeria.

- This could have reduced Nigeria’s foreign exchange earnings and made it difficult to accumulate foreign reserves, including the Yuan.

- Other factors such as changes in government policies, inflation, and fluctuations in the value of the Yuan against other currencies could also have played a role.

What this means for the economy?

The fall in the Chinese Yuan component of Nigeria’s external reserve has significant implications for the country’s economy.

- Nigeria’s external reserves play a crucial role in stabilizing the country’s currency, ensuring financial stability, and promoting international trade. Nigeria’s total import from China was $10.1 billion in the first nine months of 2022.

- China is also Nigeria’s largest trade partner in terms of imports meaning a robust Yuan reserve is important to facilitate trade.

- The decline in the Yuan component of Nigeria’s external reserves could potentially undermine the country’s efforts to diversify its reserves and reduce its overreliance on the US dollar.

- Additionally, the fall in the external reserve’s value may impact Nigeria’s ability to pay off its foreign debts, especially with China, which is Nigeria’s largest creditor.

- This could further exacerbate the country’s already precarious debt situation and potentially trigger another debt crisis.

Nigeria/China Currency Swap

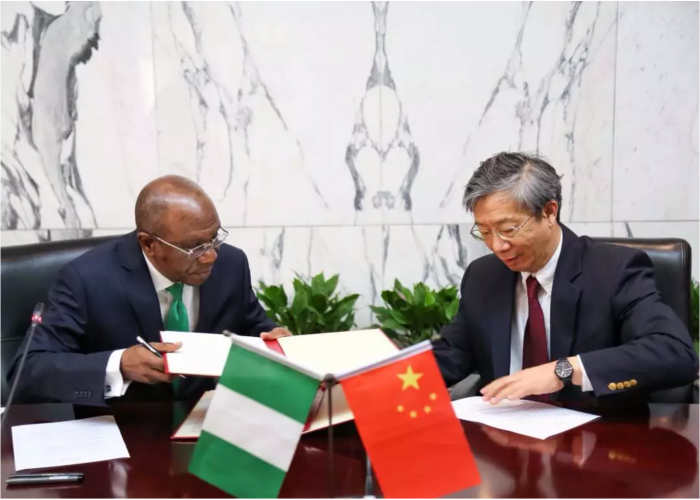

Nigeria signed a currency swap agreement or a bilateral currency exchange agreement as it is officially called with China in 2018.

- The agreement allows the Central Bank of Nigeria (CBN) and the People’s Bank of China (PBOC) to swap a total of 15 billion Chinese yuan for N720 billion.

- The aim of the agreement is to facilitate trade and investment between the two countries, and to reduce the reliance on the US dollar in their transactions.

- It was meant to ease the pressure on the demand for foreign exchange in Nigeria, which has been a major issue due to the shortage of foreign currency in the country.

- The agreement was expected to enhance economic cooperation between Nigeria and China and promote the growth of their economies.