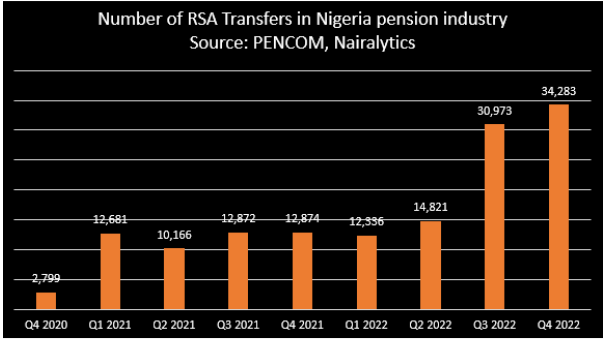

A total of 92,413 RSA pension contributors changed their pension fund administrators in 2022, representing a 90.2% increase from the 48,593 contributors that switched managers in 2021.

This is according to the quarterly summary of RSA accounts transferred by pension fund administrators report for the fourth quarter of 2022, released by the National Pension Commission (PenCom) and compiled by Nairalytics.

According to data tracked by Nairalytics, the research arm of Nairametrics, a total of 143,805 RSA contributors have transferred since the reopening of the transfer window in December 2020. The breakdown of the data showed that 34,283 RSA contributors filed for a transfer in the fourth quarter of 2022, which is the highest quarterly number recorded since the inception of the window.

The number of Pension Fund Administrators (PFAs) in the country reduced from 22 to about 19 as a result of mergers and acquisitions in the industry, following the announcement by the industry regulator to increase the minimum Regulatory Capital requirement to N5 billion from N1 billion.

Consolidations in the industry: PENCOM announced in April 2022 that all PFAs had complied with the Commission’s directive for the increase of the Minimum Regulatory Capital from N1 billion to N5 billion, although not without some restructuring.

- Earlier in the year, PENCOM approved the acquisition of AIICO Pension Managers Limited by FCMB Pensions Limited, the merger between Tangerine Pensions Limited and APT Pension Funds Managers Limited, and the subsequent change of name of the merged entity to Tangerine APT Pensions Limited.

- The Commission also approved the acquisition of IEI-Anchor Pension Managers Limited by Norrenberger, after the latter acquired the majority shareholder of the company, IEI Plc.

- Access Holdings received regulatory approval to acquire a majority equity stake in First Guarantee Pension Limited, while also completing the acquisition of an indirect equity stake in Sigma Pension, before merging the two entities.

Pension contributors have been highly alert to the developments in the pensions industry in recent times, indicated by the over 143 thousand transfers so far. Some of the factors considered are corporate governance, ease of services, instrument of investments, and returns.

Note that the pensions industry is a highly regulated sector, considering that the administrators are handling public funds, hence, the limitation of category of investments. Most of the funds are invested in government securities, to mitigate the risk of losses.

The industry grew stronger in 2022: Nairametrics had earlier reported that Nigeria’s pension fund assets rose to N14.99 trillion as of December 2022, representing an increase of N1.5 trillion (11.7%) compared to N13.42 trillion recorded in 2021.

- Notably, the gain recorded in 2022 (N1.5 trillion) is 40.2% higher than the N1.12 trillion increase recorded in the previous year. However, when compared to 2020, the gain was 24.9% lower than the N2.09 trillion increase recorded.

- Investments in federal government securities increased by N870.55 billion to stand at N9.64 trillion, most of which were in form of FBN bonds (N9.22 trillion).

- Corporate debt securities as of the end of the year stood at N1.66 trillion, representing an increase of 75.99% (N716.86 billion) compared to N943.34 billion recorded as of the same period in 2021.