Nigeria’s 2023 presidential election is scheduled to hold on the 25th of February, 2023. This means that the three main candidates — Peter Obi of the Labour Party, Bola Ahmed Tinubu of the ruling APC and Atiku Abubakar of the People’s Democratic Party — have barely one month to prepare for the most important election in the democratic history of the country.

Whoever wins the election to emerge as the next president would inherit a country deeply divided, with a fiscal deficit of N11.3 trillion and a sliding currency.

Nairametrics recently reported that the N11.34 trillion deficit in the 2023 budget would be financed through domestic and foreign sources, including multilateral and bilateral loan drawdowns, as Nigeria’s total debt stock hit $101.91 billion as of the end of September 2022.

Nigeria’s serious economic challenges

Nigeria’s Debt Management Office (DMO) recently revealed that the next administration might inherit a public debt of N77 trillion if the Ways and Means Advances from the CBN are securitized.

Also, the exchange rate which began 2022 with N587/$1 on the black market depreciated to N745/$1 in January 2023 after hitting a record low of about N900/$1 in November of last year.

All these indicate that the next administration might have to hit the ground running with sound fiscal and monetary policies. But what kind of economic policies are they proposing? Let’s take a look.

What the candidates plan to do to the Nigerian economy

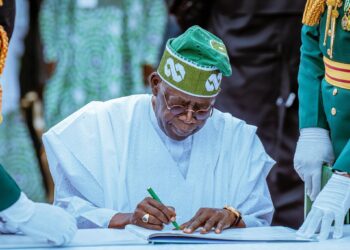

Bola Ahmed Tinubu of the All Progressive Congress believes that to save Nigeria’s fiscal basket, the country must break the explicit link between naira expenditure and dollar inflows into the economy.

He also said we must legislatively suspend the limits on government spending, which would need legislative action as it contradicts the Fiscal Responsibility Act. He said:

- “Review Federal Budgetary Methodology Budgetary custom bases our annual budget and fiscal policies largely on the dollar value of projected oil revenue.

- “Not only does this practice artificially restrict the federal government’s fiscal latitude, but it also unduly attracts the nation’s attention towards a single source of fiscal revenue to the detriment of others.

- “To achieve optimal growth in the long term, we must wean ourselves from this limitation. A more efficient fiscal methodology would be to base our budgeting on the projected level of government spending which optimises growth and jobs without causing unacceptable levels of inflation.

- “As part of this prudent growth-based budgeting, we will establish a clear and mandatory inflationary ceiling on spending.

- “However, we must break the explicit link between naira expenditure and dollar inflows into the economy. Much like the European Union has done, we too must be realistic and legislatively suspend the limits on government spending during this protracted moment of global economic turmoil exacerbated by domestic challenges in security, economy and demography.

Peter Obi said that Nigeria must first of all deal with its insecurity issues and restructure the polity to reflect effective legal and institutional reforms that entrench the rule of law, eliminates corruption and reduce the cost of governance.

In terms of his economic policies, Obi said the multiple exchange rate regimes only present a huge arbitrage opportunity for a few privileged persons, adding that the Ways and Means Advances to the FG have fueled inflation. He also cited that his fiscal and monetary policy will be properly coordinated by deploying conventional tools transparently instead of distorting markets to favour a few privileged persons. He said:

On macroeconomic restructuring, he added that Nigeria’s fiscal policy is plagued with anomalies that have progressively hurt the economy. He said the anomalies are:

- The pursuit of multiple objectives by CBN, some of which appeared to conflict with the bank’s core mandate of controlling inflation and its declared objective of achieving a measure of exchange rate stability;

- The loss of fiscal viability by the Federal Government, as revenues are now consumed entirely by debt service, whilst the cost of the inflated petrol subsidy has risen to a level where it also threatens to consume the entire FG revenue;

- The financing of excessive fiscal deficits through Ways and Means Advances above N22 trillion as of August 2022 (i.e. a level well beyond the statutory limits set in the CBN Act) has helped fuel the spike in the inflation rate to close to 20% per annum.

- Exchange rate stability has also become a mirage, as foreign exchange can only be accessed at the artificial official exchange rate by a handful of privileged persons and businesses, whilst the generality of Nigerians can only access forex via a parallel market in which the US Dollar now attracts a 75- 80% premium over the official rate.

He warned that the current multiple exchange rate regime presents a huge arbitrage opportunity for a few privileged persons, citing that the prevalence of repatriation risks and other supply-side constraints have significantly dented investor confidence, whilst also encouraging capital flight.

- “Our administration will only support measures which ensure a level playing field and are in line with global best practices.

- “If the competitiveness of a sector is to be boosted then that will be done via the enactment of transparent and specially targeted fiscal and trade policies designed to stimulate investment and growth.

- “Revenue shortfalls and leakages such as oil theft will be dealt with decisively by holding persons in positions of authority fully accountable.

He urged that reducing the cost of governance is a necessary means to achieve fiscal sustainability and will also promptly review the recommendations of the Steve Oronsaye Commission on the restructuring of the Federal Civil Service for implementation.

Atiku Abubakar said he will focus on increasing the flow of FDI into the Non-Oil Sector, citing that by 2030, his administration shall increase the inflow of foreign direct investment to a minimum of 2.5% of our GDP.

Some of the core aspects of the economy his administration planned to focus on were highlighted as follows:

- “Working towards achieving the lowest corporate income tax rate in Africa.

- “Strengthening the credits guaranteed initiatives of infra-credit by substantially increasing its capital base.

- “Streamlining the multiplicity of often discretionary, incentives for investment and simplifying the associated complex legislative and regulatory framework.“

On his plans to optimise the fiscal space, he said Nigeria is currently in a situation where revenues are small in absolute terms, which poses significant risks to Nigeria’s long-term growth and development.

- “Nigeria’s tax to GDP ratio, which is abysmally low at 6%, is significantly below potential and is one of the lowest in the world.

- “Nigeria’s development expenditure need (14% of output) dwarf the resources provided by revenue collected by the public sector (10.3%).

The fiscal strategies he urged are:

- Domestic reforms to improve IGR

- Promote export growth to Improve FX earnings

- Improve spending efficiency

- Finance projects through public-private partnerships, diaspora bonds and project-tied (SUKUK)

- Pool revenues from Government Owned Enterprises and consolidate capital expenditure

- Create fiscal buffers to absorb shocks and rebuild fiscal-social contracts to rebuild integrity.