In the absence of benchmarks for each of these groups of funds, it is worth comparing returns to some economic and equity indices as well as some benchmark bonds in the market as of 31 December 2022.

Economic data:

Stock Market

Sample Bonds

Note: The figures presented are unaudited. A report using audited figures for the year ended 31 December 2021 is available to download via this link Money Counsellors Annual Report on Pensions (MCARP 2022). Individual reports are also available in the Literature & Downloads section of each respective PFA and fund on the moneycounsellors.com website.

Fund I is accessible strictly by formal request of the contributor and only for those aged 49 years and below.

For the month of December 2022 Oak Pensions Fund I led the performance table, with a return of (2.06%) followed by Fidelity Pension Managers Fund I (1.93%), then PAL Pensions Fund I (1.85%).

For the full year, 2022 the performance table of Fund I is topped by the Stanbic IBTC Pensions Fund I (13.02%), followed by NPF Pensions Fund I (11.86%) and Premium Pension Fund I (10.61%).

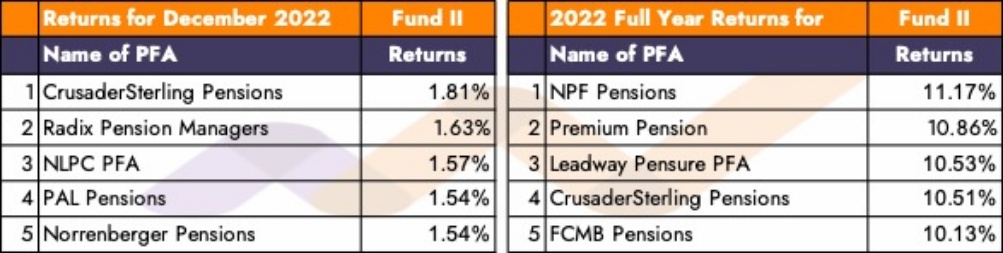

Fund II Fund II is the default fund for all active pension fund contributors that are 49 years and below.

For the month of December 2022 CrusaderSterling Pensions Fund II led the performance table, with a return of 1.81% followed by Radix Pension Managers Fund II (1.63%), then NLPC PFA Fund II (1.57%).

For the full year of 2022, the best performing Fund II was NPF Pensions Fund II (11.17%), followed by Premium Pension Fund II (10.86%), then Leadway Pensure PFA Fund II (10.53%).

For the full year of 2022, the best performing Fund II was NPF Pensions Fund II (11.17%), followed by Premium Pension Fund II (10.86%), then Leadway Pensure PFA Fund II (10.53%).

Fund III is the default fund for active contributors that are 50 years and above.

For the month of December 2022 Norrenberger Pensions Fund III led the performance table with a return of 1.62% followed by NPF Pensions Fund III (1.54%), and Oak Pensions Fund III (1.48%).

For the full year of 2022, Access Pensions Fund III topped the Fund III performance table with a return of 11.53%, followed by NPF Pensions Fund III up 10.77% and then CrusaderSterling Pensions Fund III (10.65%).

For the full year of 2022, Access Pensions Fund III topped the Fund III performance table with a return of 11.53%, followed by NPF Pensions Fund III up 10.77% and then CrusaderSterling Pensions Fund III (10.65%).

Fund IV Fund IV is strictly for retirees only.

For the month of December 2022 Oak Pensions Fund IV led the performance table with a return of 1.52%, followed by CrusaderSterling Pensions Fund IV with a return of 1.48%, then Norrenberger Pensions Fund IV (1.33%).

For the full year of 2022, CrusaderSterling Pensions Fund IV topped the performance table with a return of 11.81%, followed by Access Pensions Fund IV with a return of 11.71%, then Oak Pensions Fund IV (11.65%).

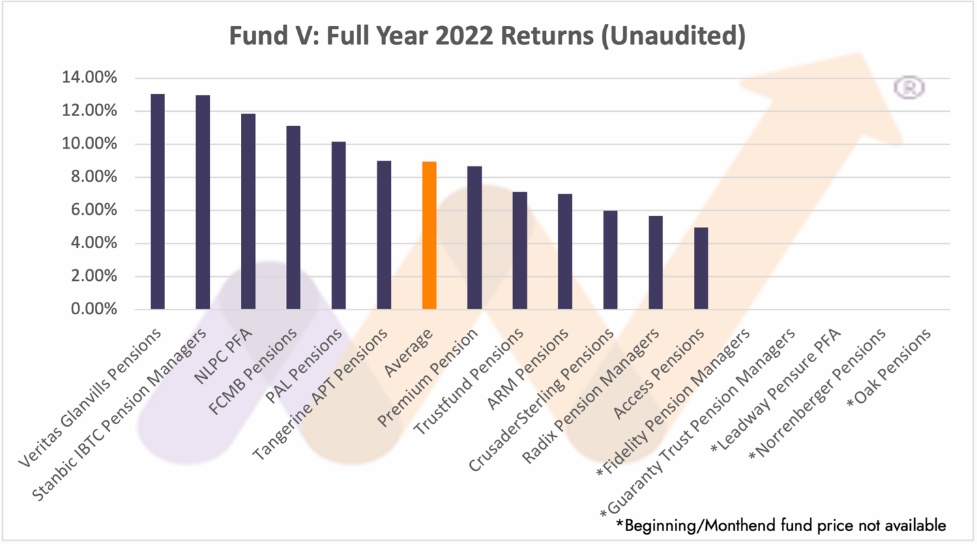

Fund V Fund V is only for Micro Pension Fund contributors.

Whilst not all PFA’s offer Fund V, the performance of those that do and publish prices and other information on their website shows that the best performing Fund V for the month and full year to December 2022 were as follows:

Fund VI (Active) is for those that choose to have their contributions invested in Non-interest Money and Capital Market Products.

For the few that offer and publish information on the Fund VI (Active), the table and chart depict the respective fund performances in the month of, and full year to December 2022:

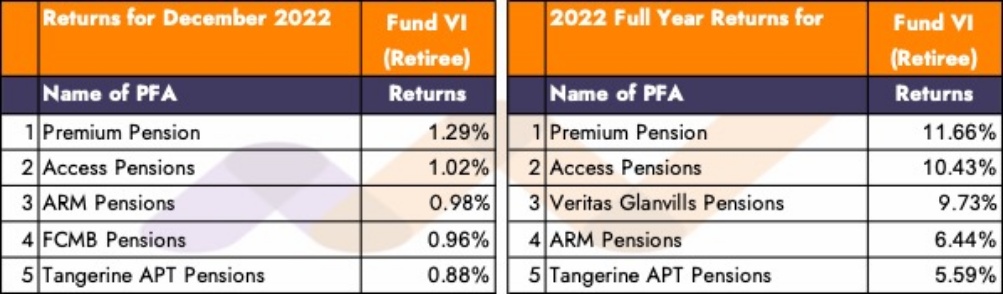

Fund VI (Retiree) is for those that choose to have their contributions invested in Non-interest Money and Capital Market Products.

For the few that offer and publish information on the Fund VI (Retiree), the table and chart depict the respective fund performances in the month of, and full year to December 2022:

Global view of the investment returns of All funds for the month of December 2022, for the full year to December 2022 and since inception of each respective fund to 31 December 2022 (Unaudited).

The tables below have been compiled using the daily prices as published by each respective PFA. However, they are unaudited. They present a global view of returns of ALL funds to 31 December 2022. Your fund’s audited returns since inception to 31 December 2021 are available to download here MoneyCounsellors Annual Report on Pensions (MCARP 2022). 2022 audited performances will be presented in due course. You can also go to the Literature and Download section of your fund on moneycounsellors.com and download an individual report.

Month of December

Fund Returns for the full year of 2022

Pension Fund Returns Since inception to December 2022

Download the Money Counsellors Annual Report on Pensions (MCARP 2022) for a full analysis of yours and other Pension Fund Administrators (PFA) in one single document. The report presents a holistic review of the last five years of activities of all PFAs, and the funds managed, including 5-year summary company and fund accounts, ratios, fund performances, fund performance rankings vs. peers, asset allocation, AUM ranking, RSA ranking and much more. The Report is a must read for all 9.8m RSA holders and those thinking of signing up to a PFA or switching a PFA.

Our data and information provided is based on public data, our regulatory intelligence effort, from our archives, and other public sources such as from Fund Managers, FMAN, Pension Fund Administrators (PFAs), PenOp, etc. We have taken care to ensure that the information is correct, but MoneyCounsellors neither warrants, represents, nor guarantees the information’s contents, nor does it accept responsibility for any errors, inaccuracies, omissions, or inconsistencies contained herein. Because past performance does not predict future performance, it should not be used to make an investment decision. We make no product recommendations. No news or research item on our website or in this document should be interpreted as a personal recommendation to buy, sell, or switch any investment. Investments and the income generated by them rise and fall in value, so you may receive more or less than you invested.

© MoneyCounsellors.com