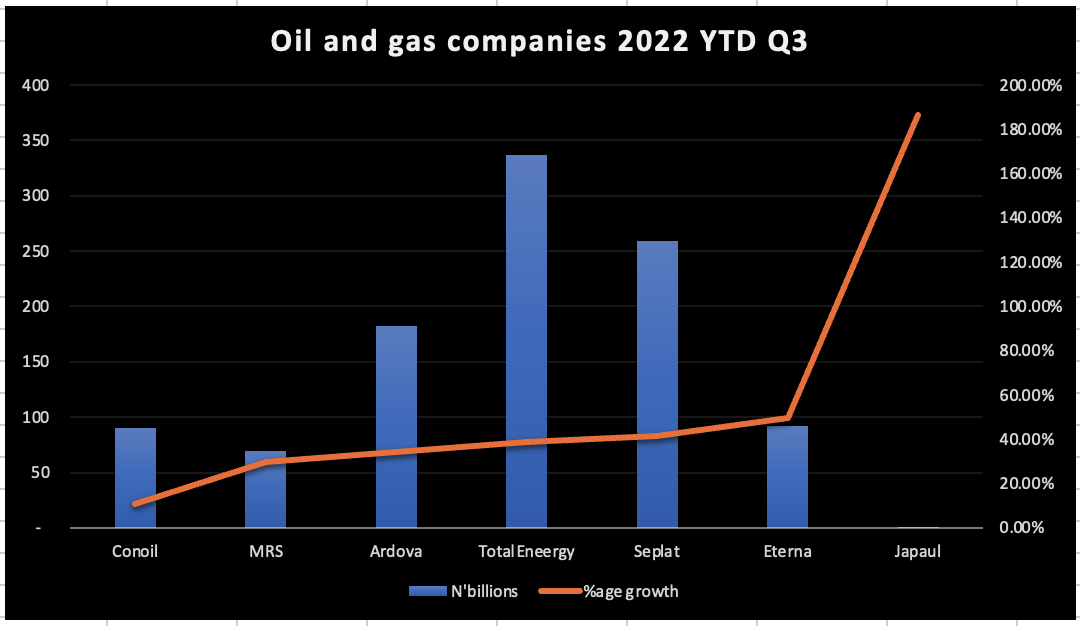

An analysis of results of Nigeria’s publicly leading oil and gas companies reveal they earned a whopping sum of N1.031 trillion as revenue in the nine months that ended September 2022, outpacing their earnings (N776.939 billion) in the corresponding period in 2021.

According to the financial statements of these companies, as compiled by Nairametrics Research, revenues rose by 32.7% compared to the nine months of 2021.

The revenue growth is remarkable, considering economic disruptions in the global economy occasioned by the ripple effect on energy, power, and food cost, amongst others, caused by the Russia-Ukraine face-off.

Note that this analysis is based on the revenue reported as of Q3 2022, based on calendar months. For the sake of emphasis, we excluded Oando Plc, which is yet to release its third-quarter results.

The oil and gas firms under review are divided into upstream and downstream companies with Seplat the sole upstream oil and gas player listed on the exchange.

2022 Q3 YTD

What they reported: Apart from Conoil, all the oil and gas companies under review reported a revenue boost in the first 9 months of the year.

- MRS for example, reported a 29% revenue growth while Ardova’s growth was a whopping 34%.

- Total Energies, one of the largest downstream companies reported amassive 39% boost in revenues topping N337 billion in the first 9 months.

- Upstream OIl and gas giant, Seplat also rode on higher oil prices to report a 41.6% boost in topline revenues.

- But unlike upstream companies, the downstream players suffered margin drops evidenced by a higher inflationary environment that hikes input cost.

Upstream Price boost: Seplat, the local oil and gas major rode on higher crude oil prices to record a massive revenue boost despite challenges with crude oil production and output.

- The company reported it had evacuation challenges over force majeure but got reprieve from higher oil prices.

- “In Q3 Seplat suffered from an unusually elevated level of evacuation problems – primarily the major FoT outage and the force majeure on Bonny Light crude exports by Shell. However, these issues have all been addressed in time for Q4, and it is guiding strong exit production (55kboepd), at the very top end of its prior FY guidance range. As such, we expect this to be a bump in the road from which the company has already recovered, but which will leave a mark on the FY results – albeit one that is more than offset by improved oil prices, with 9M22 revenue up 34.4% at an average price of $108.25/bbl”

- Seplat Energy Plc sustained a positive trajectory during the nine months that ended September 30, 2022, with a 41.6% growth in revenue. The company reported a revenue of N258.716 billion in its nine months of 2022 revenue from N182.677 billion a year ago, taking advantage of the global rise in oil and gas due to the Russian invasion of Ukraine and operational headwinds during the period.

Seplat closed its last trading day on Thursday, November 10, 2022, at N1,100.00 per share on the Nigerian Exchange (NGX). Seplat Petroleum Development began the year with a share price of N650.00 and has since gained 69.2% on price valuation.

Downstream issues: While most downstream oil and gas companies under review mostly posted higher revenues, they faced significant margin drops often due to fuel scarcity, higher inflationary cost inputs as well as supply disruptions.

- Ardova provided an insight in its 2022 Q3 results, explaining that despite upward price adjustments it still faced margin declines due to fuel scarcity and product allocations.

- “Third quarter revenue was strong although volume declined for our white products except ATK. Revenue growth benefitted from upward industry price adjustments on the white products. The decline was largely due to factors including general scarcity of fuel, wider allocation of products due to new industry entrants, and less haulage and transport trucks due to increase in diesel price. As a result, we are enabling Axles and Cartage, a subsidiary of Ardova, to increases its fleet size by more than 40% in 2023.”

- Yet, Ardova Plc leveraged the market environment to record a revenue of N182.590 billion for the period under review from N136.102 billion in 2021, accounting for an increase of 34.16% following the increase in fuel price occasioned by inflationary pressure.

- Despite this it reported a pre-tax loss of N4.3 billion for the period under review.