Nigeria’s leading electricity power plant Geregu Power Plc has officially listed N2.5bn shares by introduction on the Main Board of the Nigerian Exchange (NGX) on Wednesday, October 5, 2022.

Nairametrics first reported the planned listing on Monday.

Some details of the listing include the listing price of N100 and a market cap of N250 billion with an international securities identification number (ISIN) – NGGEREGU0000.

This is also the second listing on the Nigerian Exchange this year and will likely be seen as a major achievement for the Exchange under the leadership of its CEO, Temi Popoola.

What this means for Nigeria’s power sector

Ever since the listing was made public earlier this week, power stakeholders have expressed confidence in Nigeria’s power generation ecosystem. Geregu Power already has a reputation for excellence in service. So, some industry stakeholders see the company’s listing on NGX as a bonus point.

- For the first first time, Nigerians will be able to invest directly in the power generation ecosystem through a private sector company, Geregu Power.

- Energy industry analyst, Kayode Oluwadare told Nairametrics that the listing means two things;

Proof of concept – The listing will show stakeholders and potential investors that Geregu Power is creating some value in the power sector. According to Oluwadare, prior to this time, those looking to invest in power generation companies may have been reluctant to do so, due to the notion that power generation is not a profitable venture as a result of debts being owed by power generation companies to natural gas suppliers. But, with this listing Geregu Power has been able to instill confidence in those who may want to invest in power generation.

Market presence – The listing shows that there is a market for power generation in Nigeria, which is good news for investors and potential partners. It shows that Geregu Power is doing something right and that there is commercial value in the business. Oluwadare also said that if Geregu Power is able to increase its capacity, the Transmission Company of Nigeria (TCN), will be able to wheel all the power the company generates. The TCN struggles with wheeling capacity due to aging infrastructure. However, with the ongoing power deal, Nigeria has with Siemens energy, TCN will increase wheeling capacity in the near future.

How to trade Geregu Power shares on NGX

According to NGX, when you invest in shares of listed companies on NGX, you become part owner of these listed companies and thus can benefit from share price growth and/or income paid as dividends. An investor can trade shares by using a licensed stockbroker to buy and sell shares on his/her behalf or remotely through direct market access.

- The NGX says that in order to trade security listed on the Exchange, you must sign up with any of the Trading License Holder Firms listed on their website. You need to go through the list carefully because some firms have been deregistered.

- After selecting a stockbroking firm to trade under, you will need to get information on the best trading conditions, as well as all the fees and commissions associated with trading.

- Then your stockbroker will aid you in registering an account with the Central Securities Clearing System (CSCS), after which, you will receive a unique CSCS account number once registration is complete.

- The CSCS can now track the record of all your holdings. When you are done with the CSCS registration, you will register a live trading account with your stockbroker and start trading shares.

What you should know

- The Company began operations in February 2007, to generate electric power supply to the National Grid managed by the Transmission Company of Nigeria (TCN).

- Amperion Power owns 99.9% of the company. Calvados holding (owned by Femi Otedola) owns 95% of Amperion Power while Shangai Power owns 5%.

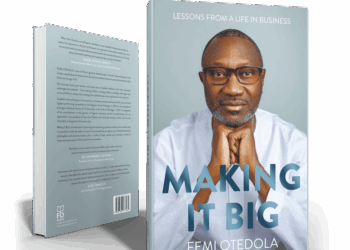

- Femi Otedola is the Chairman of Geregu Power Plant while Mr. Akin Akinfemiwa is the Chief Executive Officer.

- Geregu Power will be the second company Nigerian billionaire, Femi Otedola will be listed on the Exchange.

Isn’t this a scam? Recall that Geregu was spun off Forte oil before it was sold and the minority shareholders were left high and dry,, couldn’t exit the company on the same terms as Otedola did, rather were paid a paltry sales dividend of about #4.00 or less on the spun off company.. . Now here we are, same Geregu listed at #100 with a market capitalization of #250b