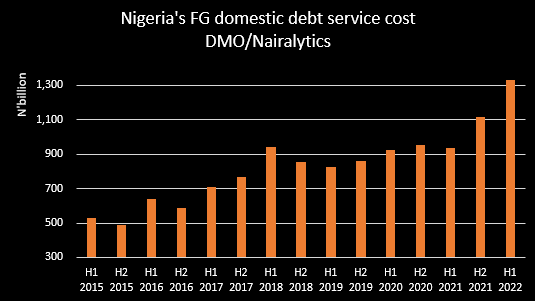

Nigeria’s federal government spent N1.33 trillion to service domestic debts in the first half of 2022, representing an increase of 42.5% compared to N935.46 billion spent in the corresponding period of 2021.

When compared to the second half of 2021, domestic debt service increased by 19.2% from N1.19 trillion. This is according to data released by the Debt Management Office (DMO).

Recall that Nigeria’s total debt stock rose to a record high of $103.31 billion as of June 2022, from N41.61 trillion recorded as of the previous quarter. The breakdown of Nigeria’s debt profile showed that domestic debt stood at $63.25 billion, while external debt was $40.06 billion.

Nigeria’s debt profile has been on the rise over the years following the crunch in revenue, with the economy running on a fiscal deficit in the last 13 years. A breakdown of the report showed that the highest was spent in the month of April 2022 at N529.881 billion, followed by the N376.44 billion spent in the previous month.

Breakdown of the payment

- A sum of N892.1 billion was spent to service FG bonds in the period under review, accounting for 66.9% of the total payment.

- Also, 21.5% of the total domestic debt service payment was made on promissory notes having spent N286.67 billion, while N110.86 billion was spent on Nigerian Treasury Bills.

- Others include N715.99 million on FGN Savings Bond, N41.3 billion on Sukuk rentals, and N1.8 billion on FGN Green Bonds.

A cursory review of Nigeria’s domestic debt stock by the instrument as of June 2022 shows that FGN bonds accounted for the giant share with N15.19 trillion, representing 72.53% of the total, followed by Nigeria Treasury Bills with N4.5 trillion (21.5%).

Similarly, FGN Sukuk accounted for 2.92% with N612.56 billion, promissory noted at N514.94 billion, while TBills stood at N75.99 billion and FGN Savings Bond at N20.87 billion.

Higher interest rates to increase government debt spending

The Central Bank of Nigeria increased the benchmark interest rate to 15.5% in its last monetary policy meeting, the highest in two decades and the third consecutive rate hike this year. Following the interest rate hike, Nigeria’s Treasury Bills auctioned afterward recorded an interest rate of 12%, an increase from 8.5% recorded in the previous month.

Recommended Reading: What CBN interest rate means to Nigeria’s economy

This implies that the federal government will be more on the treasury bills, which would translate to increased debt servicing, as the interest rate increase is expected to spiral across other debt instruments issued by the Debt Management and the CBN on behalf of the federal government.

It is also worth adding that the federal government, which is still dealing with the underperformance of its revenue sources, will continue to acquire more loans despite already spending 118% of its revenue on debt servicing in the first four months of the year.

Meanwhile, the Debt Management Office (DMO) has stated that Nigeria’s debt to GDP ratio stood at 23%, which is still well below the country’s self-imposed limit of 40%, noting the importance of growing Nigeria’s revenue in other to reduce budget deficits.