One of AXA Mansard’s best insurance products is its Health Insurance (HMO) which caters to retail, corporate and international customers.

The business segment contributes almost 40% of its gross premiums and is a major driver of growth for the company. As such, when the HMO business does well, the company is in very good financial health.

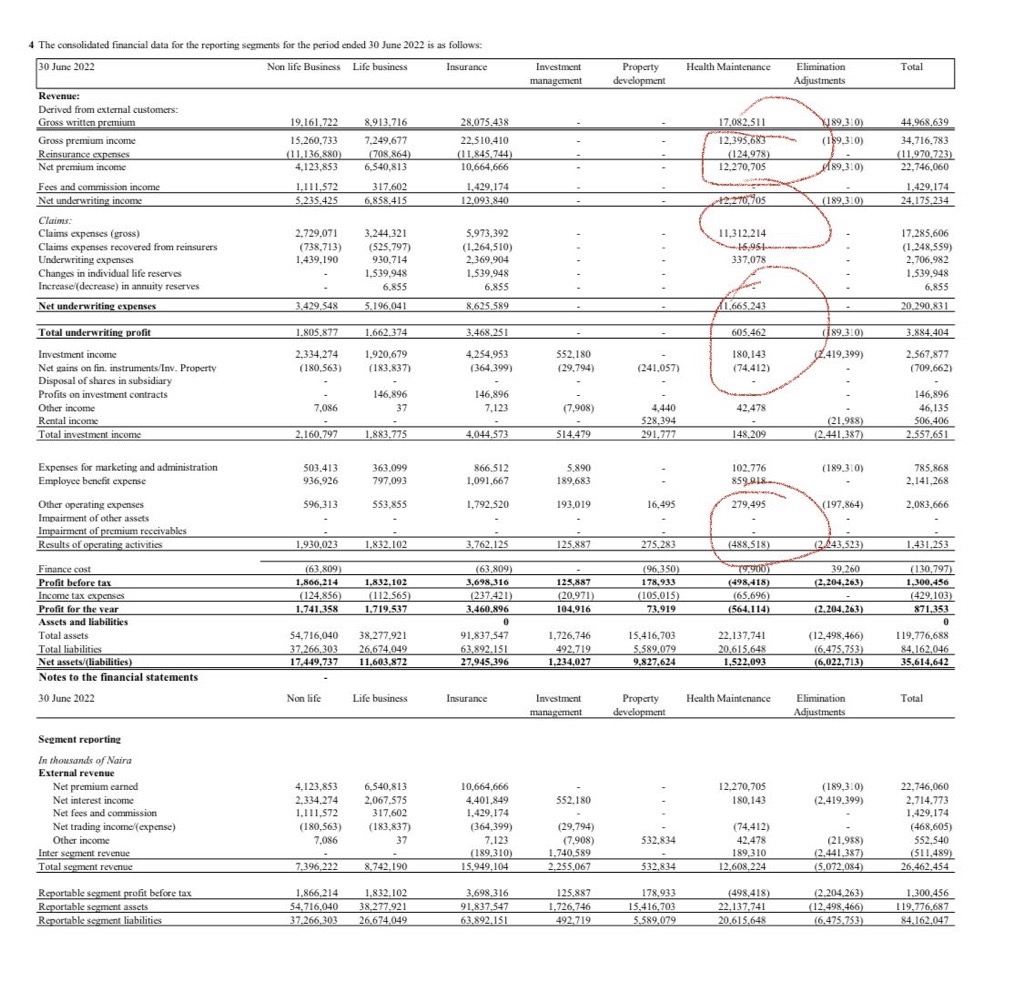

The latest half-year results of the company suggest a weakening HMO segment and there are symptoms needing urgent attention. The company reported a gross premium income of N12.3 billion in the first half of the year, up from N10.1 billion achieved in 2021 and also higher than the N8.8 billion made in 2020. But as revenue rose during the year, so did claims and reinsurance expenses.

The company reported a whopping health insurance claim of N11.3 billion in the first half of the year effectively wiping off 90% of its health insurance premiums. The surge in claims was also 65% of the total claims incurred during the quarter.

To put this into more context, the company’s total health insurance claims for the whole of 2021 were N16.9 billion. On the current trajectory, AXA Mansard is likely to see claims for health insurance rise in the second half of the year if things continue as is.

AXA Mansard projects fourth-quarter claims of N31.5 billion during the year and a pre-tax profit of just N4.5 billion. This is in contrast to the pre-tax profit of N5.7 billion reported in 2021 and N6 billion reported in 2020. Investors are seeing this which perhaps explains why its share price has fell to N1.71; a new 52-week low.

While these challenges remain, there is a major silver lining. Axa Mansard’s growth in gross premium has bolstered cash flow and so it closed the first half of the year by generating N5.1 billion. The total cash balance is currently N17 billion, unchanged from December 2021. This is despite spending over N14.5 billion on total claims paid.

AXA Mansard knows it needs to keep generating premiums from its healthcare business while efforts at reducing claims should be pursued. Its life and non-life insurance business are doing well holding on to margins and supporting the faltering HMO business. Management is also weighing in on the challenges.

The company executives did not explain why claims rose in the first half of this year but they acknowledged the spike and its impact on their bottom line. In his remark, Mrs. Ngozi Ola-Israel, Group CFO explained, “the decline of 59% and 62% respectively in the PBT and PAT is largely driven by higher claims experienced in our health portfolio. We are strengthening all our underwriting and claims management processes while continuing to excel in our investment performance where we grew 94% YoY.”

Mr. Kunle Ahmed, the Chief Executive Officer, of AXA Mansard Insurance, also weighed in on their claims process.

“We are taking steps to strengthen our balance sheet as well as our underwriting and claims management processes which will translate to increased profitability in the medium term,” he said.

The company’s promise to review its claims management will be confirmed when it releases its 3rd quarter results in the next few weeks. Until then, it is “wait and see”.

Corrigendum: This article has been updated to correct the Gross Premium Income for 2020 and 2022.

How do you control health insurance claims? AXA Mansard HMO is doing well in yes of revenue because of the robustness of their product packages. Should they reduce the scope of cover of each package? Should they reduce the limits of cover? See, new National Health Insurance Authority Act 2022 will effectively drive HMOs out of business, especially the fringe players, and will be a challenge for the bigger players to bed with if they do not think they way out ingeniously.

Health insurance isn’t like life or general insurance where you can play with policy sub-limits and warranties. There’s a whole lot of sentiment attached. Meanwhile, users aren’t even exploiting the benefits yet. Many users don’t even go for the once-a-year routine medical check granted by most health insurance covers.

AMHMO just have to sell more.