The emergence of investment and savings apps is helping to sustain the culture of savings among Nigerians even in the face of a bleeding economy. While it takes self-discipline to save from an income that is not even enough, the apps are making it easier by automating the process, such that a particular preset amount is deducted from the user’s account on regular basis as savings.

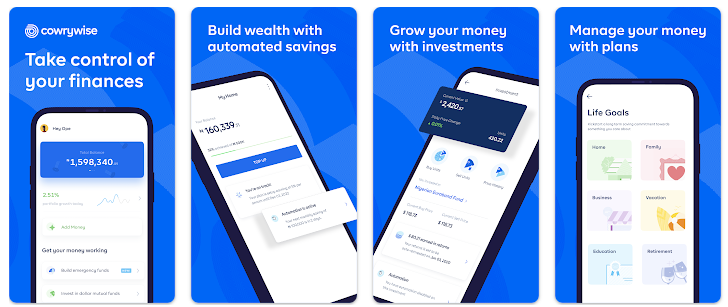

Among the apps driving digital savings culture in Nigeria today is Cowrywise. Launched in 2017, Cowrywise offers savings with interest rates at periodic, fixed, and one-time rates. With this app, you can build your savings and investment portfolios and manage your money securely. It also allows you to save as an individual or with a group. A notable highlight of Cowrywise is the friendly user interface and the ‘Savings Challenge, which challenges you to engage in rigorous savings plans that help you build emergency funds or a better stash of funds at the end of the specified period.

The app provides its users with a rate calculator that enables them to calculate their interest even before they start saving.

Recommended Reading: Top 10 savings apps in Lagos Nigeria

Users’ review

The Cowrywise app, with over 500,000 downloads on the Google Play Store is flexible with a beautiful design and simple user interface. But while some of the app users are testifying to the smoothness and the ease of using the app for savings and withdrawals, the experience on the app has not been palatable for many other users.

Users who spoke with Nairametrics are more worried that the app easily flags their legitimate transactions as suspicious, especially, at the point of withdrawal, thus denying them access to their money at the time of need. Here’s what they have to say about their experience:

- For Bisi Adedeji, everything about the app works fine except for the issue she faced at the point of withdrawing her savings. “The app is good and makes it easy to save. However, I was disappointed last week when I wanted to withdraw my savings and it was flagged as suspicious. I couldn’t complete the transaction that day and it took me like 3 days of speaking with their customer care before the issue was resolved. This aspect of the app should be looked into,” she said.

- Lanre Awolere also had the same experience withdrawing from the app after saving and was only able to scale through after contacting the app’s customer care. “I think the app is just being too security sensitive. There should be a way to detect fraudulent transactions and flag them without causing problems for people that want to withdraw their money legitimately,” he said.

- On the Google Play Store, some Cowrywise app users lamented experiencing similar issues, even though several others describe the app as one of the best based on their experience. But some are also concerned that the saving limit on the app, which used to be N100 has been reviewed upward to N1,000.

- According to Nicholas Uchenna, he has no disappointment whatsoever in the last 3 years he has been using it. “I’ve been using Cowrywise for almost 3 years now, and I am never disappointed at their service and constant improvements to make saving easy and fun. They’ve come a long way in proving themselves worthy as a great Financial Institution, it’s a great privilege to have joined them on this journey. And I look forward to more exciting endeavors ahead,” he said.

- But the experience is not the same for Tunmise Tope, who was frustrated after his transaction was flagged by the app. “What a very useless app, I send money into the regular account and thereafter moved it to stash because I wanted to send it to a friend using the same app, only for them to flag my account. Who send them work? They said they noticed an unusual transaction. I have been sending messages to their customer service since last week but they didn’t respond and even their call centre number is not going through,” he lamented.

- Egbeyalo Motunrayo had the same experience with the app. According to her, “my account has been flagged for trying to transfer money to my bank account. Support has been silent, no replies. The WhatsApp customer care line has been silent, I’ve filled in the form, and no response yet. Please rectify this immediately.”

- Sharing a similar experience, Ahmad King said: “I wish I could rate the app -5 star. The app is totally useless. I opened an account and a friend sent me money, I tried to withdraw and they flagged my account immediately. Their customer service was of no use like everything was just useless in the app.

- Cowrywise customer care, however, responded to Ahmad’s complaint via the same platform saying: “Hi Ahmad, we’re sorry to hear that. Our system automatically flags an account to protect it when it notices any irregular action. We would love to take a look at the issue. Please reach out to our customer support team to have this resolved ASAP.”

- Another user, Winifred Dada has this to say about the Cowrywise app: “Since I started using this app last year, it has been really wonderful and easy for me to save money. Thank you. However, since the last two updates, I noticed the minimum I can save is N1,000, please can that be fixed? So that even if I do not have up to that amount, I can still save Overall though, this is a wonderful app.

- Lawal Abdulrasheed feels the same way about the upward review of the savings limit on the app. “By reviewing upward, the minimum of saving N1,000, you think you want to help your customers to save more, but I want to tell you in real sense you are not! Kindly reverse to status quo where customers will save what they are able to save, fingers are not equal,” he said.

Bottomline

The Cowrywise app is, no doubt, one of the best out there when it comes to savings apps in Nigeria in that it simplifies savings and makes it convenient for the users to save. However, it needs to fix the bug flagging legitimate withdrawal transactions as suspicious, which could be frustrating for users.

Hi my

Silly flagging of account and the cc being slow to resolve was why I moved from cowrywise to another popular wallet about 2 years ago.

Quite surprised, 2 years later, the issue persists.

Hi includes my money .atmcard of mygcash.paymaya .and my money in websites .casino.play games..

They even seized my money and banned me from using the platform. Scammers.

The truth is they are using our money for business, and as at the time some people request for withdrawal, the said funds are not available, so they device a means to hide under security scrutiny. Liars, if I request and my money is not made available, I will file a law suit because that’s a breech of agreement and denial of financial right.

Please in anything you do I need that money to access it. I do business with my mom and you people have flagged my account. She’s scared to the point of death I can’t afford her to cry her eyes out loosing the money. Cause she keeps saying I warned you…

Cowrywise is no doubt a top saving app that is highly recommended, giving the fact that you can also invest, make it very lovely