With the emergence of investment and savings apps offering mouth-watering incentives to encourage savings, many Nigerians are now forming the habit of setting aside a part of their income to earn rewards in terms of interest or returns on investment.

The savings apps are helping to sustain the culture of savings among Nigerians even in the face of a tough macroeconomic environment.

While it takes self-discipline to save from an income that is not even enough, the apps are making it easier by automating the process, such that a particular preset amount is deducted from the user’s bank account regularly as savings.

Among the top apps in this category are Piggyvest and Cowrywise, both offering varieties of savings plans and rewards.

What are these two apps doing differently and which is doing what better? Nairametrics examined the features of these two apps, their offerings, consumer ratings and what the users are saying about them.

Piggyvest: Launched in 2016, Piggyvest has been helping its customers to manage their finances with simplicity and transparency through its savings plans.

- With over 1 million downloads on the Google Play Store, Piggyvest has different savings plans tailored to meet the different needs of its customers.

- Piggyvest offers different rates based on its different savings plans. The company offers an 8% per annum interest rate on its Piggybank savings plan and 8% on its Target savings, while it promises up to 13% per annum on its Safelock plan.

In the latest update to the app, Piggyvest introduced a new investment plan called Investify. According to the company, with as little as N1,000, you can invest in PiggyVest in areas that appeal to you, like agriculture, real estate, transportation, and even commercial papers, and earn as much as 100% return on your capital, depending on the investment type/project, investment duration, etc.

Cowrywise: Launched in 2017, Cowrywise offers savings with interest rates at periodic, fixed, and one-time rates. With this app, you can build your savings and investment portfolios and manage your money securely. It also allows you to save as an individual or with a group.

- A notable highlight of Cowrywise is the friendly user interface and the ‘Savings Challenge, which challenges you to engage in rigorous savings plans that help you build emergency funds or a better stash of funds at the end of the specified period.

- The app’s interest rates vary. Hence, Cowrywise provides its users with a rate calculator that enables them to calculate their interest even before they start saving.

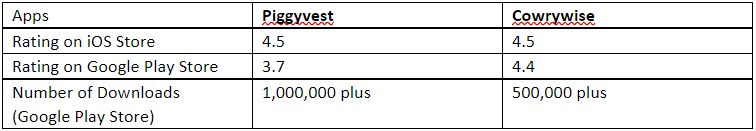

Ratings and downloads: Both Piggyvest and Cowrywise apps are available on the iOS App Store and the Google Play Store. Both have recorded a significant number of downloads and have also been rated by the users based on their experience. Here’s how they stand:

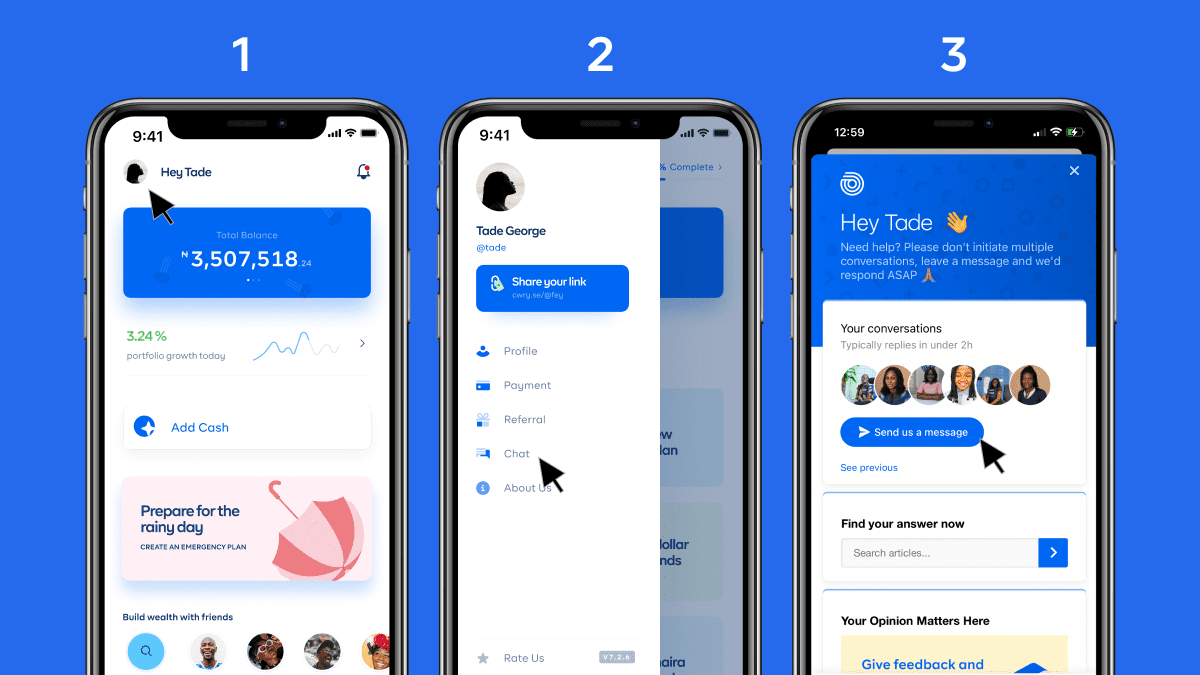

Piggyvest and Cowrywise apps come in beautiful designs and both have simple user interfaces. However, beyond the looks, users’ reviews of the apps on the Google Play Store and the iOS App Store show the true experience of the platforms. Here’s what the users are saying:

Piggyvest review: For Praise Yusufu who has been using the app over the last two years, the experience has been smooth, even though she would want the interest rate on the platform to be increased.

- “I’m very pleased with this app. I’ve been using it since 2020 and I’ve never looked back since. I’ve recommended it to so many friends and family and so far, there is no issue. I just wish the interest rate is more than what is given and flex-to-flex transfers enabled back because it makes transactions easier. Overall, I like the app and I definitely see myself using it in the long run,” she said.

Precious Sobamiwa is delighted with the savings option of the app and the interest rate. Sharing her experience, she said:

- “I use this app to save, it’s amazing. There are no bank charges monthly and you get interest and coins when you save often. This app has really helped me to start and sustain a saving culture. Now, there’s a new feature, that enables you to save in dollars. It’s the best thing. Although, the investment is always sold out!!! Please look into that because I’d love to invest.”

- However, Henry Kemfert is worried about the security on the app. According to her, “the app is good and the interest rate is fair. My problem is that the app isn’t secure. It shows in the app to enable fingerprint lock but it has never been activated once. Anyone can just take my phone and open the app and find out the amount I am saving which is supposed to be kind of a secret since it’s my savings. it’s just like someone having access to my local saving box. Please work on the security aspect of the app it’s very important.

Cowrywise review: Nicholas Uchenna, says he has no disappointment whatsoever in the last 3 years he has been using the Cowrywise app.

- “I’ve been using Cowrywise for almost 3 years now, and I am never disappointed at their service and constant improvements to make saving easy and fun. They’ve come a long in proving themselves worthy as a great Financial Institution, it’s a great privilege to have joined them on this journey. And I look forward to more exciting endeavors ahead,” he said.

But the experience is not the same for Tunmise Tope, who was frustrated after his transaction was flagged by the app.

- “What a very useless app, I send money into the regular account and thereafter moved it to stash because I wanted to send it to a friend using the same app, only for them to flag my account. Who send them work? They said they noticed an unusual transaction. I have been sending messages to their customer service since last week but they didn’t respond and even their call centre number is not going through,” he lamented.

- Egbeyalo Motunrayo had the same experience with the app. According to her, “my account has been flagged for trying to transfer money to my bank account. Support has been silent, no replies. The WhatsApp customer care line has been silent, I’ve filled out the form, and no response yet. Please rectify this immediately.”