With the current economic realities, many Nigerians are now depending on loans to survive. As dangerous as leaving on credit may be, it is life-sustainer for many who would have remained helpless while their payday is still far away. This is why the loan apps with their brutal recovery method are more like necessary evils at this time.

In Nigeria today, FairMoney is one of the popular loan apps being used by Nigerians to access instant loans without collateral. Fairmoney’s CEO, Laurin Hainy, made it clear that the app aims to provide a platform that ordinary citizens can use to fund their dreams and businesses to go up the ladder.

The app uses artificial intelligence to analyse your bank records and validate your BVN to make lending decisions based on your credit score. The loan is 100% online, with no collateral required and you can apply at any time, any day of the week.

In terms of design, the app is made to be easy for every user. The dashboard is simple and straightforward and navigating through the app is quite simple too. Application for loan and repayment can be done through simple quick steps.

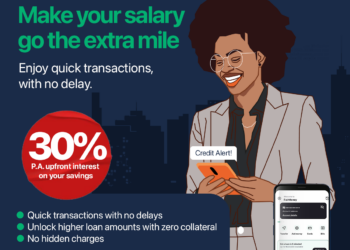

FairMoney offers loans between N1,500 to N500,000 with repayment periods from 61 days to 180 days at monthly interest rates that range from 10% to 30%.

FairMoney app is, no doubt, one of the most used by Nigerians as it has been downloaded 5 million times and still counting. But among these millions of downloads are customers who have had to download and later uninstall the app from their phones out of frustration or disappointments experienced with the app.

Nairametrics spoke with some users of the app and here is what they have to say about their experience with the app:

What the users are saying

Olaleye Precious says her experience with the app was good at the beginning until she started noticing an increase in the amount she was to pay as interest on her loan. Asked about her experience with the app, she said: “What the app promised was that the earlier I repay my loans, the better credit score, which will also ensure I get lower interest rate, but that is not so. I noticed that the interest rate keeps increasing after each loan, even though the loan is the same amount.”

For Samuel Ishola, his challenge with the app is the difficulty in linking his debit card to the app. “Each time I try to link my verve card, it doesn’t appear after all the many steps of inputting all the many numbers on the card, then they debit me N50 naira, yet it won’t link. I can’t apply for a loan without linking my card. It is really frustrating,” he said.

Olalekan Yusuf says the app has been great in granting instant loans but he is unhappy that the app has not upgraded his loan status despite keeping to repayment deadlines. “I am made to believe that repaying loans promptly will make me qualify for a higher amount of loan but that has not happened. I am still limited to N10,000 loan, despite the fact that I have not been defaulting. This is my only issue with the FairMoney app,” he said.

Google Play Store reviews

On the app store, the app is receiving a mixture of positive and negative reviews: Here’s what some of the users have to say about the app:

Obinna Ofodile: “The speed of transaction on the app is good, but the interest rate on loans is too high. I was given loan of the same amount twice, the interest rate of the first was high and the interest rate of the second was even higher. I don’t understand why. I also was not given a discount for early repayment of the loan as promised on the app.

James Divine: “For 3 consecutive days, I have sent and received over 25 emails just to link my card. I input my card details to be linked but after following through on the process, I get this message that says my card is linked to an ongoing loan. I have removed and reinstalled the app a dozen times now still the same old story. I successfully deleted the card from my payment options. This would have been impossible if I actually have a running loan. Disappointed!”

Sharon Akere: “FairMoney regularly sends me texts to invite me to apply for a loan and as soon as I complete the details of my application, I get an error message saying “we are facing an issue now, please download a newer version to enjoy our services”. I can’t count the number of times I’ve applied for loan. This is really bad as I wonder why they can’t seem to leave me alone. I keep getting invites and I can’t get a loan at the end of the day.”

Esosa Vincent: “The payment time is too short and the interest rate is too high and if you ask for an extension, you will have to pay the extension fee first before they extend your loan period, which is bad and annoying.”

Tomilola Ogunade: “Your app is great but I’m a little disappointed because I paid back a loan of N30,000 with interest which makes it 38,100 in a month and you reduced my next loan approval to N10,000. That is ridiculous. Meanwhile the last loan I paid I was supposed to pay it on the 8th of August but I paid you on the 29th of July only for you to even reduce the loan to a ridiculous amount. That’s unfair.”

Bottomline

The interest rate on the FairMoney app loan is, no doubt, high. However, considering the high risk the company is also taking in giving out loans to people without collateral and the high possibility of default by the recipients, it may be justifiable. Limiting some people to a certain amount of loan may also be a way of minimizing its risks.

Nairametrics rating

Based on the users’ experience and our analysis of the app, we rate FairMoney app 7 out of 10.

How safe it is to share one’s debit/credit card details with online loan companies i.e Fair Money & what is the interest rate for a possibly #200, 000 loan?