The Office of the Accountant General of the Federation revealed on Tuesday, 26th July 2022 that Nigeria’s Excess Crude Account (ECA) depleted to $376,655 in July from $35.7 million recorded as of the previous month.

This represents a significant decrease in the nation’s retained crude export earnings. Basically, the ECA is a savings account retained by the Federal Government and is funded by the difference between the market price of crude oil and the budgeted price of crude oil as contained in the appropriation bill.

For example, the federal government prepared its 2021 annual budget with an oil price benchmark of $40 per barrel. However, the price of crude averaged at $79.31 per barrel. This means that the difference of $39.31 for every dollar produced and sold will be retained in the excess crude account.

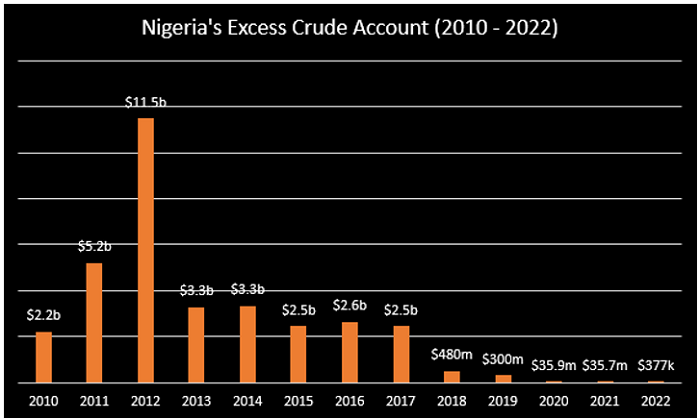

Despite the rally in the price of crude oil in previous years, Nigeria’s excess crude account dipped to $35.7 million in the previous year and has now fallen to a record low at $376 thousand. Since the peak recorded in 2012 at $11.5 billion during the Goodluck Ebele Jonathan administration, Nigeria’s ECA has dipped by almost 100%.

In 2017, a report by the Natural Resource Governance Institute ranked Nigeria’s Excess Crude Account as the most poorly governed sovereign wealth fund among 33 resource-rich countries in the world. Also, in April 2019, the International Monetary Fund (IMF) ranked Nigeria as the world’s second-worst country in the use of sovereign wealth funds, following Qatar.

Here is a compilation of the timeline leading to the depletion of the nation’s Excess Crude Account.

May 2007

- The Excess Crude Account was set up during President Olusegun Obasanjo’s administration in 2004 to save oil revenues above the budget benchmark for crude oil prices. The account belongs to all three tiers of government and withdrawals can only be made when all the tiers agree.

- As of the end of former president Obasanjo’s administration in May 2007, after which late Musa Yar’aradua came in as the president, Nigeria’s excess crude account was at $20 billion, $5 billion of which had been pledged by the three tiers of government to fund the National Independent Power project, leaving the balance at $15 billion.

2008/2009

- In 2008, the state governors instituted a suit at the Supreme Court saying that the balance of $15 billion from the ECA should be shared immediately, quoting provisions of the constitution, which support their claim.

- Later in 2009, the then president Musa Yar’adua opted for an out-of-court settlement and by the end of 2009, the balance had dropped to $6.5 billion, indicating that the ECA lost $8.5 billion in the space of 2 years.

2010

- In the year 2010, when Goodluck Jonathan assumed the position as the acting president, the state governors returned to request the immediate payment of the $6.5 billion balance. Just as the case of the former president, Jonathan reached an agreement with the governors and $2 billion was spent in addition to the sum of N339 billion spent to augment the arrears from the three tiers of government for the federal allocations in May 2010.

- Later in August 2010, the state governors returned for the $4 billion balance, in which the president agreed to withdraw some of the funds, taking out $3 billion from ECA from which $1 billion was paid into the Sovereign Wealth Fund, while the remaining $2 billion was shared.

2011

- In 2011, the state governors returned to the Supreme Court to request for the remaining $1 billion which was in the Sovereign Wealth Fund to be shared. Despite some pullbacks from some of the governors, the fund was eventually shared, leaving the account at a little over $2 billion for the next administration in 2015.

December 2018

- The Central Bank disclosed in its annual report for 2018 that Nigeria’s Excess Crude Account dropped to $480 million from $2.45 billion recorded as of the previous year. According to the apex bank, the drop-down in ECA between 2017 and 2018 was due to significant draw-down to bridge the financing gap between the three tiers of government.

July 2019

- The Federal Government under President Muhammadu Buhari was accused of mismanaging the country’s Excess Crude Account earlier in 2019, especially the $1 billion reportedly spent on military equipment.

- According to Garba Shehu, the Senior Special Assistant on Media and Publicity to the president, while responding to the controversy of how the withdrawn $1 billion was spent, he said that various procurements were made for the purchase of critical equipment for the Nigerian Army, the Nigerian Navy, and the Air Force.

- “The record we have is that the Buhari’s administration paid $496 million for a dozen Super Tucano fighter aircraft for the Air Force in a direct, government-to-government (no contractors or commission agents) transaction with the government of the United States of America. They are due for delivery in 2020.

- “Various other military procurements for critical equipment have been made. These are for the Nigerian Army and the Nigerian Navy, amounting to $380.5 million. These procurements include money for the purchase of Navy Lynx helicopters.

- “The total amount spent so far is $876.8 million. The equipment paid for has due dates of delivery of between six months to two years. Balance of the money that is unspent as at today is $123.1 million.

- “The entire expenditure involved in these exercises is on the basis of government-to-government procurement. In cases where the Nigerian government dealt with equipment manufacturers, their home governments have in all cases given guarantees to the Federal Government.

- “Again, it is important to stress that no contractors or commission agents have been involved in the procurements under discussion,” Shehu stated.

January 2022

- Earlier in the year, the Special Assistant to President Muhammadu Buhari, Tolu Ogunlesi explained that the excess crude oil declined as a result of spending on security, refunds to states as well as investment in Sovereign Wealth Fund.

- “For those pointing out ECA was $2.1B in 2015, keep in mind $1 billion went to security purchases (incl 12 Super Tucano)

- “Part went to Paris Club Refunds to States and a substantial portion invested into the Sovereign Wealth Fund/NSIA,” he said.

July 2022

- The most recent in the country’s ECA is a drop from $35.7 million to $376,655, which has been attributed to an advance payment for the purchase of brand new Offshore Patrol Vessels for the Nigerian Navy.

- This is according to a Twitter post by the federal government in response to reactions trailing the report of the decline. The tweet read:

- “The $35m disbursement from the Excess Crude Account (ECA) is from June 2022, & is an advance payment for the purchase of brand new Offshore Patrol Vessels (OPVs) for the #NigerianNavy, as part of efforts to consolidate on maritime security gains recorded in the Gulf of Guinea.”

Why this matters

The Excess Crude Account was established in 2004 with the primary objective to protect Nigeria’s planned budgets against shortfalls caused by crude oil price volatility. However, with the almost complete depletion of the reserve funds, Nigeria’s future budgets could be impacted, especially since under-performance and theft in the oil and gas sector have dwindled the amount of crude oil earnings in recent years.

Something wrong with Nigeria Leaders. God is about to intervene soonest.

Our leaders lack vision and long term thinking. This has not only resulted in mismanagement of currently spends but also leaving nothing for future generations (who are meant to benefit from our collective non-renewable resources) and leaving great debt for them to deal with

God help us

He who holds the pen calls the shot. If we put brainless lots to hold it, we get brainless result.

If we put eggheads there; excellent results. Do you think an OBJ and Okonjo would have allowed such crisis to the ECA.

So sad but they say them sabi… now dem don scatter. Oh well!