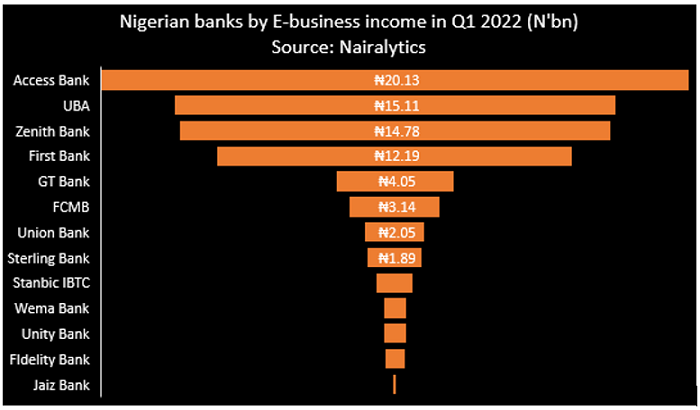

Listed Nigerian banks on the Nigerian exchange generated a sum of N77.01 billion from electronic business in the first quarter of 2022, growing the top line by 11.7% compared to N68.92 billion recorded in the corresponding period of the previous year.

This is according to the analysis of data collected by Nairalytics from the financial statements of the quoted banks.

Notably, Access Bank, UBA, and Zenith Bank led the list of banks with the highest e-business income in Q1 2022. It is worth noting that the banks also generated an aggregated profit after tax of N276.31 billion in the review period, which is 14.8% higher than N240.78 billion posted in Q1 2021.

The list was dominated by the tier-1 banks in the country, typically referred to as the FUGAZ, an acronym used to describe, First Bank, UBA, GT Bank, Access, and Zenith Bank. Basically, e-business income includes revenue from electronic channels, card products, and related services.

Specifically, the revenue is generated through transactions like mobile applications, USSD channels, Automated Teller Machines (ATM), agency banking, internet banking, and Point of Sales (POS) payments.

E-business sector growing highly competitive

The e-business space in the Nigerian financial industry is growing highly competitive in recent years, with many players coming into the industry, most of which operate as financial technology firms (FinTechs) as well as participation of telcos.

Recall that the Central Bank of Nigeria granted Airtel and MTN approvals to operate a Payment Service Bank (PSB) in the country, creating more competition in the financial space. This is in addition to the massive influx in the FinTech space.

This means that commercial banks will have to be innovative with different electronic offerings so as to ensure market dominance and customer retention. Meanwhile, the Nigerian banking penetration rate is still low, as a result of its high portion of the unbanked population.

Hence, the competition in the sector could help reduce the number of unbanked Nigeria, which would also spur growth in the Nigerian financial ecosystem.

Nairametrics presents a ranking of top banks in the country, that generated the highest revenue from electronic businesses in the first quarter of the year. It is worth noting that this analysis excludes the cost of earning the income, and would have been different if expenses incurred in earning the income were net off.

#5: GT Bank – N4.05 billion (Maintained position)

GT Bank maintained the same position with an e-business income of N4.05 billion, representing an increase of 5% compared to N3.85 billion generated in the previous year.

The newly restructured holding company accounted for 5.3% of the total income generated by the thirteen banks from electronic banking.

On the other hand, the profit after tax of GT Bank declined by 5.1% to N43.21 billion from N45.55 billion posted in the corresponding period of 2021.

#4: First Bank – N12.19 billion (Two spots down)

First Bank dropped down the ranking by two places, to stand in fourth position after its e-business revenue declined by 15.4% in the first quarter of 2022 to stand at N12.19 billion from N14.41 billion recorded in Q1 2021.

However, the bank’s e-business income accounted for 15.8% of the total revenue captured. Meanwhile, First Bank recorded a massive boost in its profit after tax in the period under review.

The profit after tax of FBN Holding surged by 107.7% in Q1 2022 to N32.4 billion from N15.59 billion recorded in the corresponding period of 2021.

#3: Zenith Bank – N14.78 billion (One spot up)

Zenith Bank ranked third on the list with an e-business income of N14.78 billion in the first quarter of 2022, an increase of 32.8% compared to N11.13 billion recorded in the corresponding period of 2021.

The second largest bank in Nigeria by asset value and the most capitalized bank on the NGX, accounted for 19.2% of the total e-business income by the thirteen banks, moving one position up the ladder.

Also, Zenith Bank posted a profit after tax of N58.19 billion, the highest posted by any bank, after increasing its bottom line by 9.7% from N53.1 billion recorded in Q1 2021.

#2: UBA – N15.11 billion (One spot up)

The pan African bank recorded a sum of N15.11 billion as e-business income in the first quarter of 2022, an increase of 21% compared to N12.48 billion recorded in Q1 2021. UBA moved one spot upward from its third position recorded as of the same time of the previous year.

The upward movement on the ranking is following the 21% increase in its e-business income from N12.48 billion generated in Q1 2021 to N15.11 billion in the review period. In the same vein, the profit after tax of the tier-1 bank increased by 8.8% to N41.49 billion.

#1: Access Bank – N20.13 billion (Maintained position)

Access Bank, which is the largest commercial bank in the country topped the list having generated N20.13 billion from its electronic business, accounting for 26.1% of the total amount generated by thirteen banks under consideration.

Its e-business income increased by 12.3% year-on-year compared to N17.92 billion recorded in the previous year. It is worth noting that Access Bank also led the list based on 2021 ranking with N66.28 billion generated in the full year.

In terms of profit after tax, Access Bank grew its bottom line by 9.2% in Q1 2022 to N57.39 billion from N52.55 billion posted in the corresponding period of 2021.

Others include

- FCMB – N3.14 billion

- Union Bank – N2.05 billion

- Sterling Bank – N1.89 billion

- Stanbic IBTC – N1.27 billion

- Wema Bank – N788 million

If this keeps increasing then the incentives to use these e-services will start declining and defeat the original idea of CBN to help get more people banked instead of a strongly competitive and significant income generating channel.

CBN should keep an eye on this burgeoning revenue channel banks are now leveraging on significantly.

Yes