The world has evolved from the novelty of digital currencies to the wide adoption of the same in just a few years. In Nigeria alone, cryptocurrency exchange Kucoin reported that 33.4 million Nigerians traded or owned crypto assets using peer-to-peer networks, despite restrictions on cryptocurrency transactions by the CBN.

The Covid-19 pandemic accelerated the acceptance of digital technologies and expedited the shift to digital solutions. Although the world is back to normalcy, this new behaviour has persisted as consumers remain adamant about using digital payment solutions. Data from the Nigeria inter-bank settlement system shows that cashless transactions rose by 44 percent year-on-year to hit 117.33tn in the first four months of 2022.

Undoubtedly, these developments indicate that digital currency is not a bubble but here for the long haul.

Depending on whom you Engage, cash is no longer king.

As of today, Nigeria’s 24.2% adoption rating is the highest rate of crypto ownership globally, a bitcoin.com survey reveals. The statistics are also interesting on the global front. At the recently concluded Milken Institute Global Conference, Brian Armstrong, CEO of Coinbase Global, opined that “One billion people around the world will use cryptocurrency technology in one way or another by the end of this decade.”

Despite the crypto market crash, the interest in digital currency and assets remains rock solid. A Bank of America survey in June showed that 91% of 1,013 people either own or expect to buy crypto within the next six months. The percentage remains the same compared to the number of people who purchased in the past six months before the latest crypto washout. Asides the promise of attractive ROIs, the adoption of cryptocurrency reflects a more fundamental paradigm shift underpinned by a revolutionary new technology known as Blockchain. Perhaps this paradigm shift is evident in the interesting trend where although central Banks worldwide mostly oppose digital currencies, they are also now creating similar instruments in a form called CBDC.

IBM defines blockchain technology as a shared, immutable ledger that facilitates the process of recording transactions and tracking assets in a business network. One top advantage of digital currency and blockchain technology is decentralization or decentralized finance (DeFi). Networks built on blockchain technology allow for fast, reliable, and secure payments at a fraction of typical costs without any third-party involvement. It also offers more transparency and a rich developer ecosystem driving rapid financial innovation. With these characteristics, it’s not impossible to imagine a world where Decentralized finance (Defi) replaces the conventional financial system. It’s also not farfetched to see why some innovative and forward-thinking technology companies are beginning to leverage blockchain technology to reinvent the banking system in Nigeria and Africa at large. Zone, Africa’s first blockchain platform for payment processing, is charting the course here. Launched in 2021, the decentralized payment network allows inter-bank transactions to be processed directly between banks, on the blockchain, without the involvement of any intermediary. With Zone, players in the industry now have a reliable and scalable payment network that enables frictionless and instant payments within and between every African country.

Notable reasons for the dogged interest in digital currencies are convenience and the absence of geographical restrictions. Digital currencies don’t require interaction with Bank branches or personnel. The complicated process of performing international transactions is greatly simplified with digital currencies such that within minutes, a person far away in Jamaica can send funds to someone in Ogun state, leveraging blockchain technology.

A peep into the future of inter-bank and cross-border transactions

A few years ago, people spent so much money to send or receive payments across borders. Speaking to a young Nigerian resident with families in Cameroon, he said, “I once had to pay about N7,000 to send just N12,000 to someone in Cameroon”. Many Nigerians studying in the diaspora can also attest to the cumbersome and expensive process of moving money from their Nigerian account to international bank accounts for school fees settlement.

Transcending global borders, digital currencies in some way enable flexibility and economic growth. They have the potential to boost cross-border trade amongst nations as they are cheaper, simpler and faster than today’s alternatives. This is one of the reasons behind the launch of the apex bank’s digital currency – eNaira. Godwin Emifiele had said at the launch that “the digital currency was introduced as part of the CBN’s cashless policy to improve cross-border trade, improve the effectiveness of the monetary policy, and increase remittances from a large diaspora base.” President Muhammadu Buhari also insisted that the adoption of eNaira and blockchain technology wields the potential to increase Nigeria’s GDP by $29bn over the next ten (10) years.

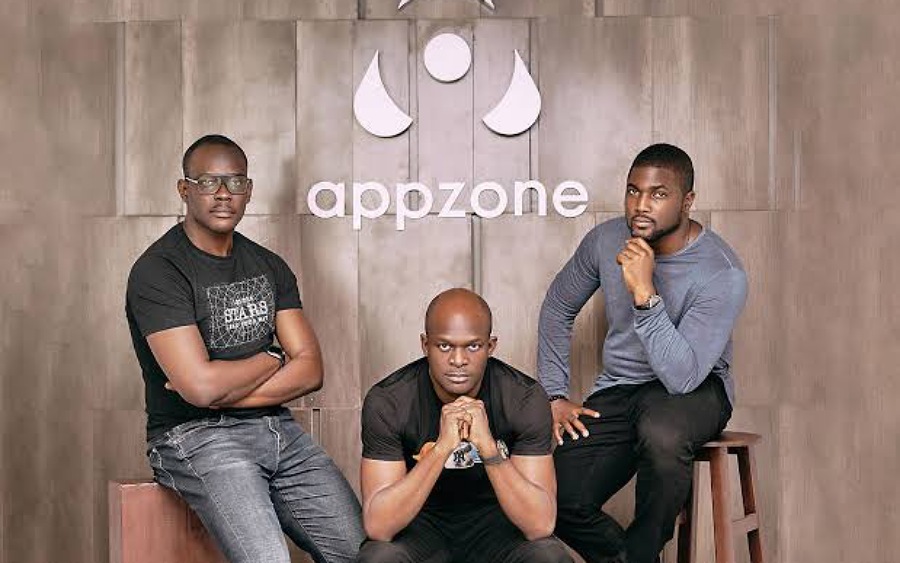

While we can’t ignore the volatility of the popular digital currencies like Bitcoin, Obi Emetarom, Co-Founder & Managing Director of AppZone, believes that stablecoins can help manage that risk. He also believes that regulators are crucial for the widespread adoption of digital currencies. At a recent Blockchain Summit, Obi, while speaking during a fireside chat, said, “Anybody hoping that there’s going to be a world where you have adoption of cryptocurrencies without regulator’s backing should forget about it. It’s never going to happen; except in a world where there are no governments.”

Is it safe to say that If the CBN gets it right with eNaira and Zone gets it right with its blockchain technology, the cumbersome process of moving funds across borders might end quicker than we think? Perhaps!

AppZone, the parent company of Zone, is one of the foremost fintech software companies in Nigeria and recently evolved into a payment infrastructure company using blockchain technology to decentralize processing, and record-keeping for digital payments while enabling real-time clearing and settlement. Zone provides capabilities for banks, fintech, and other financial service providers to connect directly and perform interbank transactions with each other in a peer-to-peer fashion without requiring the services of any intermediary or incurring associated costs.

The acceptance rate of Zone’s blockchain technology by leading financial institutions in Nigeria has been impressive, with 15 leading commercial banks currently onboarded on its blockchain network. The company has hinted at plans to extend its footprint to other parts of Africa to simplify payments processes across the region. Being Africa’s layer-1 Blockchain network for digital payments in fiat and regulated digital currencies, they are building the rails for mass adoption of DeFi in Africa.

The prediction that the internet was a bubble following the popularization of the world wide web in 1991 is one of the worst predictions of all time; just like the internet, the digital currency might be here to stay.

I also believe digital currency was invented to stay. But can you please share your list of great cryptocurrency to invest for the long run?