Some two to three decades ago, mobile payment was nowhere in sight on the African continent. The number of people who had bank accounts were below average and technology had not nearly advanced to the point of banking apps or fintech solutions. In today’s world, Africans are now faced with new kinds of problems.

Statista puts the number of banked adults in Africa at 456 million (projection for 2022), a huge leap from the 171 million as at 2012. In Nigeria alone, there are over 120 million active bank accounts, with many having several bank accounts, different fintech options, and multiple payment solutions. As many fintech platforms strive to further close the financial inclusion gap, automated and contactless payments are still lagging.

But here comes Flick

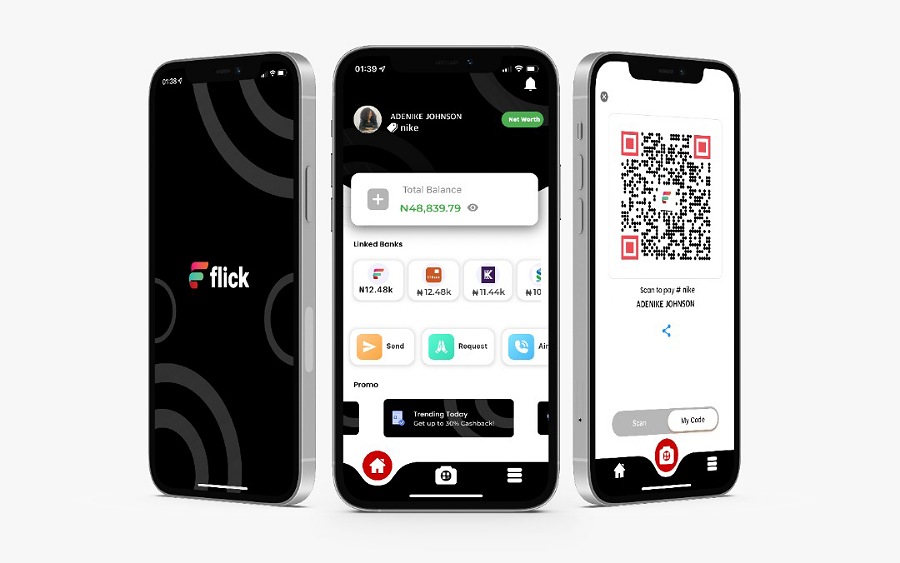

The simple reason behind Flick is this – payments should be faster and easier. Why should you have to jump through multiple banking apps, numerous debit and credit cards, USSD options, amongst others, just to make a simple payment when you can have all your bank accounts together in a single app and make all payments with ease?

Flick is the first payment solution that allows users link all their bank accounts in one place and make fast contactless payments anywhere across Africa. The goal is to make bank-to-bank payment seamless and faster for the over 120 million bank accounts in Nigeria. Additionally, Flick offers multiple solutions through its holistic business model.

Shopping gets very frustrating when payments or transfers do not go through or there are POS network issues. This does not have to be your experience.

On one hand, physical shopping is easier with the Flick ‘Scan-to-Pay’ option which allows you pay the merchant directly from your linked account or wallet within seconds.

Its online checkout solution also provides a seamless way of transacting. By simply signing in with your mobile number to complete your online purchase from any of the linked accounts, customers do not have to re-enter card details to make a payment or experience transfer delays as it happens with some other payment solutions.

There is also no need to worry about security; In addition to the bank grade security, Flick has multi-layered encryption to keep users’ data and money safe. There is the secure PIN, as well as an automated and seamless process that ensures that every payment is authenticated by the user’s originating bank before being processed by Flick.

Personal finance management is also easier with Flick. You don’t need to jump from one bank app or statement of account to the other to track how your money was spent. There on the Flick app, you can view the balance of all the accounts you have linked and manage your transactions. Many find it hard to keep track of their finances especially with several accounts receiving multiple monthly statements. Flick brings it all together. With all your finance details in a single space, you can see your real time Net-worth, and know your debt profile and Credit Score all on the Flick App. With this, you can manage your finances, and if you need to go in search of a credit facility, your credit score would be easily accessible.

The Flick team has onboarded and integrated over 20 banks and fintechs on the platform, so you can easily connect all your banking details into this single solution and make fast contactless payments.

Flick could be just the solution to the endless shopping queues, frustrating payments delays and high rate of cart abandonment.

To find out more about Flick, visit the website.

This is a nice development and a thoughtful project.